Weekly Extract 03/29/2021

Weekly summary March 22-26

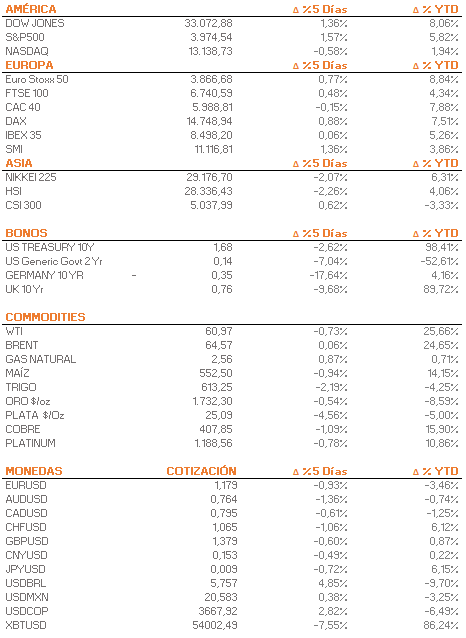

- The U.S. equity market closed the week mixed. The S&P 500 had its best performance in three weeks closing at new highs. The best performing sector for the week was Real Estate with a gain of 4,23%.

- In Europe, the week closed positively for the main equity indices. Among the most favored sectors were energy and mining, due to a rotation towards more cyclical sectors. The euro posted its second consecutive week of declines against the dollar.

To be taken into account

- Short week for financial markets worldwide, due to the Good Friday holiday. Attention is focused on the impact that the blockade of the Suez Canal by the cargo ship "Ever Given" could have at a global level. According to experts, it is estimated that 10% of international maritime trade transits this route. In the early hours of today's morning it was reported that the vessel has been "partially refloated", although it is still unclear when the canal will reopen.

- The energy sector will be in the spotlight this week. The Suez Canal blockade and the meeting by OPEC to discuss production targets could cause a lot of price volatility. Major oil producers are expected to maintain the production cuts agreed at the last meeting.

- Investors' attention will be focused on the U.S. employment data on Friday, April 2. The report is expected to be the first this year to show significant progress in the labor market recovery. Analysts expect 500,000 jobs to be created in March, the largest monthly increase in five months.

- On Wednesday, President Joe Biden is expected to provide some details on his multi-billion dollar infrastructure spending plan to help the U.S. economy recover further.

- Visa announced Monday that it will allow the use of the USD Coin cryptocurrency to settle transactions on its payment network, the company has launched the pilot program with cryptocurrency and payment platform Crypto.com and plans to offer the option to more members later this year, Reuters news agency reported.

Other important points

- According to new Trade Representative Katherine Tai, the United States is not prepared to lift tariffs on Chinese imports in the short term. However, it would be open to possible trade negotiations when the time is right.

- After a series of large block trades worth US$20 billion on Friday, investors are preparing for one of the most anticipated market openings in recent months.

- The global chip shortage puts electric car companies under the spotlight. According to analysts, Tesla would deliver only 162 thousand vehicles in the first quarter of this year compared to the 183 thousand initially expected. On the other hand, Asian company Nio Inc, has already announced that it has reduced its quarterly guidance to 19.5 thousand vehicles from a previous range of 20.5 thousand vehicles.

- Hong Kong's chief financial officer, Paul Chen, has ordered the city's stock exchange and regulator to prepare to jump on the SPACs (Special Purpose Acquisition Company) bandwagon. The aim is to become the first Asian hub to give the green light to these vehicles before the end of the year.

- Nomura Holdings, Inc. of Japan noted early Monday morning a potential loss of $2 billion at a U.S. subsidiary. At the same time, it has mentioned that it would cancel a planned bond issue due to a significant "event".

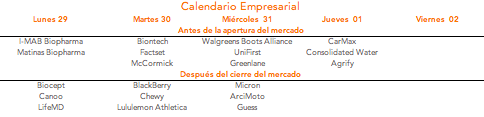

- The presentation of results continues, this week highlighting BioNTech, Chewy, Lululemon Athletica, McCormick, Walgreens Boots Alliance and Micron Technology.