Rate hikes: Are we on the verge of a financial boom?

The previous week at a glance

The previous week at a glance

- The United States reported numerous home sales statistics. For the most part the numbers came out better than expected but continue to decline.

- China released its GDP report, down from 6.3% to 4.9%.

- The Eurozone CPI has declined from 5.21GDP3Q to 4.31GDP3Q in the last year.

- U.S. consumer confidence has declined more than expected, from 108.7 to 103.

- Congress passed a temporary funding bill to avert a federal government shutdown, providing short-term funding through November 17.

- U.S. reports Q2 2023 GDP, expected to increase from 2.0% to 2.2%.

- England reports GDP for the second quarter of 2023 is expected to increase from 0.1% to 0.2%.

- Eurozone reports CPI, expected to decline from 5.21GDP3Q to 4.51GDP3Q (y-o-y).

- Press conference by Fed Chairman Jerome Powell.

- The increase in bankruptcy filings raises economic concerns. Applications reach levels similar to past economic crises, such as the Great Recession of 2008 and the pandemic of 2020.

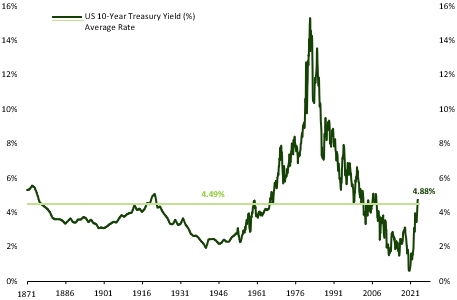

Bond yields have just reached very high levels very quickly. The most famous of all, the yield on the 10-year US Treasury bond, reached 4.88%, a record high since July 2007, a far cry from the 3.29% it recorded in May.

The 4,88% reached 10 days ago is considered a historically high level, however much it corresponds to a very long-term average (chart 1), but the speed and economic situation in which this is occurring is unprecedented.

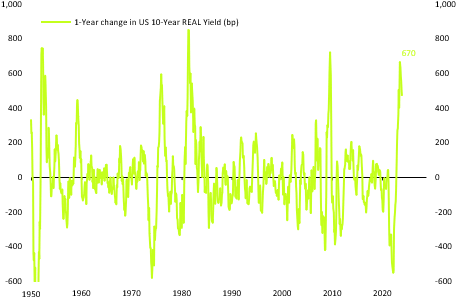

The 1-year change in U.S. 10-year real yields has also reached record highs, rising by 670 basis points in just 1 year, a historical progression seen only a few times in the past.

Graph 1: Nominal 10-year US nominal rates

Graph 2: Year-on-year change in US 10-year real rates.

Its main European counterpart, the 10-year German Bund, surpassed the symbolic 3% mark. If rates continue to rise, the risk of a major economic and financial meltdown will become increasingly likely, as has happened in the past (Figure 3).

The meteoric rise in yields can be explained in part by investors' attention to the rhetoric of central bankers. Jerome Powell, Christine Lagarde and their counterparts in major developed countries are hammering home the message that their key rates, the main tools of monetary policy, will remain "higher for longer." Therefore, every time good economic news is released, the possibility of monetary easing recedes.