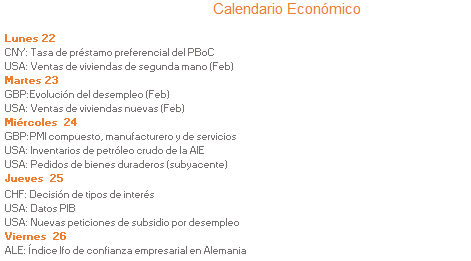

U.S. Treasury | Weekly Statement March 22

Weekly summary March 15-19

While investors' attention will be on the Treasury yield curve, the market is wondering how much longer the rise in U.S. Treasury yields can last.

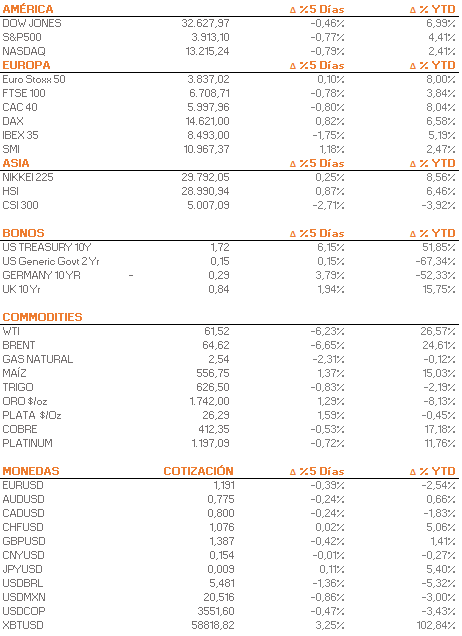

The 10-year US Treasury yield has increased, closing the week at 1.72%. Within the major sectors, the energy sector suffered the largest decline for the week at -7.66%. The US equity market closed the week negatively.

In Europe, the week closed mixed for the main equity indices. The strongest fall was seen in the Ibex 35 with a drop of -1,75% and the best performance was seen in the SMI with +1,18%.

To note/ U.S. Treasury data.

- The main focus for investors will be on the Treasury yield curve. However, the market is wondering how much longer the rise in U.S. Treasury yields can last.

- Between Tuesday and Wednesday, Jerome Powell and Treasury Secretary Janet Yellen will appear before the House Financial Services Committee and the Senate Banking Committee, where they will first discuss the state of the U.S. economy. Second, the importance of fiscal and, third and finally, monetary stimulus in the recovery from the pandemic.

- On the other hand, the PCE price index data will be released on Friday. This indicator is one of the Federal Reserve's favorite indicators of core inflation in the U.S. economy.

- In addition, the U.S. government, led by Joe Biden, is considering a historic tax hike, which would allow the government to take care of the spending plan to fight COVID-19. This could threaten the rally in US stocks.

- According to the governor of the People's Bank of China, the Asian country still has room to inject more liquidity into the economy. In other words, this could provide greater incentives for all economic players and help create an environment less prone to financial risks.

Other important points

- The Swiss central bank will hold its monetary policy meeting on Thursday, March 25. The bank is expected to keep interest rates at -0.75% (the lowest rate in the world) and also maintain its interventionist stance.

- On the European side, investors' attention will be on March economic activity data for the euro zone.

- Saudi Aramco plans to expand and intensify its cooperation with China, joining research in areas including hydrogen and ammonia production to achieve the long-term goal of low carbon emissions.

- Corporate earnings season continues and this week the focus will be on GameStop's results due Tuesday. The investor-favorite company on the Reddit platform is up more than 1,200% since its December 2020 earnings report.