Inflation and CPI data

On Thursday, June 10, financial markets were anxiously awaiting the May U.S. inflation and CPI data. The result...

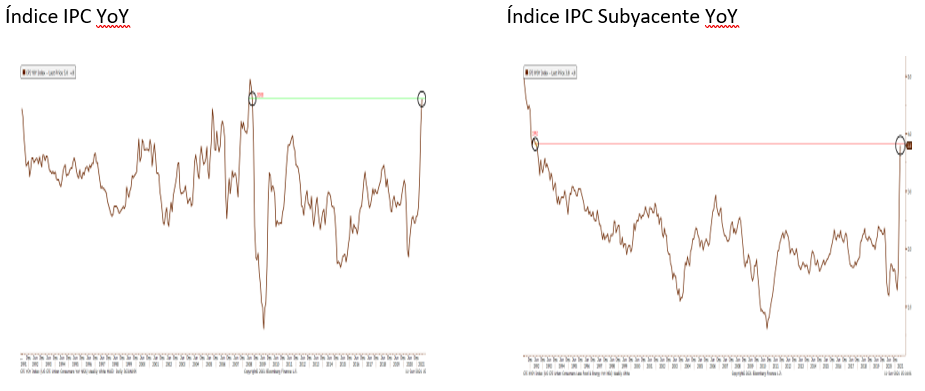

Inflation figures for the month of May were 0.6%, 50% above the consensus expected figure (0.4%). On an annualized basis, the CPI (consumer price index) came in at 5%, higher than expected at 4.7%; a figure not seen since August 2008. On the other hand, if we take into account core inflation (which does not take into account energy products or unprocessed food products), the figure released on Thursday was 3.8%, a figure not seen since 1992.

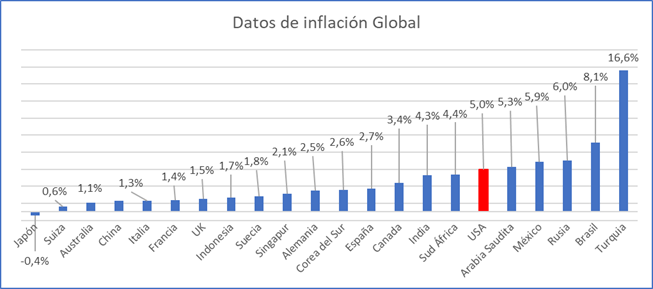

The data alone are worrying, the figures for the month of May have meant the sixth consecutive increase in inflation data in the North American country. Globally, the data in most countries are elevated, as we can see below:

Global economy VS inflation and CPI

Source: Own elaboration, Bloomberg data

Undoubtedly, the word inflation has taken on a lot of importance in recent months. As the economy has begun to rebound after a major period of forced confinement that was generated in 2020 in much of the world due to COVID-19. The struggle now is to find a balance between an avalanche of demand versus a shortage of materials and in some cases, labor.