Bonds and curves: what are they for the economy?

At the most basic level, investors look at the bond yield curve to understand the economy. This can guide decisions about sectors or assets. Although more art than science, the curve can be flat or steep, with attention to changes.

Typically, it shows increasing returns over the long term due to higher risk. Longer-term loans involve more inflation risk. This is called a term premium. When short-term yields exceed long-term yields, it is an inverted curve. Investors monitor these indicators to understand the economic cycle and adjust their strategies.

Bears and Bulls in bonds?

Now a normal upward curve indicates a robust economy with long-term growth, without sharp increases in interest rates. In contrast, flattening or inversion may signal difficult times, such as a looming recession.

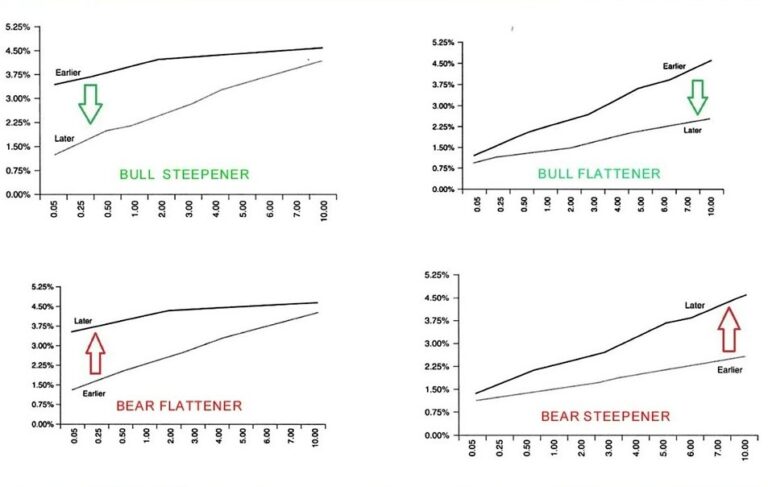

A "bear flattening" is when the yield curve rises sharply in the short term relative to the long term, suggesting concerns about tightening monetary policy; while a "bear steepening" is the opposite and may reflect inflationary fears.

On the other hand, a "bull steepening", which is a very rapid fall in short-term rates, can usually precede a rate reduction policy; while a "bull flattening" is when long-term rates fall much faster than short-term rates, which may indicate downward inflation expectations.

Curve inversion, particularly with short-term yields outperforming long-term yields, has historically preceded recession, but the time between inversion and recession can vary significantly. It is crucial for investors to observe the location of the shift in the curve to better understand its economic implications.

Chart 1: Different bond yield curves

Where will the next curve go?

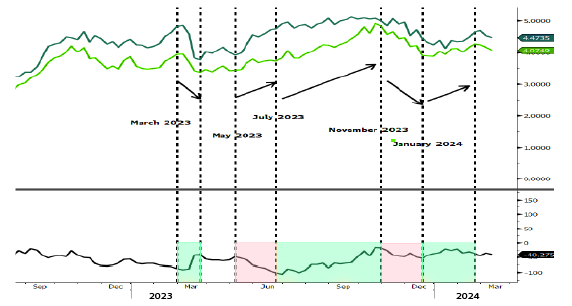

Since March 2023, the yield curve has experienced notable fluctuations, from steepening to flattening. This seesawing reflects uncertainty about the Federal Reserve's policies and the economic expectations (graph 2).

Currently, the curve, with -42 basis points in the US and -52 in the Eurozone, suggests unease among investors. Recent forecasts from JP Morgan point to a yield of 3.80% for two- and ten-year bonds at the end of 2024, indicating a possible flattening of the curve. Despite this setback, some are still betting on a steeper curve, arguing its vital importance to economic performance.

Graph 2: U.S. 2-year yields; U.S. 10-year yields; U.S. US 2-year yields; US 10-year yields; US 10-year yield spread -2 years US 10-year yield spread -2 years

What opportunities do we see?

The inverted yield curve is a concern due to uncertainty about the Fed's actions. We expect a shift to an upward steepening, which could affect both bond and equity markets.

If you would like to obtain investment advice or identify opportunities in U.S. fixed income, our team of brokers will be happy to assist you and provide you with the information and advice you need.

You can contact us through the following form:

Contact with us

"*" indicates required fields

ComShare this content:

DISCLAIMER: Singular Wealth Management, Corp. and Singular Securities, Corp. (SWM&SC), offer perspectives on various markets, sectors and investment opportunities that could be valuable to subscribers of our editorial content. This includes views on different types of securities, as well as commentary on economic and political scenarios. It is crucial to understand that this publication does not constitute financial guidance and is not an invitation to make specific investments. For personalized advice, we recommend using the Unique Advisory Services through our Securities House's qualified financial advisors to achieve your investment objectives. Although the information in this publication comes from reliable sources, we cannot guarantee its accuracy or completeness. Information is current at the time of publication, but may change without notice. Investing in securities involves risks, including the possible loss of principal, and past performance is no guarantee of future returns. SWM&SC personnel may invest in the securities discussed from time to time without receiving any compensation from the companies mentioned. We disclaim any liability for damages resulting from the use of our services. Entity regulated and supervised by the Superintendencia del Mercado de Valores of the Republic of Panama. Singular Wealth Management Corp., "License to operate as a Securities Brokerage Firm, Resolution CNV- No. 219-2005 of September 19, 2005". Singular Securities Corp., "License to operate as a Securities Brokerage Firm. Resolution SMV- No. 672-15 of October 21, 2015"....