Volatile but timely market

A bearish phase for a volatile market has been forecast since 2021. The decision to increase the printing of new dollars by the FED has generated economic repercussions worldwide.

On the other hand, we are all wondering, when will the war between Russia and Ukraine end, as some of the big brands such as McDonald's have had to exit this economy.

In China, covid is apparently here to stay as there are still some cases in Beijing. The point is that when an entire city in China is paralyzed, it is like stopping the production of an entire Western country and in the end it affects both the supply chain and prices. But in general the only thing that China could threaten right now is if it decides to attack Taiwan. Although I don't think that's going to happen this year because Xi Jinping will want to be re-elected as permanent president at the end of 2022 and I think he has a lot to think about right now.

Inflation in a volatile market

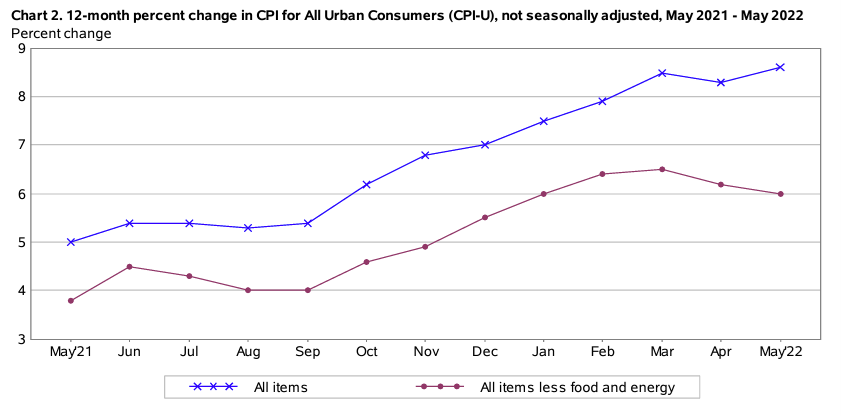

This chart shows everything that is going up:

- In blue color, food and energy are included.

- In red color, food and energy are not included and as we can see it is going down. Some products or services that make up the red line:

- Airline tickets.

- Hotels, etc.

It appears that the consumer has spent the savings they acquired in the pandemic and possibly this summer the demand for many of these products and services will drop considerably. Another piece of news that I think is relevant to mention at this point is the inventory at Target and many other stores. It appears to be at record highs and will certainly want to get rid of everything at lower prices.