Weekly Excerpt 08/03/2021 - March

Weekly summary March 01 to 05

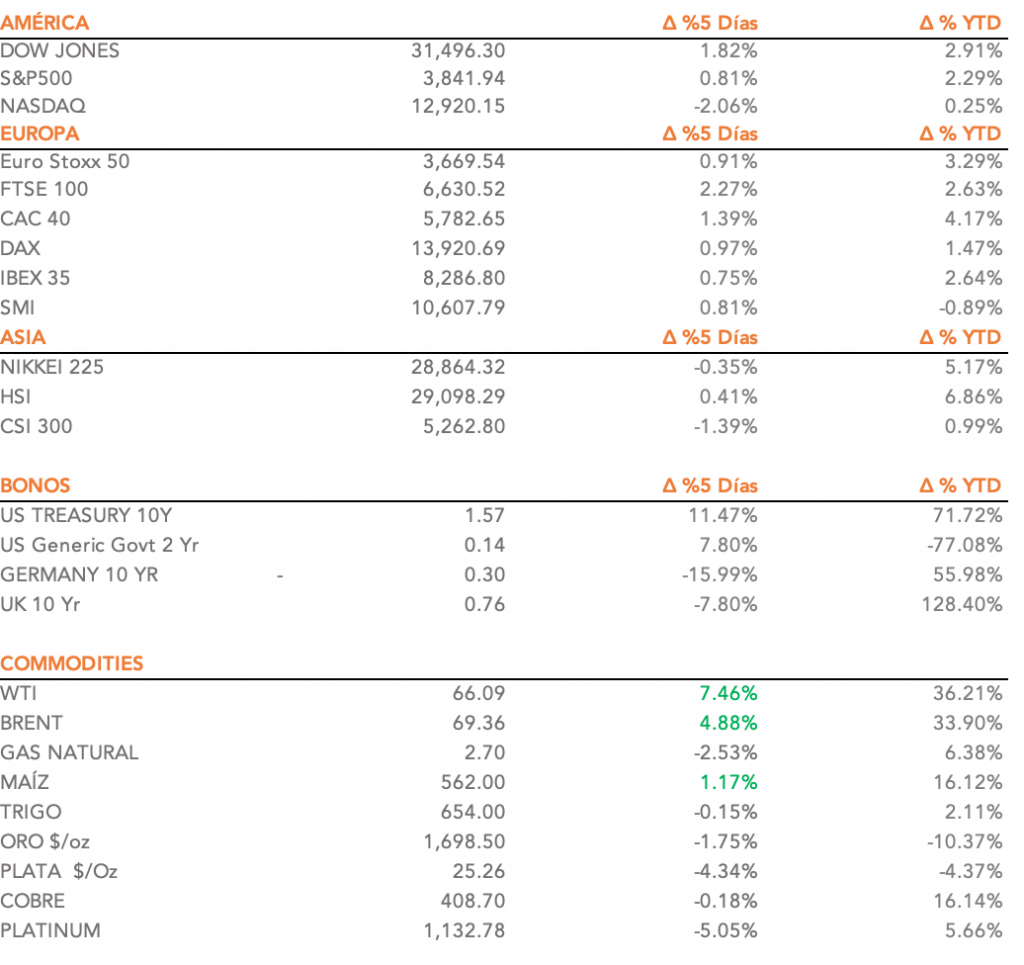

- The U.S. equity market closed the week mixed. Of the three major indices, both the S&P50 and the Dow Jones closed the week in positive territory. However, the NASDAQ closes the first week of the month down -2,06%.

- In Europe, the main equity indices closed the first week of the month in positive territory. The FTSE 100 stood out with an increase of 2.27%.

To be considered/ March 2021

- Investor attention is focused on the last step in the final approval of the new $1.9 trillion fiscal stimulus. The stimulus still needs to be ratified in the House of Representatives. However, no surprises are expected, given the relatively comfortable majority the Democrats have to achieve their goal.

- Investors' attention will be focused on new inflation data (CPI-PPI). It will be possible to assess whether prices have already started to rise as some feared before a major economic opening.

- Saudi Arabia's most protected oil facility was attacked last Sunday, March 7, driving oil prices to over $70. The missile and drone bombardment caused no loss of life or property.

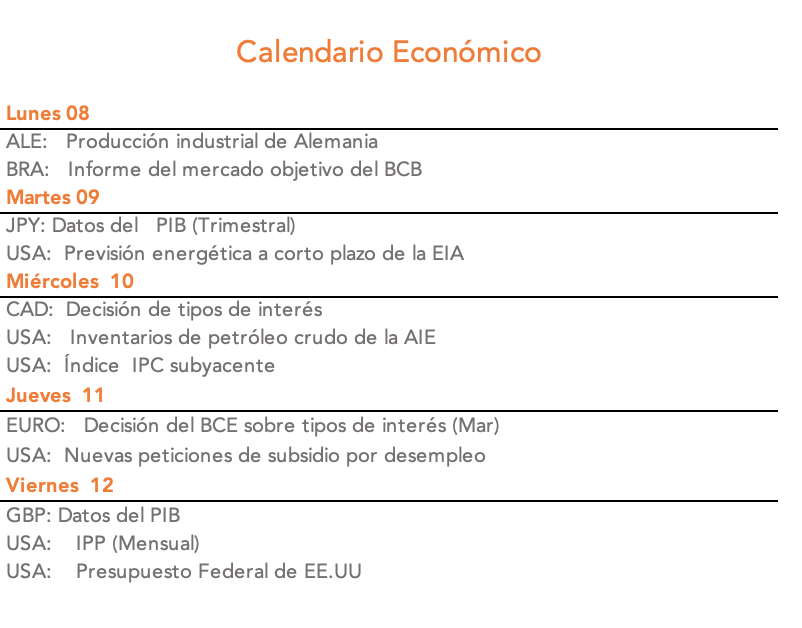

- On the European continent, the focus will be on the meeting on Thursday, March 11, of the ECB. The message from Christine Lagarde on the incipient spike in long-term government bond interest rates in Europe and the action plan to contain bond yields.

Other important points

- Tensions between the United States and China are beginning to resurface. A senior Chinese diplomat has urged the United States to stop "crossing lines and playing with fire" in Taiwan, as part of a broad series of warnings to President Joe Biden against meddling in Beijing's affairs. Taiwan could pose the greatest risk for a clash between the two powers.

- Concern is growing over cybersecurity issues following a sophisticated attack on Microsoft's widely used enterprise email software. According to Microsoft, the attack has so far claimed at least 60,000 known victims worldwide, including the European Banking Authority.

- Gaming platform Roblox Corp (RBLX), which allows users to easily play and develop video games, will make headlines this week when it makes its long-awaited debut on the New York Stock Exchange on Wednesday, March 10 via a direct listing.

- As the earnings season draws to a close, earnings per share (EPS) growth was 5.3%, a figure 17.2% above market expectations. 69% of companies have exceeded estimated sales and 78% have exceeded expected earnings.

- The big three U.S. telecommunications companies, Verizon Communications, T-Mobile and AT&T will hold their investor day events this week. The events begin on Wednesday, March 10 and end on Friday, March 12.

- There are rumors that General Electric Co (GE) is closing in on a USD 30 billion-plus deal to combine its aircraft leasing business with Ireland's AerCap Holdings NV, the Wall Street Journal reported.