Finding the right symphony in a world of financial noise

Under normal conditions, the main asset classes have historically shown a certain decorrelation.

The last few years will surely go down in the history books due to the different events that have taken place globally... all with important repercussions in the different segments of the economy that have greatly impacted the normal behavior of the financial markets. Today's news is probably not the most encouraging, but within all the noise there can surely be a symphony. To start with a little context, it will be somewhat summarized, but there have been several events.

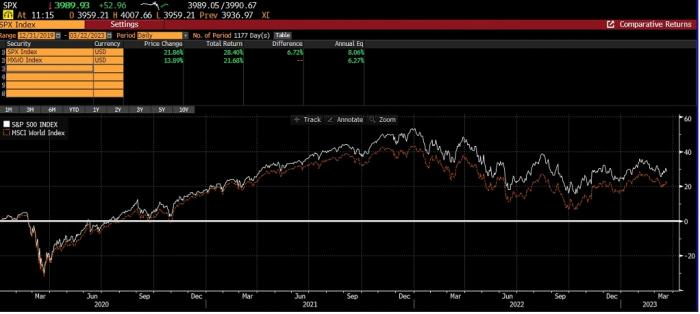

To name a few, in 2020, with the first news of the arrival of Covid-19 and fear gripping the world's population we saw the major indices enter a bear market (down over 20%) at a speed rarely seen before. Immediately after, following the announcement of positive findings on vaccines that could control the pandemic and the maximum use of all possible central bank tools to add liquidity to the markets, we have seen one of the most aggressive bull markets in history (2021). In which, investors encouraged by an environment of low interest rates and excess liquidity saw the returns on their investments indiscriminately increase considerably.

With encouraging results in being able to control a pandemic that left irreparable damage in record time, 2022 finds us with the start of a new war... to once again usher in one of the worst years in history in terms of performance for financial markets. Under normal conditions, the major asset classes historically have shown some uncorrelation, which meant that if, for example, equities moved in one direction, the other major asset class such as Fixed Income moved somewhat in the opposite direction...2022 was the opposite...we saw one of the years with the highest positive correlation, which meant that both asset classes moved in similar directions causing one of the worst years in terms of performance.

After all this, we begin 2023... with the bankruptcy of several financial institutions that have aroused global attention and uncertainty. To make a brief summary, on March 10, the bankruptcy of Silicon Valley Bank (SVB) occurred, which was the second largest bankruptcy in the history of the United States, as well as the largest since the 2008 crisis. The reasons for this event may be various and minimally debatable from different points of view, such as what we mentioned in our article on how the new systematic risks are the new epidemic, but what we cannot ignore is that it had an immediate contagion effect.

Two days later, the closure of Signature Bank was reported, which is considered the third largest bankruptcy in the history of the United States. The effect did not end there, we immediately saw how the financial entities of the American country had to intervene with a rescue plan for First Republic Bank of more than 30 billion dollars to guarantee deposits and avoid another such event.