Weekly Extract 01/03/2021

Weekly summary from February 22 to 26

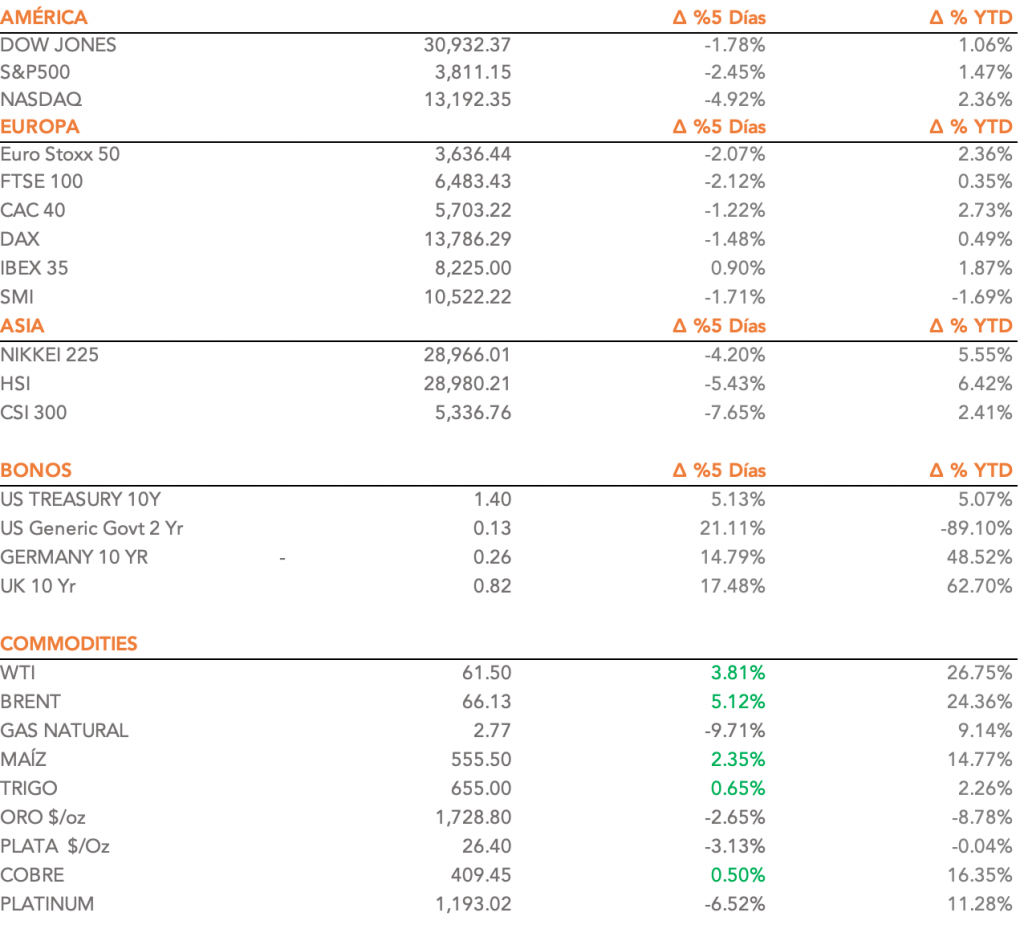

- The US equity market closed the week negatively. However, the three main indexes, the Dow Jones, the S&P500 and the NASDAQ, closed the month of February with rises of 3.17%, 2.6% and 0.93% respectively. The Nasdaq 100 falls by - 0.12% in the month.

- In Europe, equities closed the week in negative territory, with the exception of the Ibex 35. European indices closed the month of February on a positive note. The Ibex 35 stood out, with a 6.03% and the Euro Stoxx 50 with a 4.45%.

To be taken into account

- Investor attention is focused on rising Treasury yields. Important announcements are expected from Fed officials and a clear plan on how they will deal with this scenario.

- A U.S. Centers for Disease Control and Prevention advisory panel voted unanimously last Sunday, Feb. 28, to recommend Johnson & Johnson's COVID-19 shot for widespread use. The final authorization for the vaccine comes a day after it was cleared by U.S. regulators.

- Investors will be closely watching what happens at the OPEC+ meeting on March 4. Decisions are expected to be made about increasing oil production starting in April. Prices are at 13-month highs and an agreement is expected to be reached to increase production by 500,000 barrels per day.

- Legendary investor Warren Buffett published his famous annual letter to shareholders. Among the highlights, he mentioned how the company's stake in Apple has grown. The company has accumulated USD 120 billion in Apple shares since his conglomerate started buying shares at the end of 2016. Among some of the most outstanding phrases he has mentioned that "Bonds are not the place to be these days, fixed income investments around the world face a bleak future". On the other hand by way of conclusion he has quoted "Our firm conclusion: never bet against the U.S.".

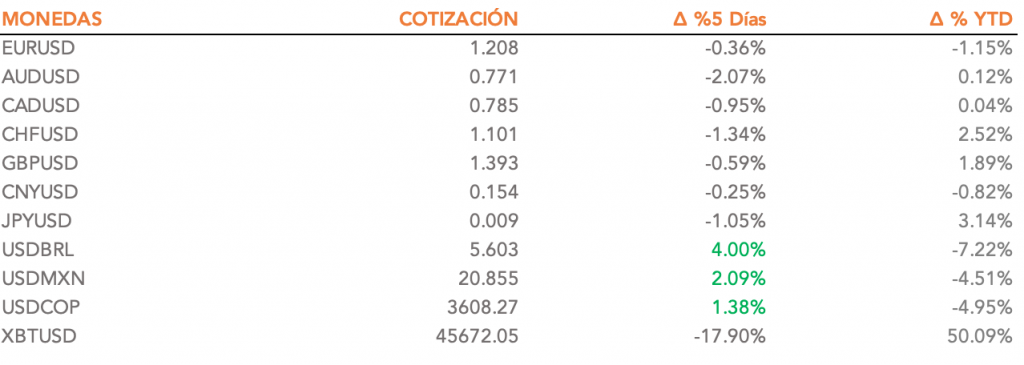

- Coinbase Inc, the San Francisco, California-based cryptocurrency trading platform, has formally filed its application with the SEC to go public. The IPO of this company could begin to set a trend among companies in the cryptocurrency space to go public.

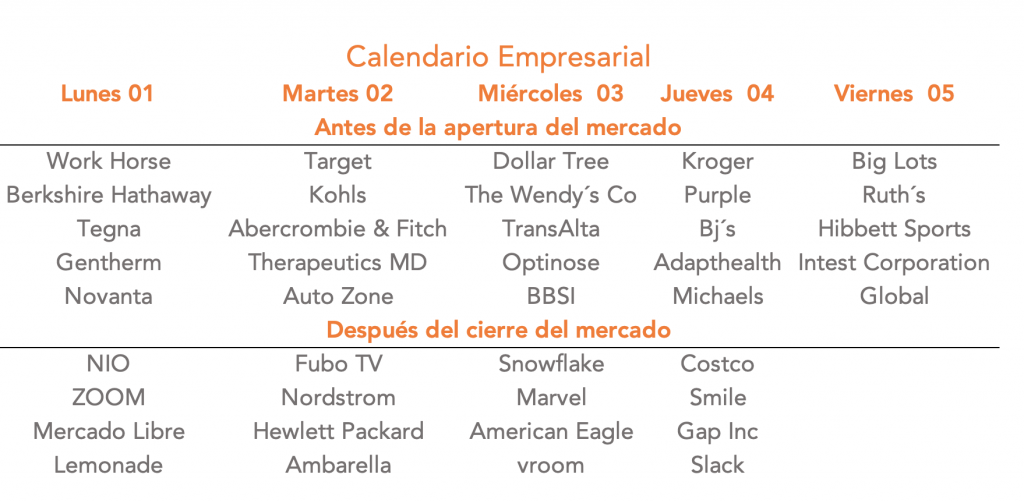

- 96% of the companies comprising the S&P 500 index already reported fourth quarter 2020 results. About 80% of the companies beat analysts' estimates with an average of about 15%. Retail companies stand out this week, including Target , Costco and Kohl's.

- House Democrats approved the $1.9 billion aid package last Saturday morning, February 27. Senate approval is expected in order to get the plan in place before March 14, when unemployment benefits end.

- At the close of the week the focus will be on the U.S. jobs report. Nonfarm payrolls growth of 225,000 is expected versus January's increase of 49,000.

- In Great Britain, the focus will be on the presentation of the budget by Finance Minister Rishi Sunak. New measures to help employment are expected and an increase in corporate taxes is not ruled out, which would keep the taxes of the lowest income taxpayers frozen for the time being.