Weekly Extract 05/04/2021 - April

Weekly summary from March 29 to April 1

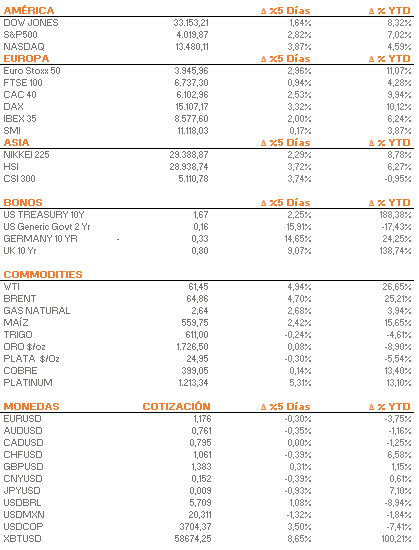

- The US equity market closed the week on a positive note. The pace of vaccination is high and the market has positively accepted Joe Biden's proposal to invest $2 trillion in infrastructure in order to create "millions" of jobs. The S&P500 has passed the 4,000-point barrier for the first time last week.

- In Europe, the week closed on a positive note for the main equity indices. The EuroStoxx 50, the Old Continent's main benchmark, has doubled the performance of the S&P500 in the first quarter of the year.

To consider - April

- Investor attention will be focused on the approval by the U.S. Congress of the huge infrastructure plan announced by President Joe Biden of more than $2 trillion.

- Considering that the market was closed last Friday, investors will only be able to react to the very good employment data that came out on Friday, April 2. Friday's report represented the strongest job creation since last August and was broad-based across all industries, with the leisure and hospitality sectors being among the highlights.

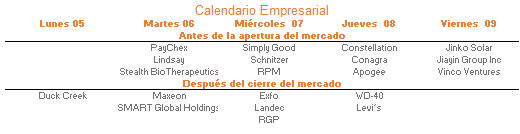

- With growing concern around the world about the global chip shortage, Intel and Applied Materials' events on Tuesday, April 6 will be closely watched by chip investors.

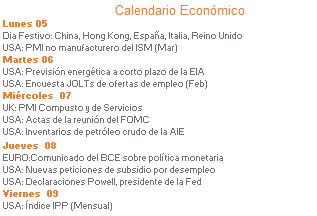

- The International Monetary Fund will begin its virtual meetings on Monday, April 5, where it is expected to announce economic growth forecasts for 2021 and 2022. On Wednesday, April 7, the G20 Finance Ministers will meet to discuss debt relief initiatives for different countries.

- In addition, the minutes of the U.S. Federal Reserve's March meeting will be released on Wednesday, April 7. Therefore, investors will be on the lookout for any changes in the inflation outlook.

- On Thursday, April 8, the focus will be on Jerome Powell's discussion at the IMF on the state of the global economy.

Other important points

- In Europe, the focus will be on the minutes to be released by the European Central Bank regarding its latest meeting. Christine Lagarde, president of the ECB, had mentioned that investors could test the bank's willingness. This could be done by slowing the rise in funding costs "as much as they would like".

- Tesla, the most important company in the electric car sector, released its production and delivery results for the first quarter of 2021 on April 2. Deliveries of 184,800 vehicles have exceeded analysts' estimates. Elon Musk's bet on the growth of the brand in China and Europe is beginning to pay off.

- A light week is expected in terms of corporate earnings releases. Investors will be on the lookout for a snapshot of how companies have performed one year after the pandemic began when corporate earnings reports begin again in the second half of April.