Which bond segment to choose in the current environment?

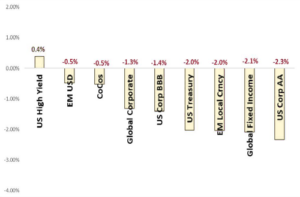

Bond market performance has been disappointing overall since January 1 (Figure 1). The resilience of the US economy and the slower-than-expected slowdown in inflation have led investors to fear that central banks may not be able to cut their policy rates as early as March. Market expectations now are that the Fed, but also the ECB, will ease monetary policy in June.

Given that investors are convinced that the bond yields will eventually fall, they are willing to take on more risk. Their primary objective is to take advantage of higher yields, knowing that those opportunities may no longer be available in a few quarters.

Graph 1: Year-to-date fixed-income returns

Bonds and the Fed

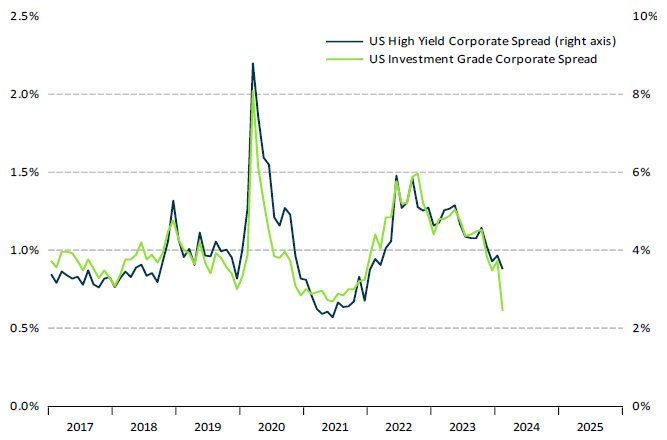

Currently, investors think the Fed will lower rates for the good reasons. That is, they believe they will do so because of a reduction of inflation and not necessarily because of an economic downturn. For this reason, the yield spread on U.S. high-yield corporate bonds (a benchmark commonly used to measure this perception of risk) fell to 351 basis points, its lowest level since January 2022.

This is even more impressive for investment-grade companies, as "single A" rated bonds now offer a premium of only 61 basis points, their lowest level in history. Normally, credit spreads are low when financial conditions are favorable and corporate defaults are minimal. Paradoxically, this is not the case today (Figure 2).

Figure 2: U.S. corporate yield spread: High yield (right scale) and Investment grade (left scale)

S&P 500 and spreads

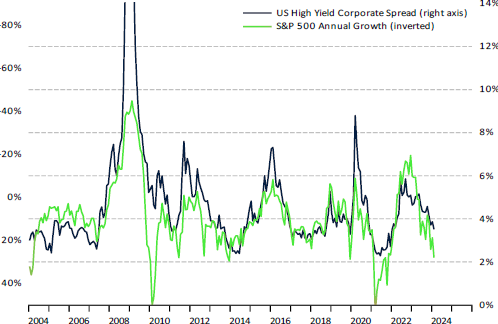

This risk-taking in the bond market, which may seem reckless to some, has been aided by the strong performance of the stock markets, giving an impression of low economic risk. The S&P 500 has just reached a new all-time high of $5,137. With the exception of the COVID-19 period between 2020 and 2022, credit spreads have always moved in step with equity returns and volatility (Figure 3).

All three indicators react similarly to changes in economic and financial conditions. To keep U.S. spreads this low, the annual return of the S&P 500 will have to continue to exceed 15%. Otherwise, the possibility of seeing increased volatility and credit spreads is high.

Chart 3: High yield spreads (364 basis points) and inverted S&P 500 (31%)

What opportunities do we see?

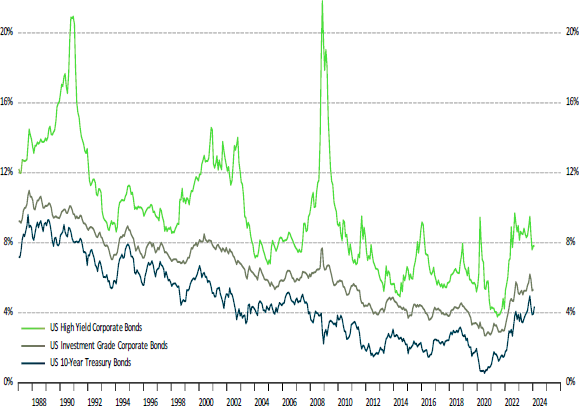

In light of these expectations and given the current yield spread between High Yield and the rest, we believe it would be wise to avoid speculative bonds (Figure 4). Current speculative bond yields do not offset the potential risk of widening credit spreads ahead.

Chart 4: Current yields: US High Yield, US Investment Grade, US 10yr Treasury

If you would like to obtain investment advice or identify fixed income opportunities, our team of brokers will be happy to assist you and provide you with the information and advice you need.

You can contact us through the following form:

Contact with us

"*" indicates required fields

ComShare this content:

DISCLAIMER: Singular Wealth Management, Corp. and Singular Securities, Corp. (SWM&SC), offer perspectives on various markets, sectors and investment opportunities that could be valuable to subscribers of our editorial content. This includes views on different types of securities, as well as commentary on economic and political scenarios. It is crucial to understand that this publication does not constitute financial guidance and is not an invitation to make specific investments. For personalized advice, we recommend using the Unique Advisory Services through our Securities House's qualified financial advisors to achieve your investment objectives. Although the information in this publication comes from reliable sources, we cannot guarantee its accuracy or completeness. Information is current at the time of publication, but may change without notice. Investing in securities involves risks, including the possible loss of principal, and past performance is no guarantee of future returns. SWM&SC personnel may invest in the securities discussed from time to time without receiving any compensation from the companies mentioned. We disclaim any liability for damages resulting from the use of our services. Entity regulated and supervised by the Superintendencia del Mercado de Valores of the Republic of Panama. Singular Wealth Management Corp., "License to operate as a Securities Brokerage Firm, Resolution CNV- No. 219-2005 of September 19, 2005". Singular Securities Corp., "License to operate as a Securities Brokerage Firm. Resolution SMV- No. 672-15 of October 21, 2015"....