Corporate results and stock performance... Part 2

Earnings and earnings per share - EPS

In the previous article, we mentioned that the performance of a stock does not necessarily match what one would immediately think; after seeing the main news headlines when a company releases its results for the quarter in question.

Among the large number of financial indicators that have been designed through financial information to know the situation of a company. Speaking in terms of capacity, performance, indebtedness, among others; we had mentioned in the previous article that among the most representative ones are the Revenues and the Earnings per share (EPS). These two measures are the first to be mentioned when a company reports results. It is important to mention that these data are not sufficient to draw a conclusion about the company's financial situation, much less to make an investment decision about it.

EPS highlights

In order to put into perspective and understand the importance of studying and studying correctly the numbers of a company, let's mention two examples.

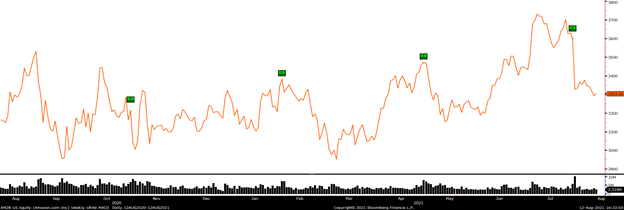

In the images below, we can see that the price of a stock has reported EPS (green box); better than expected by analysts. However, immediately after the presentation of the results, the share price corrected sharply.

In the following image we see the opposite. The selected action has presented EPS below analysts' expectations for three consecutive quarters. However, the performance has been upward immediately after the presentation.

It is very important to understand that the equity market tends to discount the future scenario. Additionally, the behavior of stocks actually shows what is expected from a company in a different time period than the current one.

In the world of investments, professional specialists must have the ability and the obligation to look deeper into the results presented by a company. These are an image in the past tense. Our obligation is to interpret the prospects that the company may have based on the strategies defined; it may be by its directors for the coming periods. It is important to include in this perception the context of different external variables that may or may not facilitate the achievement of these objectives.

In this sense, we emphasize the importance of making investment decisions in a responsible manner; based on complete analyses and not solely on the basis of informative headlines that may present information that is biased from reality.