SUMMARY OF THE MONTH

August lost all of its gains during the last sessions of the month, despite some relief on the last trading day, all while the yield curve continued to deepen its inversion.

The apparent slowdown in inflation for July, coupled with a strong employment report, strengthened markets' conviction that Powell could slow the pace of hiking at upcoming meetings. However, that idea was proven wrong after the Fed's Jackson Hole meeting.

Europe continues to struggle with high inflation as well as the prospect of a very challenging winter with inadequate heating. The euro fell slightly below parity during the month.

MACRO CORNER

August lost all of its gains during the last few sessions of the month, despite some relief on the last trading day, marking another volatile month in the markets. As they fall, we want to remind investors to be cautious and look at rallies as an opportunity to rebalance, rather than a marker of a strong market. If anything, we have seen throughout August the current fragility in the bull market.

The month started off strong, with an apparent slowdown in inflation for July, along with strong employment reports that strengthened the markets' conviction that Powell could slow the pace of hikes at upcoming meetings. However, that idea was proven wrong after the Fed's Jackson Hole meeting in late August, where Powell effectively reiterated that they would do whatever it takes.

Inflation is likely to return to the two percent target, signaling more pain ahead for markets.

Things began to break down during the third week of the month, ending a nearly 2-month rally that had taken the Nasdaq into a "technical" bull market.

Several pieces of bad news emerged, but the worst was housing. The Fed is looking at a puzzle with 3 pieces: inflation, employment and housing - to determine their tightening policy. Specifically, they are looking for signs of a cooling economy to slow the pace of rate hikes, which, paradoxically, would help asset prices even as the economy crumbles.

We saw inflation potentially peak in last week's numbers, but it was housing that showed a substantial slowdown this week. Housing starts fell 9.6% and existing home sales fell 5.9%.

The NAHB's August measure of homebuilder confidence fell below 50 for the first time since May 2020. "Existing home sales have fallen for six consecutive months and are 26% lower than the January peak."according to Pantheon macro economist Ian Shepherdson. "But the bottom is still a long way off, given the degree to which demand has been crushed by rising rates; the required monthly mortgage payment for a new buyer of an existing single-family home is no longer rising, but still increased by 51% year over year in July."

The biggest loser on a global basis continues to be Europe, plagued by a series of events. Extremely dry summer weather and lack of rain have made it extremely difficult for shipments to the Rhine and inflation is soaring.

Germany recorded an annualized inflation number of 37% and other nations are following suit. The most important part of this is, of course, commodities, particularly energy, given Europe's dependence on Russia and Putin's militarization of access to gas. EU gas prices reached €343 per megawatt hour, almost 400% more than a few months ago and about 10 times the US equivalent. This has spread to all industries: according to the region's fertilizer industry association, 70% of production in Europe had been affected by high gas prices.

A recession is looming, a question of when, not if, and every conceivable metric is deteriorating, especially in Europe. The next few months will be challenging, so we urge investors to be cautious and prudent, as well as skeptical of bear market rallies.

VARIABLE INCOME

August closed negative for stocks with the S&P down 3.5% and the Nasdaq down nearly 5%, despite a strong start to the month following Powell's Jackson Hole speech. We would expect the S&P to revisit prior lows and potentially drop to $ 3'200 in the coming months, especially when comparing the current market to the early 2000s.

It is important to note that many are marking relatively low P/E ratios for investment, however, most of the reduction has come from a decrease in the numerator while the denominator remains constant. Each recession has come with a downgrade in EPS and EPS expectations, and we have yet to see this happen, leading us to believe that as expectations adjust, we could see higher PE ratios as prices fall.

One area to watch for long-term investors is the industrials and materials industry, with a focus on copper and other metals needed for electric vehicles and renewables. We downgraded from overweight to neutral in May due to performance, as well as technical positioning relative to the S&P and the cyclical nature of commodity businesses.

We don't think it's the right time to go back to overweight, but given how far we are from the production we need in the next few years, it's important to keep the sector in mind.

On a sector basis, Energy (XLE + 3.60%) and Utilities (XLU + 1.19%) were the only positive performers, while Gold Miners (GDX -8.34%) and Technology (XLK -5.29%) were the worst performers.

FIXED INCOME

Fixed income had a broadly negative performance as yields rose to the highest level in a few months as YTD 10 rose to 3,11%. More important, however, has been the continued and deepening inversion of the yield curve that we see in years 2-10. The 2-year Treasury bond is now paying 3.47%, surpassing its previous high during 2022. Inversions generally indicate recessions in the future, but they are also a very important indicator to watch when trying to understand positioning in the bond market. Despite the strong rally in equities, it was clear that fixed income never really believed it would be sustainable.

We still see a likely policy error by Powell, especially given his latest comments, as likely to offer some short-term pain, but create an opportunity for bondholders in the medium term. Yields will eventually compress as inflation is brought under control, albeit as the economy sinks.

However, it is good to keep in mind that investing is a relative endeavor: bonds will do better than stocks, and U.S. bonds will probably do better than European bonds. With the dollar showing continued strength, we believe the lower band of U.S. investment-grade bonds could outperform. We continue to be constructive on bonds relative to equities at these levels.

The worst performers for the month were International Treasuries (IGOV -6.4%) driven mainly by their European components, hit hard due to inflation and the prospect of a very difficult winter, as well as a euro at parity with the USD.

TECHNICAL CORNER

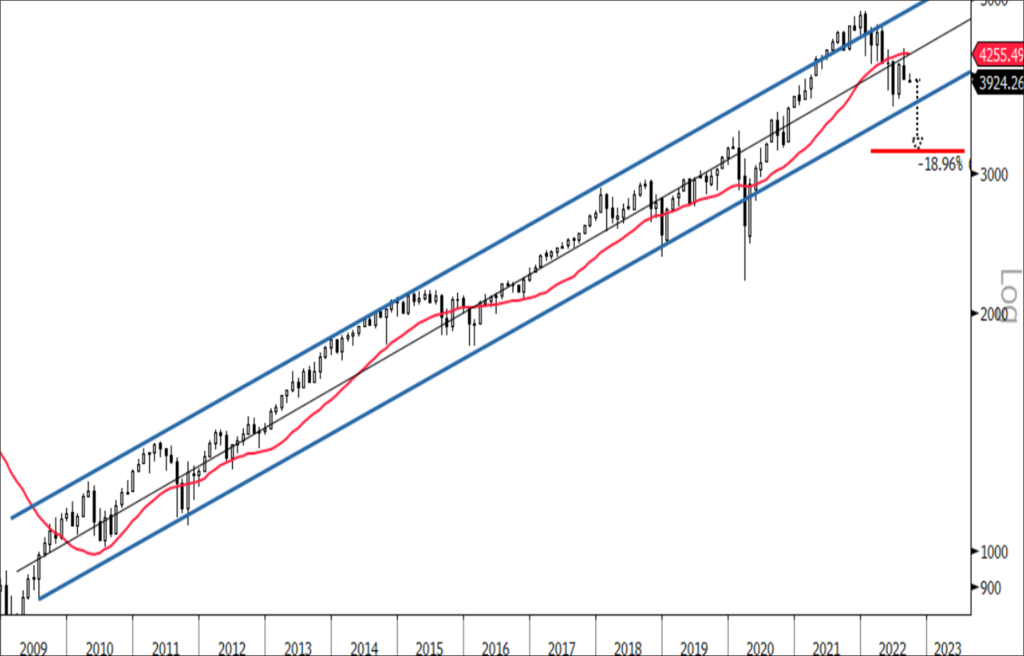

S&P 500 (3'924.26) / Monthly Chart

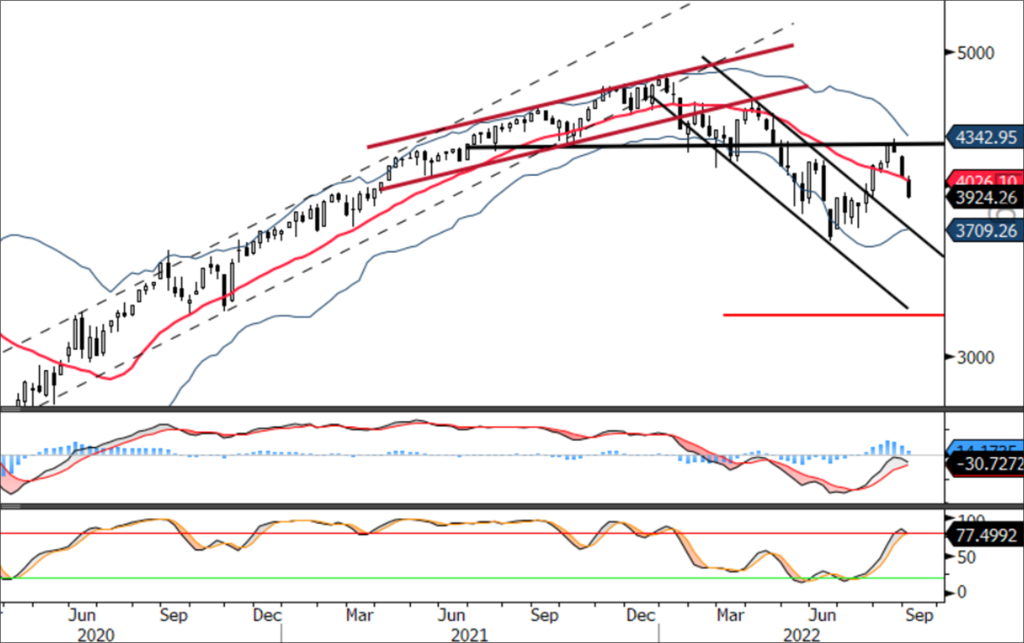

S&P 500 (3'924.26) / Weekly Chart

As expected and as we discussed in our last report, the rally that started in June found its peak near the highest weekly Bollinger band at the 4'400 level. Since then, prices have declined 3 consecutive weeks, calling into question a possible market bottom.

As for the weekly indicators, stochastic is still in its overbought zone, which means more bearishness could come in the coming weeks.

Given that we are putting more likelihood of a recession coming very soon, rather than a soft landing situation, prices should revisit the June lows and drop below those levels to reach the 3,200 levels at one point in time.

Despite seeing the S&P 500 fall over 23% from the peak to this year, we have always been cautious about using the word Bear Market on the recent decline. The reason is that prices have not (so far) broken any long-term trend lines and are still in a long-term bull market 2009-2022, determined by the rising blue channel on the monthly chart. For this reason, any drop below the June lows at 3,600 would break the long-term ascending channel and technically define the end of the long-term bull market started in 2009 and the beginning of a new dynamic. So far, the current trend is a medium-term correction within a long-term bull market...

THEME OF THE MONTH

Commodities: short-term pain for long-term gain

Most commodities, whether industrial metals, precious metals, agricultural products, have fallen sharply after record highs reached in the spring. Commodities, such as the so-called "Copper Doctor," are leading indicators, signaling a coming recession. The metal is down more than 24% from highs, despite a 17% rally since mid-July. The real estate crisis in China, along with the specter of an impending recession in the U.S. and Europe are headwinds for the metals. And certainly, with the exception of those used in batteries or for energy, most commodities have followed copper's lead.

Electrification, energy transition and the rapid growth of low-carbon technologies will lead to a transformation in metals demand far beyond current supply capacity. This will lead to a prolongation of the period of high prices. In fact, global metal supply will start to slow down in 2024-25, at the same time that demand is expected to accelerate due to the energy transition.

In addition, with the current downward pressure on prices, mining projects could be delayed. Demand is expected to far outstrip supply if the automotive industry transitions to all electric. The war in Ukraine has underscored how dependent the world is on fossil fuels. But policy announcements in recent months by Germany and the UK confirm that low-carbon energy will be essential in the future.

Among base metals, there is a great need for new investment in copper and nickel exploration and production. The outlook is even more extreme for cobalt and lithium. The capacity to extract and refine the raw materials used in batteries must be expanded to meet the exponential growth in demand for electric vehicles. However, CapEx intentions of the major miners are tepid at best, and many of the majors are reluctant to embark on new large-scale projects that will take years to develop.

Despite the pandemic and war in Europe, mining investors have enjoyed record returns over the past 18 months. Collectively, mining company balance sheets have never been stronger. That said, valuations remain relatively low, with companies such as Rio Tinto offering dividend yields of more than 10%.

So how should we think about investing in the sector? The impending global economic slowdown and the real estate crisis in China are likely to continue to weigh on materials prices in the near term. Copper is likely to continue to be a good leading indicator of the economic cycle and move with market volatility. However, the correction should not be as sharp as in 2008 or 2016, given the medium- to long-term structural bullish scenario.

We are not upgrading the sector to overweight at this time due to the potential cyclical pressure the sector may continue to face. However, the valuation and dividend yields of the companies are extremely attractive for a sector that benefits from global megatrends and secular forces. For long-term investors, starting to invest makes a lot of sense and are certainly good entry points, despite the risk of further pressure in the short term.

Follow us on Linkedin | Instagram | Facebook | Twitter | Youtube