Stocks to watch | August 2022

We share with investors three companies that have caught our attention in August due to their relevance in the mining industry. Different economic aspects could generate that companies with competitive advantages could be benefited in the medium term by a fair valuation from the market.

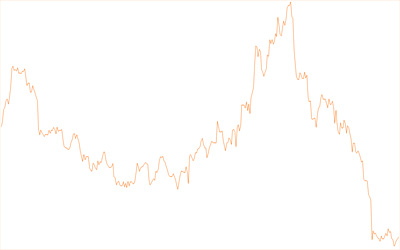

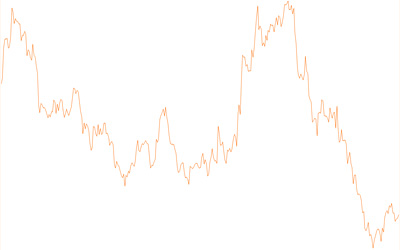

One of the industries that has been heavily impacted in the bear market has been the mining industry, especially gold mining, even though historically these precious metals have been the panic room for investors in times of uncertainty, the aforementioned companies have seen huge devaluations in their share prices.

- Newmont Corp

- NEM

- United States

- Mining

- USD

Buy

41%

Hold

59%

Sell

0%

0

ESG Score*

0

Price

0

52 Week High

0

52 Week Low

Buy

41%

Hold

59%

Sell

0%

0

ESG Score*

0

Price

0

52 Week High

0

52 Week Low

The largest gold producer with significant operations and/or assets in the United States, Canada, Mexico, Dominican Republic, Peru, Suriname, Argentina, Chile, Australia and Ghana. The company has attributable proven and probable gold reserves of 92.8 million ounces and an aggregate land position of approximately 24,300 square miles. Newmont is also engaged in copper, silver, lead and zinc production. Although the company's sales come primarily from refined gold, the end product of its operations is doré bars. The company generates most of its revenues outside the United States.

Newmont's performance over the past five years has experienced year-over-year growth, with 2021 being its strongest year of performance among the period. Newmont's revenue increased by $725 million to $12.2 billion compared to 2020 revenue of $11.5 billion.

- Barrick Gold Corp

- ABX

- CANADA

- Mining

- USD

Buy

75%

Hold

25%

Sell

0%

0

ESG Score*

0

Price

0

52 Week High

0

52 Week Low

Buy

75%

Hold

25%

Sell

0%

0

ESG Score*

0

Price

0

52 Week High

0

52 Week Low

One of the world's leading gold and copper producers, with proven reserves that are among the largest in the industry. It has interests in 15 producing gold mines in a dozen countries, with the largest assets in Nevada (United States) (Cortez and Goldstrike), Mali (Loulo-Gounkoto) and the Democratic Republic of Congo (Kibali). Barrick also holds all the shares of Acacia, which owns gold mines and exploration properties in Africa.

Gold sales represent approximately 95% of revenues, followed by copper sales and others, which represent the remainder of revenues.

The Company focuses on return to its stakeholders by optimizing free cash flow, managing risk to create long-term value for its shareholders, and partnering with host governments and their local communities to transform their country's natural resources into sustainable benefits and mutual prosperity. Barrick's goal is to achieve this through asset quality, operational excellence and sustainable profitability.