Is NIO a Tesla competitor?

NIO shares so far this year have performed extraordinarily well. Resulting in a YTD of 944%. However, Tesla shares continue to outperform the Chinese electric vehicle company.

Below, we can see in detail its performance over different periods of time.

| PRICE | 41.98 | Return 1M | -13.1% |

| PRICE MAX 52 S | 57.20 | Return 6m | 588.2% |

| PRICE MIN 52 S | 2.11 | Return 52 | 1749.3% |

| BETA 52 S | 1.62 | Return YTD | 944.3% |

The NIO company is in a very expectant situation for what may be the next few years.

Business evaluation highlights

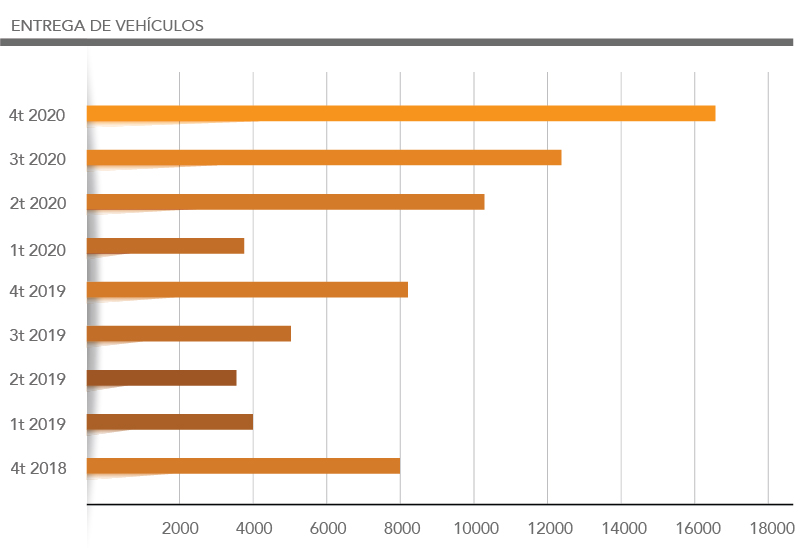

1- Vehicle deliveries are on the rise and the latest vehicle delivery report has surpassed analyst estimates. The November vehicle deliveries report show that deliveries reached 5,291 units, up 109% over 2019. NIO's market share in the sector shows growth, now standing at 7.4%.

Q4 2020 figures represent the expected data.