Consumer credit in the U.S. amounted to US$9,057 million in the face of the US$9.5 billion expected.

Unemployment rate in the U.S. stood at 3.9% versus the expected 3.8%.

- Germany's trade balance was 1TP4Q16.5 billionhigher than the 1TP4Q16.3 billion expected.

- The UK composite PMI stood at 48.7%, higher than expected (48.6%).

Initial claims for unemployment benefits in the U.S. were at 217 thousand, higher against the position of the 218 thousand expected.

- Inflation report expected for the first quarter of 2008 United States (monthly, annual and underlying).

- Euro Zone expects quarterly GDP, employment, and the ZEW index of investment confidence in the region.

- Japan GDP on an annual and quarterly basis.

- China expects unemployment rate and Industrial Production index.

- United States expects underlying retail sales.

Healthy trend: A perspective from the markets

The fight against obesity is the kind of issue that could be compared to that of logistics, telemedicine, foodtech, the metaverse or artificial intelligence, it is a megatrend issue.

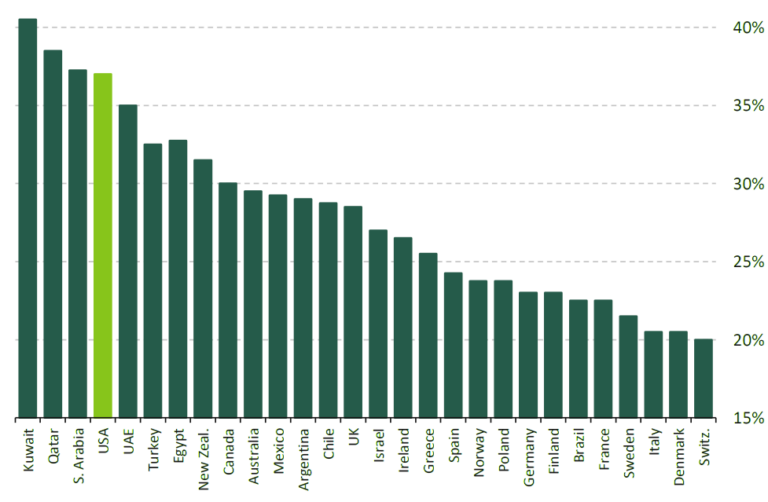

Today, more than 650 million adults are obese and the rate of obesity per country is skyrocketing (Figure 1). This epidemic is driven by poor diets, sedentary lifestyles and a modern food environment full of cheap, hyper-available processed foods and beverages. The health consequences are immense, for example, increasing the risk of chronic diseases in general.

Figure 1 : Obesity rates by country

Recently approved obesity medications include semaglutide, a GLP-1 inhibitor that acts in the brain to reduce appetite and food intake. GLP-1 is an incretin hormone, which means it stimulates the release of insulin from the pancreas. It sends a signal of satiety and fullness to the brain, which decreases appetite and food intake.

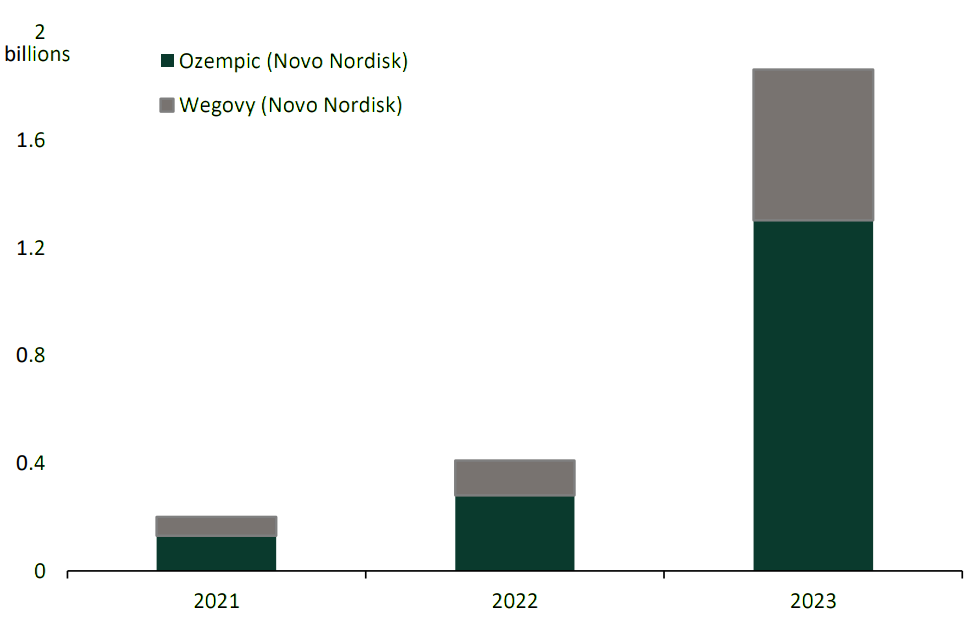

A handful of companies are already reaping the benefits. Given the interest shown by consumers looking at these drugs (Figure 2) and investors, the trend could become exponentially profitable.

Figure 2: Number of TikToks linked to Novo Nordisk's obesity treatment.

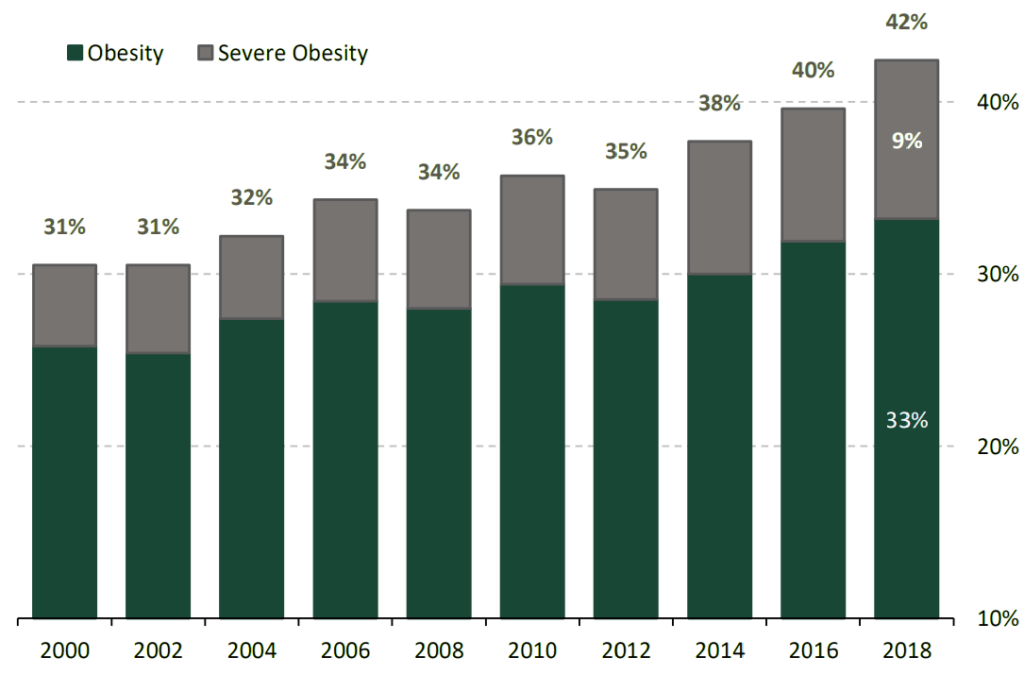

In the United States, 31% of adults are overweight, 33% are obese, and 9% are severely obese (Figures 3 and 4). If prevention and medical management do not improve, the World Obesity Federation (WOF) predicts that half of the population will be overweight or obese by 2035.

Figure 3: Distribution of obesity in the U.S.

No Data Found

Figure 4 : Evolution of obesity in the U.S.

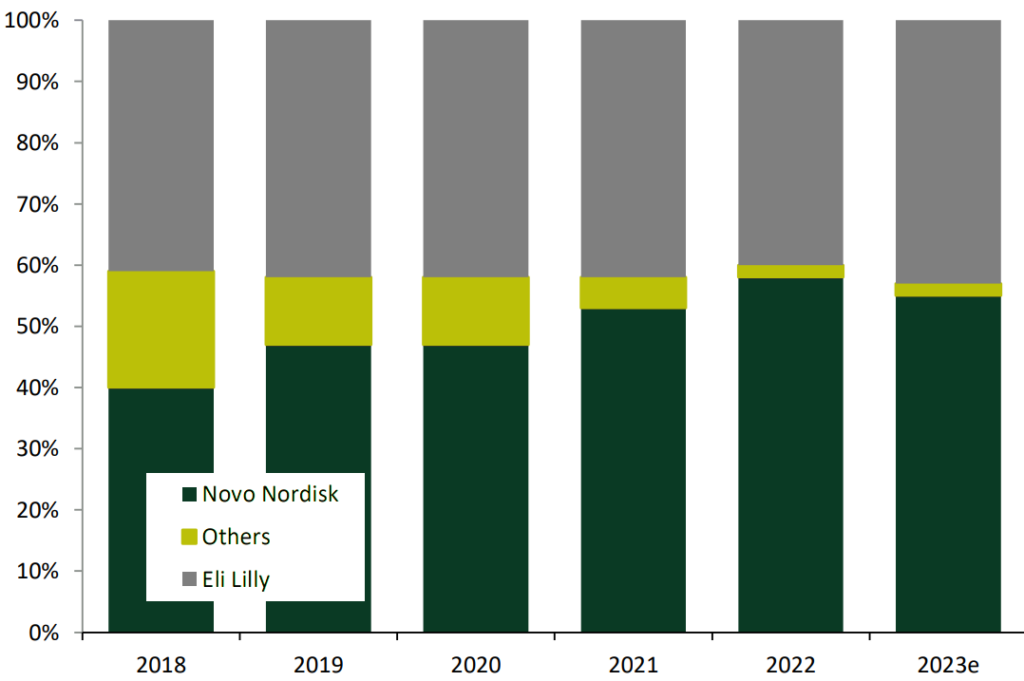

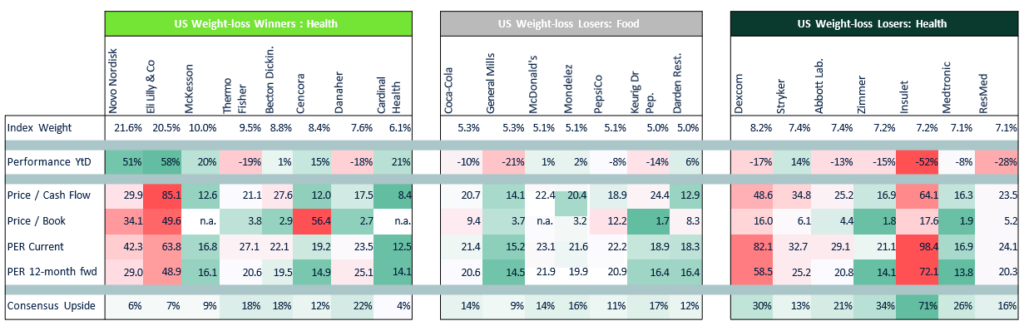

Novo Nordisk and Eli Lilly are currently the leaders in this field (Figure 5). Several other smaller pharmaceutical companies are also working on potential injectable obesity drugs and are looking to enter the market behind Novo Nordisk and Eli Lilly. However, no other competitor has an approved obesity injection beyond these two market leaders at this time.

Eli Lilly and Novo Nordisk injectable anti-obesity drugs are quite expensive, especially without insurance coverage, as they could reach US$1,000 to US$1,500 per month.

Graph 5 : Market share by company

The pharmaceutical industry, in order to reduce the costs of this type of treatment, is developing tablets that can be taken daily. Novo Nordisk, Eli Lilly, Pfizer, Astrazeneca are carrying out projects in this direction.

In the United States, Novo Nordisk and Eli Lilly seem to be taking off on a highway. This is not yet the case in the Old World, as the European Medicines Agency (EMA) is examining the adverse effects of these anti-diabetic treatments, which are prescribed for weight loss.

There are always winners and losers

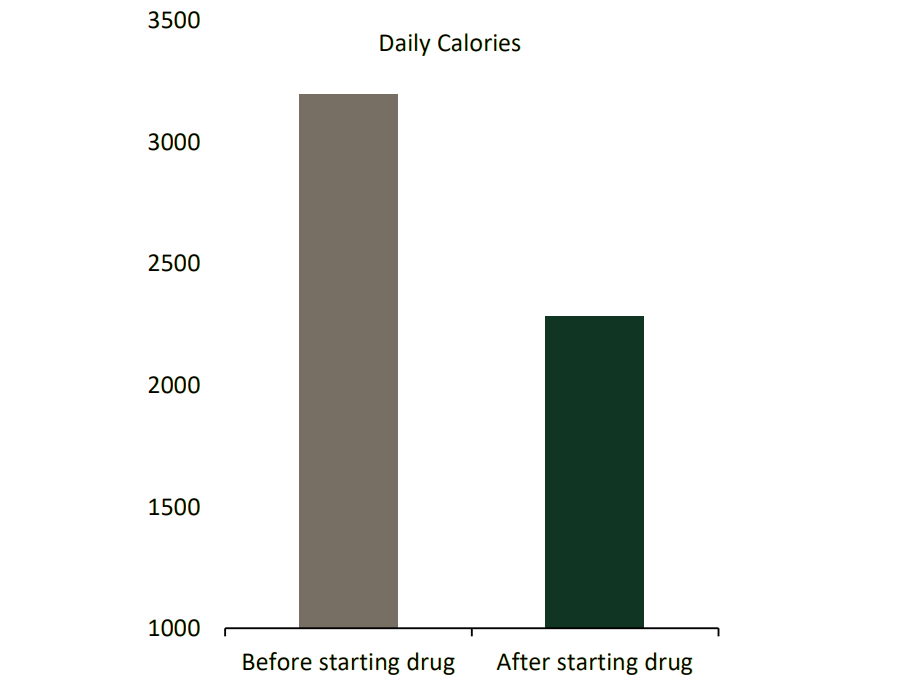

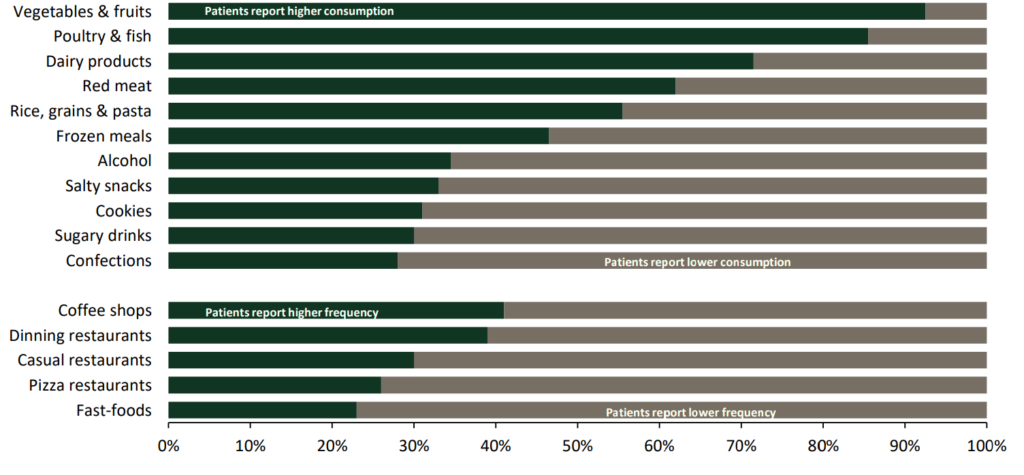

For companies at the other end of the investment, such as snacks and meals, they may face "market penalties" as this trend leads to a reduction in calories consumed by people by between 20% and 30%, which would inherently affect the revenues of these sectors.

Companies such as Coca-Cola, General Mills, Mondelez, PepsiCo, Danone and Unilever, among others, could see clear penalties in the value of their shares. However, it is worth noting that these companies may develop over time strategies to adapt to new consumer preferences. For example, brands such as Nestlé have already modified some of their star products in terms of sugar, salt and fat content as part of this process.

Graph 6: Daily calories new habits

Other companies that could be penalized are those that produce or distribute medical equipment.

The use of continuous glucose monitoring devices (DexCom, Abbott, Medtronic) and insulin pumps (Insulet, Medtronic, Roche, Tandem) will decrease as obesity is addressed. Likewise, providers of Dialysis products and services (Fresenius, DaVita) will face the same problem, because with fewer obese patients, there will be less need for their equipment, which replicates the main functions of the kidneys, i.e., removing waste, toxins and excess salts and fluids from the body.

Figure 7 : Change in eating habits before and after medication

Who will take advantage of the trend?

Companies that offer healthy foods could naturally benefit from this change in trend.

Companies such as Simple Good Foods and BellRing Brands in the food sector, while Adidas and Nike in sports apparel (as well as sports equipment), will receive this reorientation of demand due to the changing habits of the population.

There are very few stock indices that track their performance passively (Solactive ETF: SLIMID Index). Among the healthcare companies that will emerge as 'winners' we have the GLP-1 Winners Index (UBXXGLPW Index) containing Novo Nordisk and Eli Lilly.

Conversely, investors do not seem to have fully grasped the strong headwinds facing the "losers" as the GLP-1 Food Loser Index (UBXXGLPF Index) and the GLP-1 Health Care Loser Index (UBXXGLPH Index) as they continue to have relatively high market valuations, despite what we mentioned above.

Figure 8 : Expected winners and losers Indices (with components) in the fight against obesity

What opportunities do we see?

A change in consumer preferences will always open up market opportunities, just as it will leave losers.

In this case, the change of preferences is towards healthy eating and physical-sports activities, so that we see an opportunity in these sectors, which means that including some instrument of this nature to your portfolio can be an interesting addition to your investments.

However, it is important to note that companies such as Novo Nordisk, with an increased yield of 47%, and Eli Lilly with a 64%, may be a bit expensive in terms of value at the moment. This means that it is possible that their values may decline (through a market correction) in the near future. So we recommend being cautious when investing in these types of stocks, as well as similar companies and instruments.

If you would like to obtain investment advice on companies related to the healthy trend or identify opportunities, our team of brokers will be happy to assist you and provide you with the information and advice you need.

You can contact us through the following form:

Share this content:

DISCLAIMER: Singular Wealth Management, Corp. and Singular Securities, Corp. (SWM&SC), offer perspectives on various markets, sectors and investment opportunities that could be valuable to subscribers of our editorial content. This includes views on different types of securities, as well as commentary on economic and political scenarios. It is crucial to understand that this publication does not constitute financial guidance and is not an invitation to make specific investments. For personalized advice, we recommend using the Unique Advisory Services through our Securities House's qualified financial advisors to achieve your investment objectives. Although the information in this publication comes from reliable sources, we cannot guarantee its accuracy or completeness. Information is current at the time of publication, but may change without notice. Investing in securities involves risks, including the possible loss of principal, and past performance is no guarantee of future returns. SWM&SC personnel may invest in the securities discussed from time to time without receiving any compensation from the companies mentioned. We disclaim any liability for damages resulting from the use of our services. Entity regulated and supervised by the Superintendencia del Mercado de Valores of the Republic of Panama. Singular Wealth Management Corp., "License to operate as a Securities Brokerage Firm, Resolution CNV- No. 219-2005 of September 19, 2005". Singular Securities Corp., "License to operate as a Securities Brokerage Firm. Resolution SMV- No. 672-15 of October 21, 2015"....