An imminent recovery?

During the Covid period, the world witnessed a boom in video games, with impressive growth of +158% between 2000 and 2001, eclipsing the MSCI World's +75% (Chart 1). However, the sector has since lost momentum, falling by 60% and creating a significant gap versus the market.

Despite current underperformance, video games are emerging as an economic giant in a world where reality and the virtual are intertwined. Despite regulation in China, the global number of gamers is growing. The diversity of the player profile and improved mobile connectivity make video games more accessible. The industry is booming, in a battle where innovation and creativity define the value of companies.

Chart 1: 03.2020-02.2021 MSCI World All (+72%); Global X Video Games & Esports ETF (+157%)

Who is leading this long revolution?

In the 1970s and 1980s, Atari and Nintendo led the video game boom with physical consoles and games. Then, PlayStation and Xbox introduced 3D graphics and online gaming in the 1990s and 2000s, shifting the focus to subscriptions and DLC (Downloadable Content). The mobile era brought free-to-play games like Clash of Clans and Candy Crush, diversifying revenues and stock market valuations.

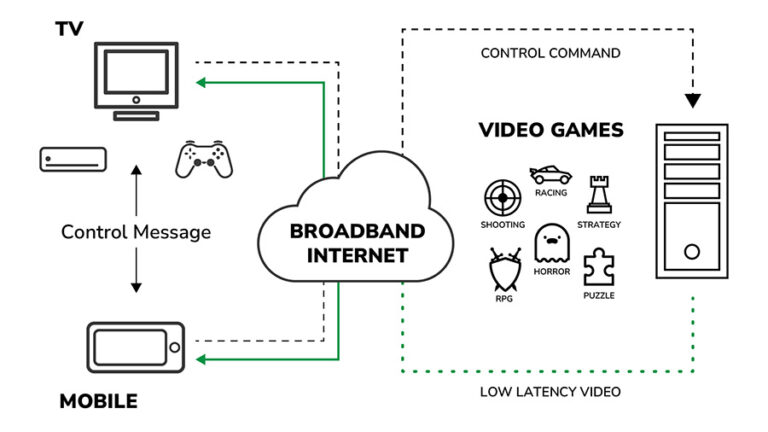

Today, the cloud, virtual reality and AI are transforming games, offering quality without expensive hardware and Netflix-style subscriptions. Led by Google, Microsoft and Sony, they anticipate a change comparable to streaming. Recurring revenues and player attraction define stock market valuations. VR, AI and blockchain create immersive experiences and innovative genres (Figure 2).

Figure 2: Cloud gaming ecosystem

In the case of artificial intelligence, it is very clear that it improves graphics and behavior in games, adapting elements to the player. Blockchain introduces digital property and monetization of assets. eSports, streamers and forums influence promotion, generating income. Publishers and hardware manufacturers adapt to maintain profitability in the video game industry.

Among the companies that are leading this generational change are well-known names such as Microsoft, Tencent (especially in China), Electronic Arts (with its legendary FIFA), as well as Japan's Sony and Nintenado. However, we should not forget to mention smaller companies that are doing extremely well, such as Epic Games, Roblox, NetEase (World of Warcraft and Overwacht) and Take-Twi Interactive with its resounding success GTA V, which positions it as one of the industry leaders.

Figure 3: Revenues in the global video games market by segment and Figure 4: Revenues in the global video games market by country

Video Games Revenue (per segment)

No Data Found

No Data Found

Video Games Revenue (per country)

No Data Found

No Data Found

What opportunities do we see?

Video games, a growing economic sector, could be favored in times of economic constraints due to their attractiveness as a form of affordable entertainment.

Although regulatory challenges have affected stock markets, prices may have adjusted to these concerns. Thus, companies in the sector could once again attract investors at discounted price levels, while a relative recovery is on the horizon. With this, hardware manufacturers and game publishers are well positioned to increase their profits in the near future.

If you wish to obtain advice on investing in companies related to video games, our team of brokers will be happy to assist you and provide you with the information and advice you need.

You can contact us through the following form:

"*" indicates required fields

ComShare this content:

DISCLAIMER: Singular Wealth Management, Corp. and Singular Securities, Corp. (SWM&SC), offer perspectives on various markets, sectors and investment opportunities that could be valuable to subscribers of our editorial content. This includes views on different types of securities, as well as commentary on economic and political scenarios. It is crucial to understand that this publication does not constitute financial guidance and is not an invitation to make specific investments. For personalized advice, we recommend using the Unique Advisory Services through our Securities House's qualified financial advisors to achieve your investment objectives. Although the information in this publication comes from reliable sources, we cannot guarantee its accuracy or completeness. Information is current at the time of publication, but may change without notice. Investing in securities involves risks, including the possible loss of principal, and past performance is no guarantee of future returns. SWM&SC personnel may invest in the securities discussed from time to time without receiving any compensation from the companies mentioned. We disclaim any liability for damages resulting from the use of our services. Entity regulated and supervised by the Superintendencia del Mercado de Valores of the Republic of Panama. Singular Wealth Management Corp., "License to operate as a Securities Brokerage Firm, Resolution CNV- No. 219-2005 of September 19, 2005". Singular Securities Corp., "License to operate as a Securities Brokerage Firm. Resolution SMV- No. 672-15 of October 21, 2015"....