Weekly Extract 03/15/2021 - Bank

Weekly summary from March 08 to 12

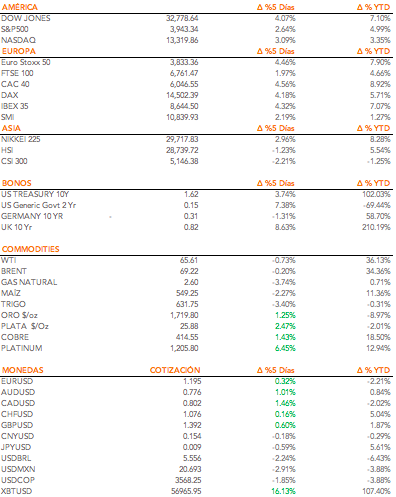

- The U.S. equity market closed the week on a positive note. For the week, the 10-year US Treasury bond yield consolidated in a range between 1.50% - 1.60%. All sectors of the S&P 500 closed the week in positive territory and the benchmark index set a new all-time high.

- In Europe, the main equity indices closed another week in positive territory. The Eurostoxx 50 reached one-year highs.

To take into account / Central Bank

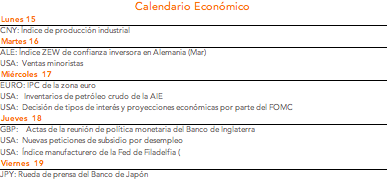

- The main focus of the week will be the new meeting to be held by the U.S. Federal Reserve on Tuesday and Wednesday. Specialists believe it will be one of the most critical events for the Fed in recent times. The central bank will release its new economic growth and interest rate forecasts, known as the "dot plot".

- Investor attention will again be focused on rising Treasury yields. The yield on 10-year US Treasury bonds is expected to reach 2% by the end of the year, but could rise above those levels in the second quarter of the year.

- Among the week's economic data of the week, February retail sales data in the United States is the highlight. Forecasts are for the report to indicate that retail sales fell by 0.6% last month, following January's 5.3% increase.

- The Bank of England will also make its monetary policy announcement on Thursday, March 18. For the time being, interest rates are expected to remain unchanged.

Other important points

- The Bank of Japan faces one of its most important policy reviews on March 18-19. It is expected to include in its statement clearer guidance on what it considers an acceptable level of fluctuation in long-term interest rates. It is important to remember that the central Bank of Japan pioneered yield curve control.

- Volkswagen will hold its "VW Power Day" on March 16-17, at which the company will discuss battery and charging infrastructure as it plans to highlight its ambitions in the electric vehicle sector.

- Earlier last weekend bitcoin hit new records, trading at a level of USD 61,700. According to Reuters, a senior Indian official has mentioned that the government is ready to propose a law that would make it illegal to mine, trade or even hold private cryptocurrencies. The bill would give those holding cryptocurrencies such as bitcoin six months to liquidate, or else they will start facing fines.

- Earnings season is practically over, with some big names such as FedEx, Nike and Dollar General standing out this week.