Tennis, kicks, sneakers, on your feet or on your shelves, but...

What makes them so special?

There are many ways to protect your feet, but since the introduction of the Adidas "Stan Smith" in 1965 and Nike's "Air Jordan"Since 1985, sneakers have become the footwear choice par excellence, their iconicity in being used by great athletes, comfort and versatility in our closets led its industry to be one of the largest and most important in the world.

Nike is recognized for its relentless focus on innovation and design, constantly pushing the boundaries, this is very apparent when looking at its diverse range of products, from running, basketball and golf shoes to casual styles, thus having a larger fraction of the market.

On the other hand, Adidas emphasizes comfort and performance, with a focus on athletes and fans. Its most significant presence is in soccer, where its cleats and jerseys are especially popular.

A curious fact is that both companies enjoy a secondary market where many of their customers are more than just consumers, but very demanding collectors who appreciate every detail of mainly the sports footwear of these companies.

Company size

No Data Found

No Data Found

Both are huge companieshowever, NIKE has a capitalization twice as large and 42% more employees than ADIDAS.a clear reflection of its participation in the industry. But this is not all, so let's look at the numbers:

The numbers (in reasons)

No Data Found

No Data Found

- Both companies have debt to assets ratios of less than 1/3, which is positive because it allows them to allocate profits to more productive tasks such as innovation and marketing.

- Nike has a 2.4x higher return on sales than Adidas, we can infer that this is due both to its size in economies of scale and product diversity where they can obtain higher margins, while Adidas being a relatively smaller player sees its margins somewhat tighter.

- Another measure that supports Nike's volume-focused view is seen in inventory turnover, where again there is a difference of 1.6x faster than its German competitor. With that said, a turnover greater than 1 is a sign of not only efficient, but also very effective and coordinated production and sales capabilities, making them leaders on their own merits.

- Last but not least, Nike's return on investment being 7.4x higher than Adidas shows a management with a great capacity for optimal resource allocation that keeps the company in its market leading position, on this measure Adidas (at present) falls short, but its positive value indicates that it is not too bad.

ESG criteria

No Data Found

No Data Found

Nike's reduced environmental impact makes it a leader in the segment, this is due to its relentless effort to have 100% source energy at its various locations and total waste detour using renewable energy sources recycling techniques such as its circularity principle. Adidas does not stand still by offering plant-based products that require less use of fertilizers and less use of water and carbon emissions.

This situation of leadership is reversed in the social sphere, where Adidas has had perfect scores in subcategories of occupational safety. and responsible marketing (10/10), whereas Nike has not completed its transition to having suppliers that meet all ESG expectations.

In terms of commitment to the environment, Adidas leads with a total score of 5.40 versus Nike's 4.87, placing both in the top 6% group in their industry.

And closing with governance, both companies are working to achieve equality in compensation, board composition, board of directors' rights, and and transparency with the audits, however, Nike has once again leads by 1.4 points.

That leaves us with two additional questions....

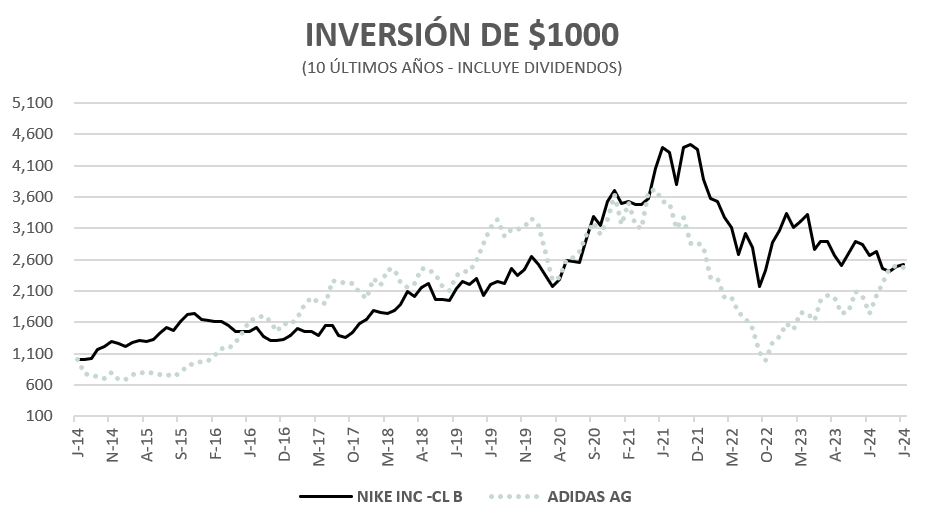

What would have happened a few years ago if you had bought one of the shares?

Market dynamics let us know that Nike's dominance is constantly being challenged, where the cumulative return over the last 10 years is 1.3x higher for Adidas at an astonishing 227.7% versus Nike's 175.11%, however, they are both impressive and definitely welcome for both their capital appreciation and dividend payments.

Would you like to be part of this industry, just do it!!

Contact with us

"*" indicates required fields

DISCLAIMER: Singular Wealth Management, Corp. and Singular Securities, Corp. (SWM&SC), offer perspectives on various markets, sectors and investment opportunities that could be valuable to subscribers of our editorial content. This includes views on different types of securities, as well as commentary on economic and political scenarios. It is crucial to understand that this publication does not constitute financial guidance and is not an invitation to make specific investments. For personalized advice, we recommend using the Unique Advisory Services through our Securities House's qualified financial advisors to achieve your investment objectives. Although the information in this publication comes from reliable sources, we cannot guarantee its accuracy or completeness. Information is current at the time of publication, but may change without notice. Investing in securities involves risks, including the possible loss of principal, and past performance is no guarantee of future returns. SWM&SC personnel may invest in the securities discussed from time to time without receiving any compensation from the companies mentioned. We disclaim any liability for damages resulting from the use of our services. Entity regulated and supervised by the Superintendencia del Mercado de Valores of the Republic of Panama. Singular Wealth Management Corp., "License to operate as a Securities Brokerage Firm, Resolution CNV- No. 219-2005 of September 19, 2005". Singular Securities Corp., "License to operate as a Securities Brokerage Firm. Resolution SMV- N° 672-15 of October 21, 2015".