First target

China: Opportunities and challenges

What does the market think about it?

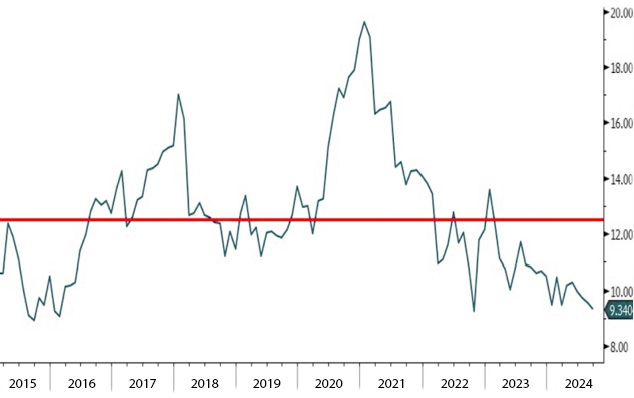

China, the world's second largest economy, faces key economic challenges, such as the real estate slowdown and restrictive fiscal measures. The manufacturing PMI reflects a slowdown since March 2024 (Figure 1). Projected GDP growth for 2024 slowed to 4.8%. In addition, consumption and retail sales show weakness due to low confidence.

Chart 1: China Manufacturing PMI

What do the major macroeconomic aggregates say?

The real estate sector, which contributes 24% of GDP and 20% of China's tax revenue, is in a severe downturn. Sales fell by 19% in 2024, and real estate investment declined by 10%. Despite easing policies, lack of demand persists due to uncertainty over prices, incomes and job security.

Are there still opportunities in Chinese stocks?

The Chinese equity market looks extremely cheap in terms of valuation, with an MSCI China forward P/E of 9.34x. (graph 2)25% below its historical average. However, price momentum remains weak and with no signs of recovery. In the short term, geopolitical risks and real estate weakness discourage investment, although it is attractive to long-term investors.

Chart 2: MSCI China Fwd P/E (9.34x); 10-Year Average (12.45x)

Second target

Small Caps: Has your time come?

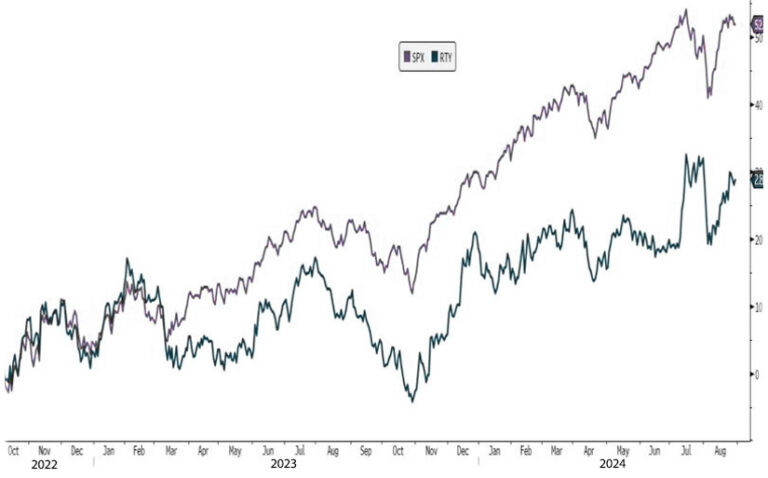

Since July, U.S. small and mid-sized companies have gained prominence among investors, given the widening performance gap versus large companies. Since October 2022, the S&P 500 is up 56%, while the Russell 2000 is up only 32%. (graph 3).

The success of the "Magnificent Seven"has distorted the performance of the S&P, raising questions about whether this gap represents an investment opportunity or a risk.

Chart 3: Performance since October 2022 of the S&P 500 (56%) and Russell 2000 (+32%)

Economic Reality and the Impact of Monetary Policy: The Case of Small Caps

U.S. small and medium-sized businesses face a bleaker economic outlook than large companies. Regional surveys reveal a possible "hard landing" for the economy, with declining production, reduced investment and layoffs.

The Federal Reserve's restrictive monetary policy has increased financing costs, further affecting these companies. A rate cut of at least 150 basis points is needed to reverse this trend and relieve pressure on small businesses, boosting investment and spending.

Assessments and rate cuts

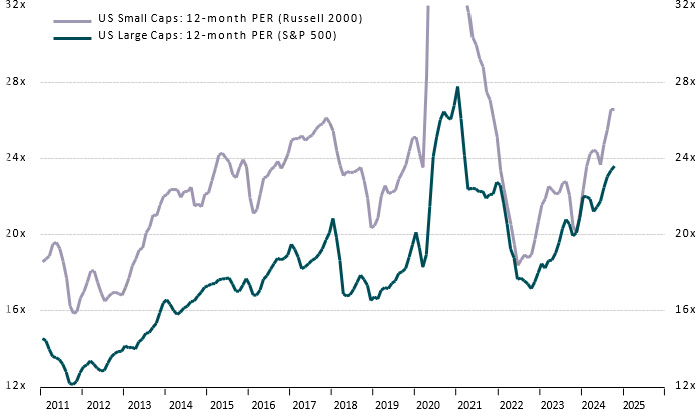

U.S. small and mid-sized companies face major challenges in earnings growth, affecting their stock performance. Although their prices have risen modestly over the past 8 months, price-to-earnings has risen from 20.1 to 26.6 times expected earnings. (graph 4).

It is worth mentioning that, while it is true that the rate cut initiated in September by the Federal Reserve benefits these companies, unless a steady rate of cuts is maintained, it is unlikely that they will outperform large companies.

Chart 4: US Large Cap 12m Fwd P/E; US Small Cap 12m Fwd P/E

The poacher

Bye bye recession in the United States?

Recessions generate widespread concern among business leaders, households and investors due to their broad consequences, such as economic uncertainty, reduced consumption, weakened investment and rising unemployment. Since the inversion of the yield curve in July 2022, the situation has intensified.

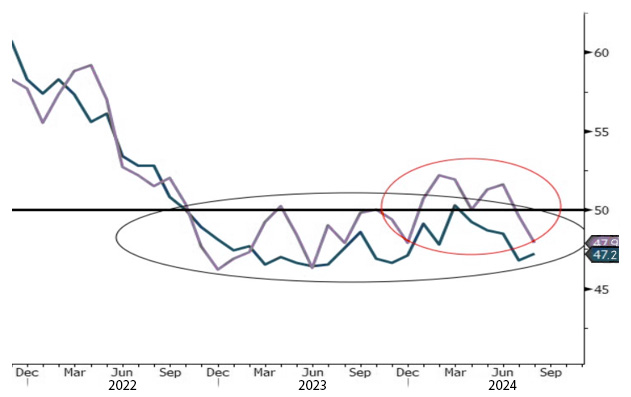

U.S. manufacturing confidence fell below 50 points in November (graph 5)The prices of computer memory (DRAM) and copper have also declined more recently, indicating a lack of dynamism in economic demand.

Chart 5: U.S. ISM PMI (47.2); U.S. manufacturing PMI (47.9)

Of probabilities and experts

Recession probability estimates among major investment banks vary significantly. Goldman Sachs and BNP Paribas project 35%, while BofA Merrill Lynch suggests 20%.

However, the methodologies behind these projections are often opaque and can be influenced by biases. So, despite signs of recession emerging in April 2022 and reaching 100% in July 2024, the recession has not materialized.

This unprecedented phenomenon highlights the discrepancy between investment bank projections and the confidence of equity investors, who must adjust their strategies accordingly.

If you would like advice on investing in U.S. stocks, on how to understand the opportunities offered by this rate change, our team of brokers will be happy to assist you and provide you with the information and advice you need.

You can contact us through the following form:

Contact with us

"*" indicates required fields

ComShare this content:

DISCLAIMER: Singular Wealth Management, Corp. and Singular Securities, Corp. (SWM&SC), offer perspectives on various markets, sectors and investment opportunities that could be valuable to subscribers of our editorial content. This includes views on different types of securities, as well as commentary on economic and political scenarios. It is crucial to understand that this publication does not constitute financial guidance and is not an invitation to make specific investments. For personalized advice, we recommend using the Unique Advisory Services through our Securities House's qualified financial advisors to achieve your investment objectives. Although the information in this publication comes from reliable sources, we cannot guarantee its accuracy or completeness. Information is current at the time of publication, but may change without notice. Investing in securities involves risks, including the possible loss of principal, and past performance is no guarantee of future returns. SWM&SC personnel may invest in the securities discussed from time to time without receiving any compensation from the companies mentioned. We disclaim any liability for damages resulting from the use of our services. Entity regulated and supervised by the Superintendencia del Mercado de Valores of the Republic of Panama. Singular Wealth Management Corp., "License to operate as a Securities Brokerage Firm, Resolution CNV- No. 219-2005 of September 19, 2005". Singular Securities Corp., "License to operate as a Securities Brokerage Firm. Resolution SMV- No. 672-15 of October 21, 2015"....