When you think of investing your savings, it is common for the following to come to mind. fixed-term as the first option for your money to generate interest and grow, But is it the only way and is it the most efficient way? Well, the short answer is no. Dou should know that there are more sophisticated instruments that, with a little knowledge, can generate better results for you.

In this article you will learn about their advantages and main characteristics, as well as how to acquire them, so that you can make a qualitative leap in planning the growth of your assets.

Before, what are Fixed Terms?

A fixed-term is a deposit with a financial institution for a fixed period of time in exchange for a fixed interest rate.s. They are usually banks and cooperatives that offer this product.

The alternative product: Bonds

Bonds are financial debt instruments that entities issue to obtain financing. When you buy a bond, you are basically lending money to the issuer of the bond in exchange for periodic interest payments, known as coupons, and repayment of principal at maturity of the bond. There are different types of bonds with different durations. These can range from months or even go into perpetuity.

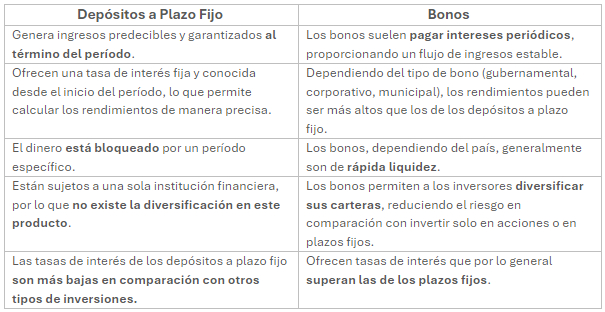

Table 1: Characteristics of each

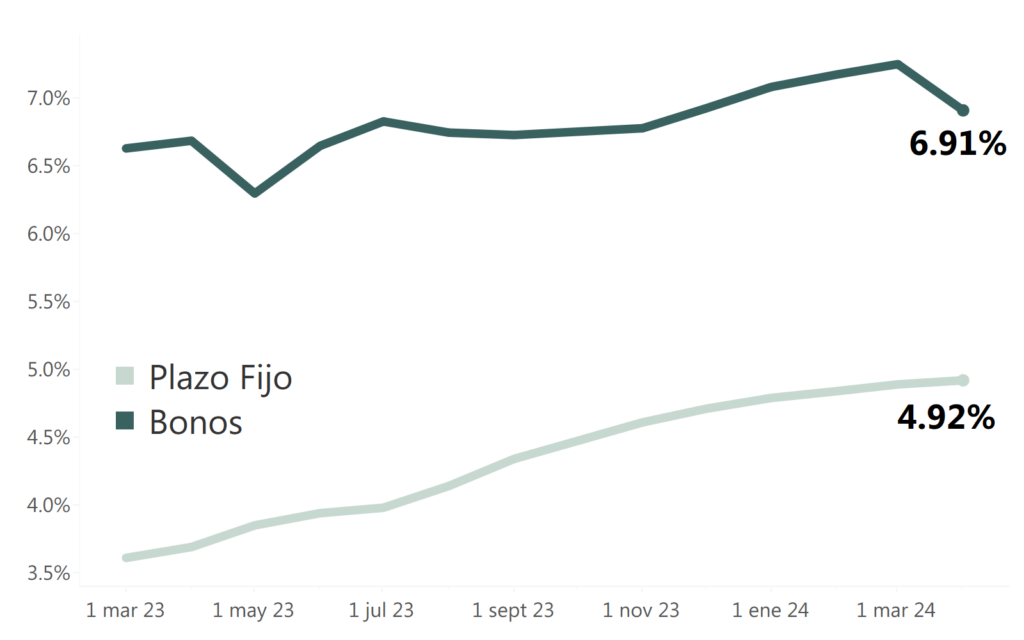

Time Deposits vs. Bonds: A Graphical Display

This chart shows an average of the interest rates currently offered by local fixed term deposits and bonds.. As we can see, investors in bond savers have seen a higher return than fixed-term savers, with an average difference of 2%. This means that equity investors have taken better advantage of their opportunity cost, which has brought them closer toon faster to their financial targets.

Graph 1: Average interest rates of Fixed Term and Bond rates in Panama

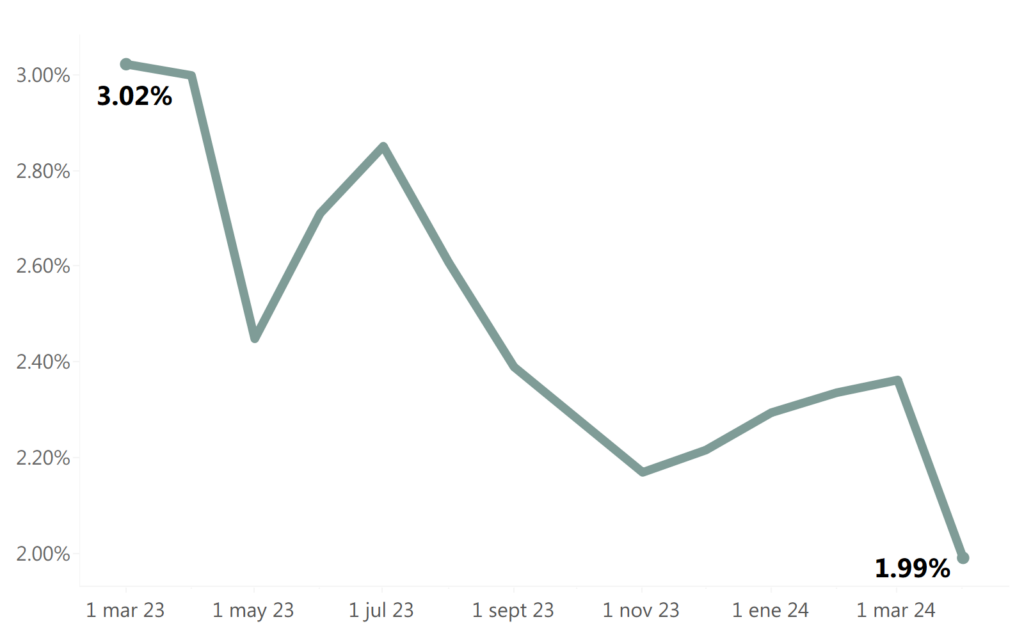

Graph 2: Difference between interest rates on Bonds and Fixed Terms in Panama

There was a time when the bonds paid up to 3% more, so we can say that it was a good investment opportunity at the time, although the average 2% held in the period from March 2023 to March 2024 is not to be underestimated.

Investing in time deposits is not the only or the most efficient way to grow your money. There are more sophisticated alternatives, such as bonds, which can offer higher yields. In the last year, local bonds have outperformed fixed terms in average yields, proving to be a more profitable and efficient option. effective in achieving your financial goals.

If you want more information about the different alternatives we offer, do not hesitate to contact us.

You can do it through the following form:

Contact with us

"*" indicates required fields

Share this content:

DISCLAIMER: Singular Wealth Management, Corp. and Singular Securities, Corp. (SWM&SC), offer perspectives on various markets, sectors and investment opportunities that could be valuable to subscribers of our editorial content. This includes views on different types of securities, as well as commentary on economic and political scenarios. It is crucial to understand that this publication does not constitute financial guidance and is not an invitation to make specific investments. For personalized advice, we recommend using the Unique Advisory Services through our Securities House's qualified financial advisors to achieve your investment objectives. Although the information in this publication comes from reliable sources, we cannot guarantee its accuracy or completeness. Information is current at the time of publication, but may change without notice. Investing in securities involves risks, including the possible loss of principal, and past performance is no guarantee of future returns. SWM&SC personnel may invest in the securities discussed from time to time without receiving any compensation from the companies mentioned. We disclaim any liability for damages resulting from the use of our services. Entity regulated and supervised by the Superintendencia del Mercado de Valores of the Republic of Panama. Singular Wealth Management Corp., "License to operate as a Securities Brokerage Firm, Resolution CNV- No. 219-2005 of September 19, 2005". Singular Securities Corp., "License to operate as a Securities Brokerage Firm. Resolution SMV- No. 672-15 of October 21, 2015"....