Earnings vs. Expectations: A Critical Analysis for 2024

The previous week at a glance

The previous week at a glance

- USA. USA: Existing home sales were -4.71%, below the expected -2.2%.

- USA. USA: FOMC meeting minutes.

- Germany: Quarterly GDP -0.1% (same as expected) and annual GDP of -0.3% (below the -0.3% expected).

- China PoBC prime lending rate of 3.45%, in line with expectations.

- United Kingdom: Autumn forecast statements.

- USA. USA: New home sales, 721 thousand forecast

- USA. USA: Consumer confidence index

- China: November Manufacturing PMI. It is expected to be at 49.6

- Europe: Christine Lagarde's appearance on November 30.

- USA. USA: Remarks by Jerome Powell on Friday, December 1.

Optimistic markets vs. pessimistic indicators

S&P 500 earnings are on track to achieve year-over-year growth of 5.7%, according to Refinitiv IBES+, the leading platform that provides financial and estimation data for public companies. Excluding the energy sector, whose earnings have contracted -33.9% from a year ago, earnings growth would be respectable at 11.1%. In addition, 82% of companies reported earnings above analysts' expectations, averaging 7%, which is above the 5-year average of 5.4% (Figure 1).Chart 1: Magnitude of S&P 500 EPS outperformance (7%)

Although companies outperformed financial expectations, investors did not react positively as expected.

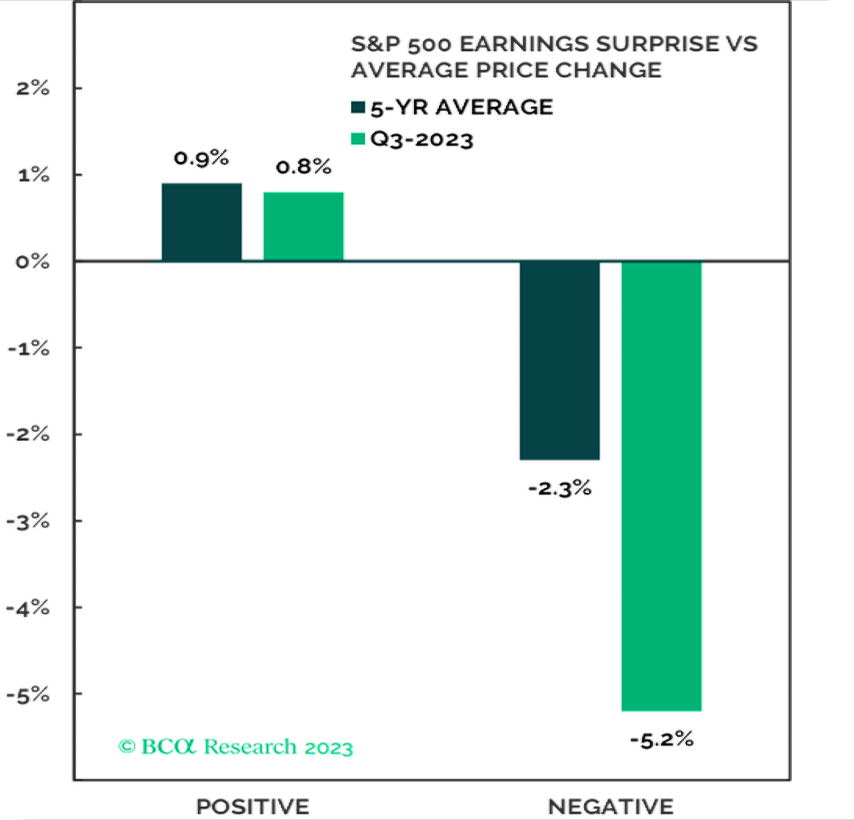

According to Factset, another provider of financial data and professional financial analysis, when companies beat estimates, the average increase in stock price was 0.8%, slightly below the five-year average of 0.9%.

On the other hand, when companies missed expectations, the punishment was more severe, with an average decline in share price of -5.2%, compared to the historical average of -2.3% (see Chart 2).

Although companies outperformed financial expectations, investors did not react positively as expected.

According to Factset, another provider of financial data and professional financial analysis, when companies beat estimates, the average increase in stock price was 0.8%, slightly below the five-year average of 0.9%.

On the other hand, when companies missed expectations, the punishment was more severe, with an average decline in share price of -5.2%, compared to the historical average of -2.3% (see Chart 2).

Chart 2: Change in S&P 500 performance after positive or negative performance announcements

It seems that investors have been much more focused on what the Fed was doing than on how companies were reporting their third quarter profit or loss results.

If the market doesn't get too excited when there is good news, but reacts strongly when there is bad news, it could be a sign that something is not right and that there could be trouble ahead. It is as if bad news sets alarm bells ringing louder than good news.

On the other hand, Factset expects earnings to grow by 3.9% y/y in Q4 2023 and 11.9% in 2024. This outlook indicates that analysts' projections. bottom-up (those who analyze individual companies) point to the so-called "soft landing" (a gradual slowdown of the U.S. economy rather than an abrupt recession).

However, we consider this forecast to be too optimistic and predict a -10% decline in Earnings Per Share (P/E) by 2024.

It seems that investors have been much more focused on what the Fed was doing than on how companies were reporting their third quarter profit or loss results.

If the market doesn't get too excited when there is good news, but reacts strongly when there is bad news, it could be a sign that something is not right and that there could be trouble ahead. It is as if bad news sets alarm bells ringing louder than good news.

On the other hand, Factset expects earnings to grow by 3.9% y/y in Q4 2023 and 11.9% in 2024. This outlook indicates that analysts' projections. bottom-up (those who analyze individual companies) point to the so-called "soft landing" (a gradual slowdown of the U.S. economy rather than an abrupt recession).

However, we consider this forecast to be too optimistic and predict a -10% decline in Earnings Per Share (P/E) by 2024.

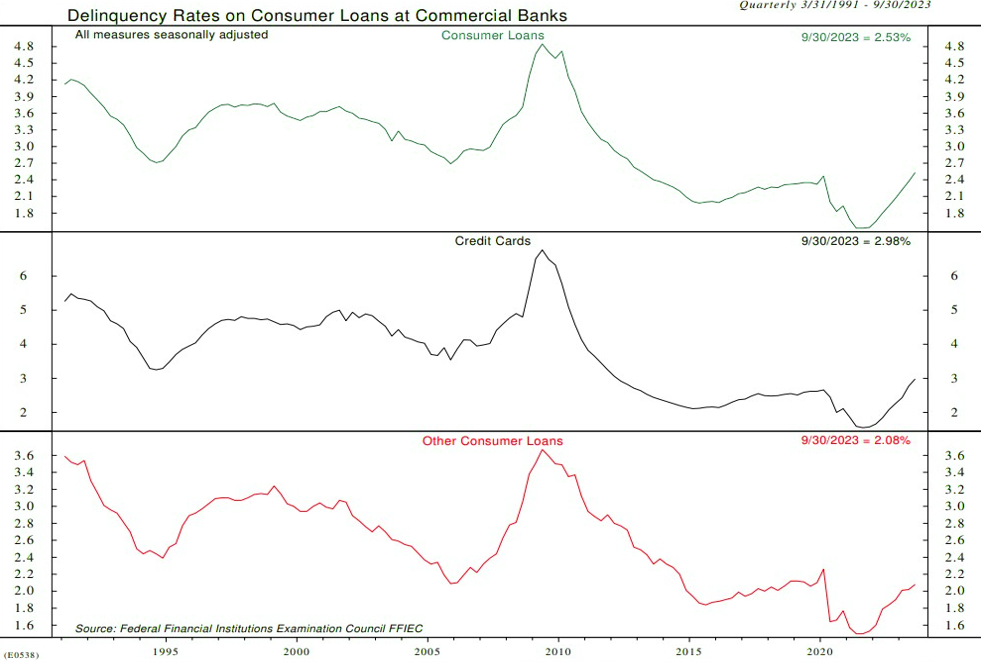

Graph 3: Delinquency Rate by Category

As we mentioned last week in our outlook for the coming year "The two faces of 2024", we believe that storm clouds are looming over the U.S. economy as consumer spending will slow in early 2024. The fact that Americans will run out of pandemic savings (accumulated during the covid-19 pandemic) will lead to further weakening of the labor market, resulting in even less spending and thus hiring.

The Fed is not done fighting inflation and should not lower interest rates before the second half of next year. It is true that the Fed may not raise rates, but the effect of its aggressive monetary policy, which began 21 months ago, should now have its effect on the economy.

Consumer spending was again a major tailwind for third quarter corporate profits, but it should start to fade in the coming quarters, as three pillars of consumer spending are starting to show cracks: job creation is cooling, excess savings are drying up, and the debt burden is rising rapidly.

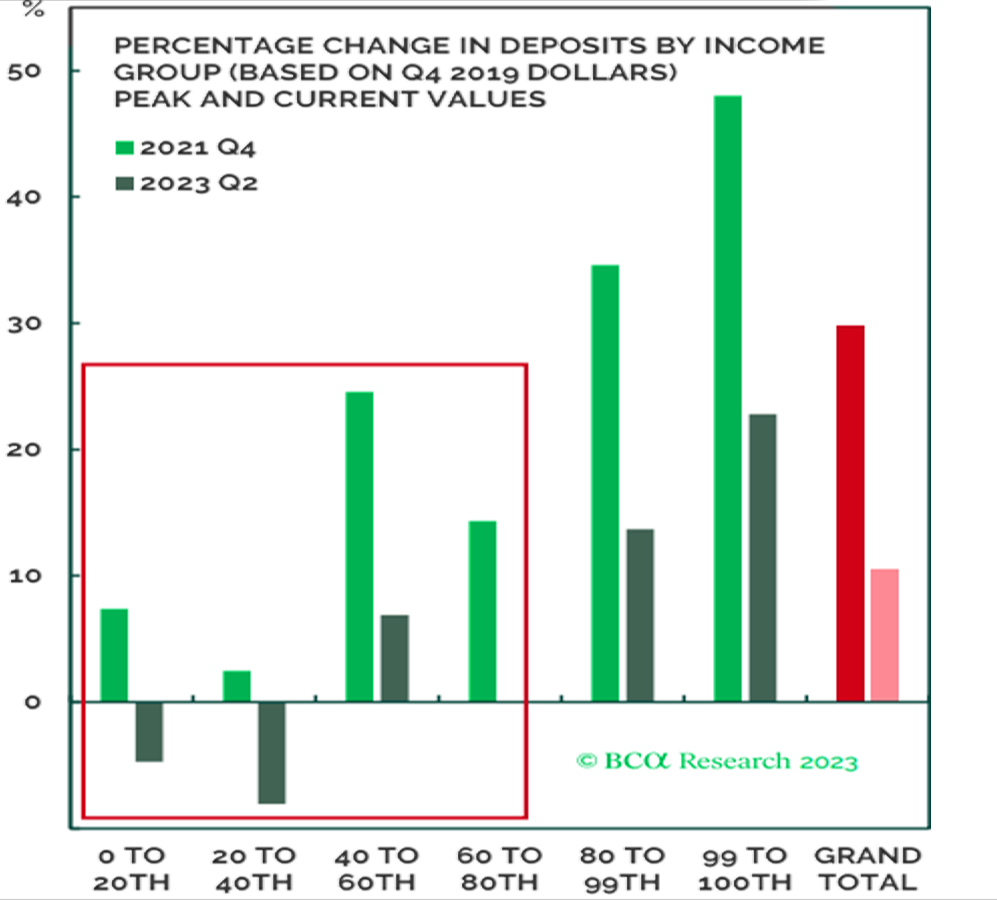

The delinquency rate of loans is not necessarily at an absolutely high level, but it has increased considerably (Figure 3). In terms of consumer capacity, pandemic savings have been exhausted for 80% of Americans (Figure 4).

As we mentioned last week in our outlook for the coming year "The two faces of 2024", we believe that storm clouds are looming over the U.S. economy as consumer spending will slow in early 2024. The fact that Americans will run out of pandemic savings (accumulated during the covid-19 pandemic) will lead to further weakening of the labor market, resulting in even less spending and thus hiring.

The Fed is not done fighting inflation and should not lower interest rates before the second half of next year. It is true that the Fed may not raise rates, but the effect of its aggressive monetary policy, which began 21 months ago, should now have its effect on the economy.

Consumer spending was again a major tailwind for third quarter corporate profits, but it should start to fade in the coming quarters, as three pillars of consumer spending are starting to show cracks: job creation is cooling, excess savings are drying up, and the debt burden is rising rapidly.

The delinquency rate of loans is not necessarily at an absolutely high level, but it has increased considerably (Figure 3). In terms of consumer capacity, pandemic savings have been exhausted for 80% of Americans (Figure 4).

Figure 4: Pandemic Savings by Income Group

In short, company results and comments regarding third quarter earnings have been broadly positive, even if challenges persist.

However, the negative outlook for economic growth, coupled with rising geopolitical risks, threaten optimistic earnings expectations.

The wave of downgrades will intensify and earnings growth in 2024 will be lower than currently forecast. The current rally is unlikely to be the start of a new bull market for equities.

In short, company results and comments regarding third quarter earnings have been broadly positive, even if challenges persist.

However, the negative outlook for economic growth, coupled with rising geopolitical risks, threaten optimistic earnings expectations.

The wave of downgrades will intensify and earnings growth in 2024 will be lower than currently forecast. The current rally is unlikely to be the start of a new bull market for equities.

Deteriorated labor market?

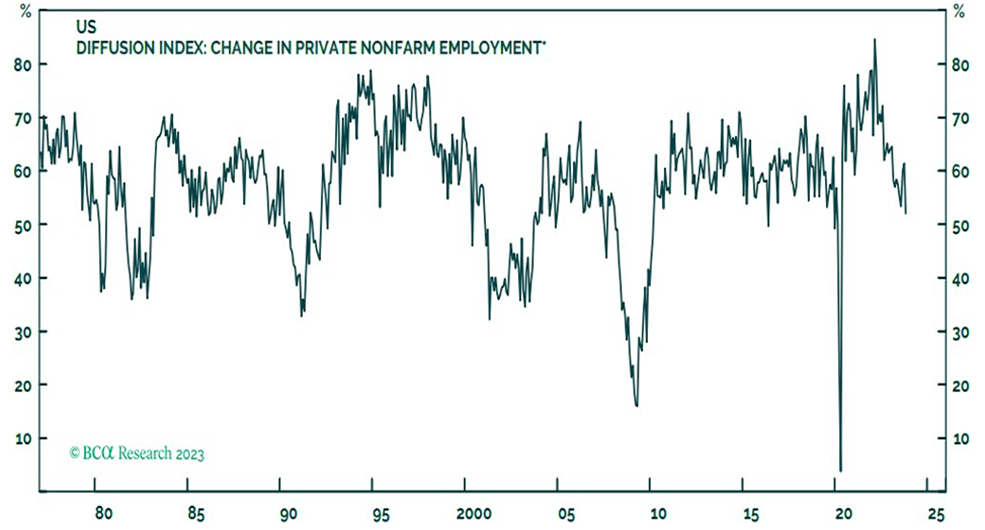

Graph 5: Non-agricultural payroll evolution

Labor markets in developed economies have been showing signs of stress in recent months.

Employment in the United States, as measured by the household survey, declined by 40,000 people in the last three months, but although payroll growth has been robust (averaging 204,000 new jobs in the last three months), there is a clear cause for this increase, which is that it is the result of people holding multiple jobs at the same time, meaning that these jobs are not necessarily new job openings.

Also, looking at the numbers more closely, the non-farm payroll figures have been revised steadily downward almost every month since March by a total amount of 351,000.

On the other hand, payroll growth in October was heavily skewed toward some industries, such as health care and government, that had become woefully understaffed.

In simpler terms, the number of industries that are generating new jobs has declined, indicating that fewer sectors are contributing to employment growth compared to previous periods.

Note: Payroll is the total number of employees in a company or industry.

Labor markets in developed economies have been showing signs of stress in recent months.

Employment in the United States, as measured by the household survey, declined by 40,000 people in the last three months, but although payroll growth has been robust (averaging 204,000 new jobs in the last three months), there is a clear cause for this increase, which is that it is the result of people holding multiple jobs at the same time, meaning that these jobs are not necessarily new job openings.

Also, looking at the numbers more closely, the non-farm payroll figures have been revised steadily downward almost every month since March by a total amount of 351,000.

On the other hand, payroll growth in October was heavily skewed toward some industries, such as health care and government, that had become woefully understaffed.

In simpler terms, the number of industries that are generating new jobs has declined, indicating that fewer sectors are contributing to employment growth compared to previous periods.

Note: Payroll is the total number of employees in a company or industry.

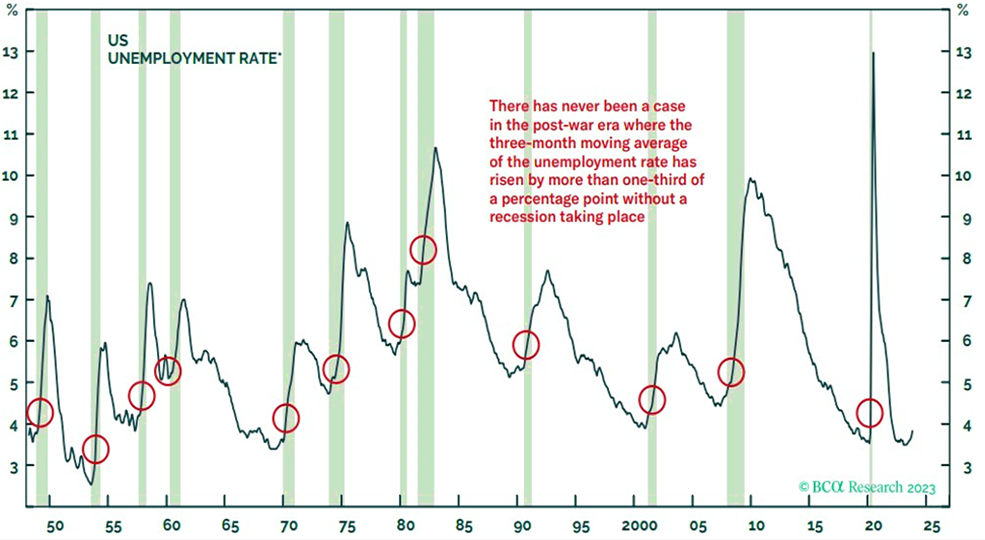

Graph 6: U.S. Employment Rate (3.9%)

On the other hand, the unemployment rate rose from 3.4% to 3.9%, but most notably, the latest 3-month average unemployment rate increased by 0.33%. The U.S. has never avoided a recession when this rate reached 0.35%.

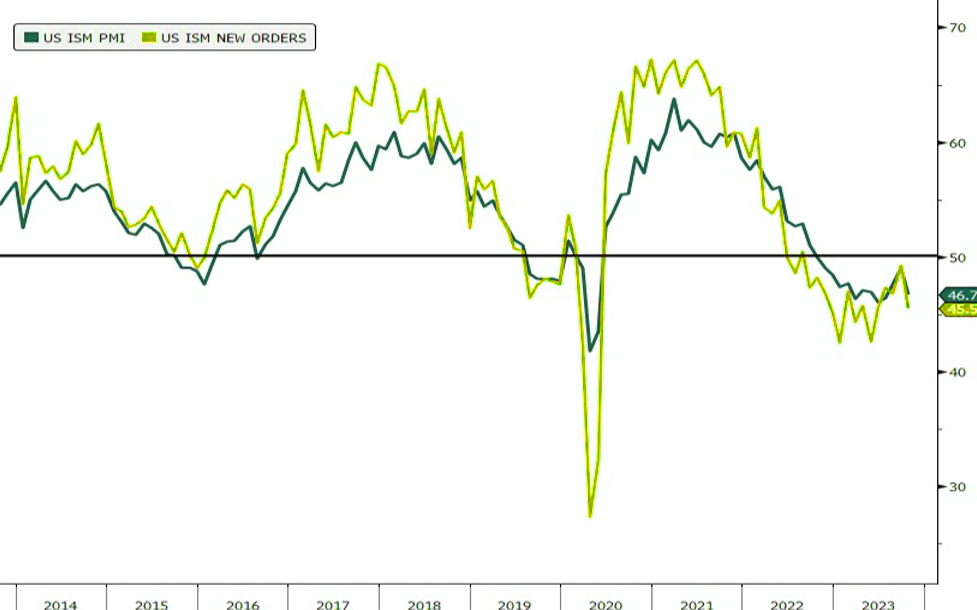

In addition, there are other worrisome signs in the economy, for example, the Institute for Supply Management (ISM) index for manufacturing employment is declining, as is that for services employment which has fallen to 50.2 from its August peak. Also, the ISM manufacturing (PMI) and new orders indices in October were very low, falling below the growth level of 50 (Chart 7).

All of this indicates that there may be more trouble ahead in terms of employment and spending.

On the other hand, the unemployment rate rose from 3.4% to 3.9%, but most notably, the latest 3-month average unemployment rate increased by 0.33%. The U.S. has never avoided a recession when this rate reached 0.35%.

In addition, there are other worrisome signs in the economy, for example, the Institute for Supply Management (ISM) index for manufacturing employment is declining, as is that for services employment which has fallen to 50.2 from its August peak. Also, the ISM manufacturing (PMI) and new orders indices in October were very low, falling below the growth level of 50 (Chart 7).

All of this indicates that there may be more trouble ahead in terms of employment and spending.

Chart 7: U.S. ISM PMI (46.7); U.S. ISM New Orders (45.5)