A green sector that cannot be ignored

Starting from a purely objective opinion, it cannot be ignored that currently one of the fastest growing industries worldwide is the marijuana industry. The sector has shown double-digit growth rates and the trend is expected to continue steadily for the next five to ten years. Through different investment vehicles it is possible to obtain direct and indirect exposure to a sector with a lot of tailwind for the coming years.

Due to several factors, the marijuana sector has shown high levels of volatility in recent months. The most relevant issue regarding the sector right now lies in the approval of a federal law. It should have a more accommodating stance and may allow for the legalization of marijuana consumption at the federal level.

On the other hand, approval is expected for the companies in the sector in the United States to be able to use different instruments for their advancement. Such as banking services, trading in the main stock exchanges, tax deductions, among others. These points could mean a potential advance for an industry that has seen its growth limited to a great extent by the different federal restrictions.

Growth in sales in the marijuana sector

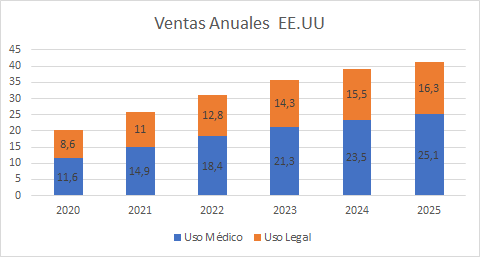

Sales growth in the United States for both the medical and recreational legal use segments has increased by more than 400% in the last five years. Annual sales are expected to maintain more than double-digit growth for at least the next ten years.

Currently, two thirds of sales come from illicit markets. Therefore, in a favorable legal scenario, the increase in sales could be substantially increased.

On the other hand, given the growth of the sector, mergers and acquisitions are playing an increasingly important role. Undoubtedly, this can be a catalyst for some companies in terms of being able to strategically take market shares that allow them to cover a larger part of the business value chain. Among the most important ones we can highlight the one carried out by the companies Tilray, Inc and Aphria, Inc (NASDAQ:APHA). They have merged after months of negotiation, creating a company with a combined market capitalization of more than USD 3.3 billion.

Read more

Companies that are not exclusively in the marijuana sector have shown increasing interest in acquiring stakes in other companies. Those, which allow them to have exposure to this high-growth sector. To cite one example, the most important acquisition to date was the deal between Jazz Pharmaceuticals (a pharmaceutical company) and cannabinoid drug company GW Pharmaceuticals plc for approximately USD 6.7 billion.

Of total global sales, the United States and Canada account for 90% of the market share. However, it is expected that the next boost to sales could come from Europe and Asia through various initiatives. Thus, they could build a medical marijuana industry and market it locally. The European Union has been in favor of passing laws decriminalizing possession. South Korea has taken the lead in approving the use of medical marijuana. Additionally, in Africa, both South Africa and Zimbabwe are making accelerated progress in legalizing its use.