Weekly Excerpt February 22

Weekly summary from February 15 to 19

- 83% of the companies comprising the S&P 500 index reported results for the fourth quarter of 2020. Approximately 80% of the companies are beating estimates made by analysts for this quarter.

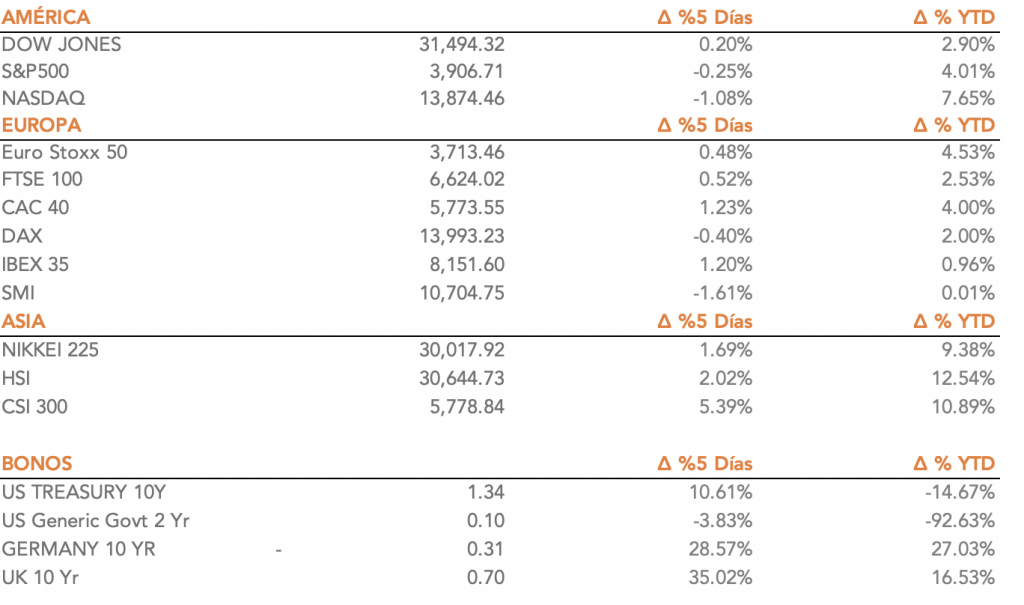

- The US equity market closed the week mixed. Of the three main indexes, the Dow Jones was the only one to end the week in positive territory.

- In Europe, the main financial markets closed the week on a positive note. The main benchmark index in the old continent, the Euro Stoxx 50, is up 4,53% so far this year.

To be taken into account / companies

- Investors will be on the lookout for another week full of corporate results. 83% of the companies that make up the S&P 500 index reported results for the fourth quarter of 2020. In other words, 80% of the companies are beating estimates made by analysts for this quarter.

- The focus in recent days has been on rising U.S. Treasury yields. The optimism is on the prospects of an anticipated economic reopening as the distribution of Covid-19 vaccines accelerates and on expectations that another massive wave of fiscal stimulus will boost growth.

- On February 26-27, the meeting of G20 representatives will take place. They are expected to discuss the idea of extending IMF financing and the initiative to allow the poorest countries a six-month suspension of some debt payments. Additionally, the G20 is expected to lead a global immunization plan against COVID-19. The meeting will be the first to be attended by the new U.S. President Joe Biden.

- According to data from the national immunization program in Israel, Pfizer and BioNTech's Covid-19 vaccines appear to have prevented the vast majority of recipients in Israel from becoming infected with 89.4% effectiveness. This information provides the first indication that immunization could curb transmission of the coronavirus.

- Global dividend payments could recover by as much as 5% this year. Corporate payouts to shareholders fell by more than 10% on an underlying basis in 2020, as one in five companies cut their dividends and one in eight cancelled them altogether.

- Brazil's securities industry regulator (CVM) is expected to launch an investigation starting Monday following President Jair Bolsonaro's announcement of a change in the CEO of state-owned oil company Petrobras.

- Chip production shortages could wreak havoc in the automotive sector. Major automakers such as Volkswagen, Ford Motor Co and General Motors Co, have been forced to opt for production breaks. This inconvenience could lead to a reduction in automobile production of between 5% and 10% on the European continent and in North America.

- HSBC is considering strengthening the role of Asia as its center of gravity. Europe's largest bank would be scaling back its global ambitions and start marketing what is known internally as the "pivot to Asia".

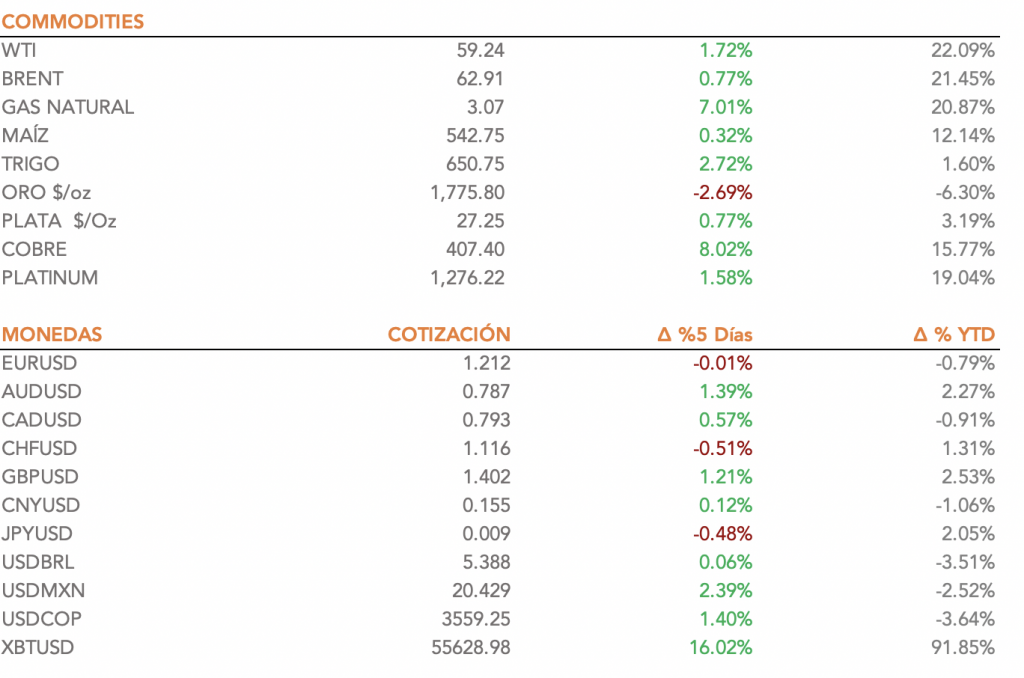

- The bitcoin continues its rally and on Sunday, February 21, touched a new all-time high price of USD 58,354. The cryptocurrency has managed to achieve its first billion dollars in market capitalization and so far this year, the return is close to 100%.

- Chinese State Councilor and Foreign Minister Wang Yi has called on President Joe Biden's administration to work with Beijing to undo the damage inflicted on bilateral relations during Donald Trump's tenure and to reopen channels of cooperation and dialogue. At the same time he has called for the elimination of tariffs on Chinese goods.