Focus turns to clean energies

Clean energy investors have suffered a steady decline since 2021, with prices down more than -60% over 3.5 years, a negative return of -25% annually (chart 1). Overvaluation and anticipation of interest rate hikes following the 2020-2021 rally have been the main causes.

Chart 1: Ishares Global Clean Energy (US$ 15.04) / weekly chart

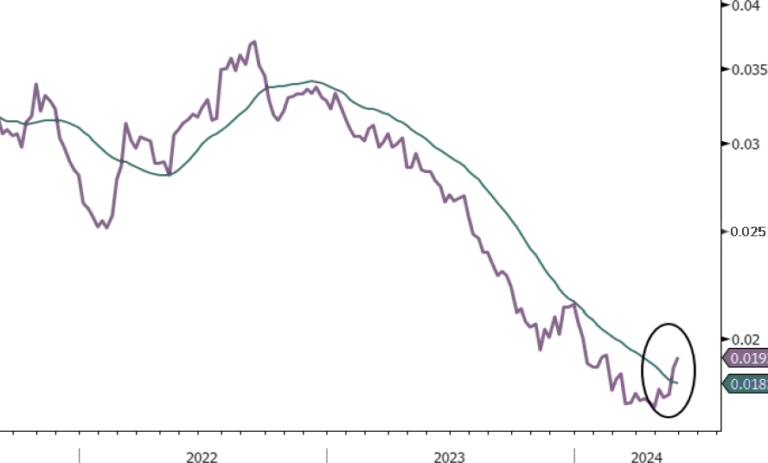

In addition, supply chain disruptions during Covid and trade tensions increased costs and delayed projects in the clean energy industry. However, after more than 3 years of bear market, prices are showing signs of reversal, forming a double bottom and outperforming the MSCI World in relative returns (chart 2) .

Chart 2: Ratio Ishares Global Clean Energy/MSCI ACWI Index

Drivers: Some new, some not so new

The rapid development of the Artifical intelligence (AI) will increase the demand for alternative energy, as this technology requires a lot of computational power, it will drive the use of renewable sources to reduce the carbon footprint, as well as in other sectors today. Governments and technology companies are investing in clean energy, such as Google, Microsoft and Amazon, committing to operate with 100% renewable energy.

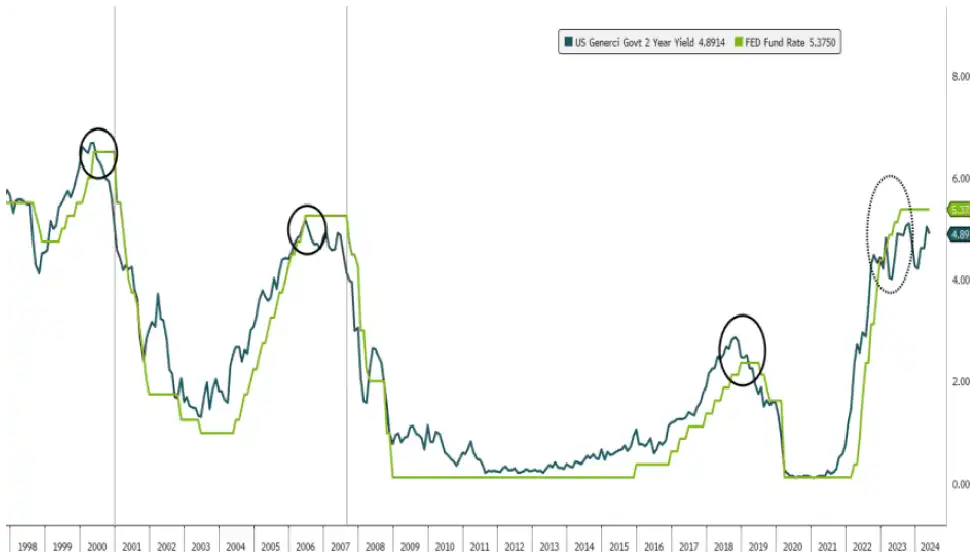

Another element to take into account is the interest ratesThe company's interest rates are sensitive to interest rates because clean energy companies, with capital-intensive projects and long payback periods, are sensitive to interest rates. Higher rates increase debt costs, reducing profitability and project valuation through discounted cash flow analysis. Therefore, a rate cut, as expected, would benefit these companies (Figure 3).

Chart 3: U.S. 2-year yields (4.89%); Average fed funds rate (5.375%)

An attractive valuation

After 3 years of downtrend, valuations in the clean energy sector are attractive. The current P/E is 38.7x, 20% lower than the 5-year average and 70% lower than in 2022.

Chart 4: Current P/E of S&P Global Clean Energy (38.7X)

Earnings per share (EPS) growth of 55% is expected in 2 years. On the other hand, book valuation (P/B) and price-to-sales (P/S) ratios are also favorable, at 1.90x and 1.74x respectively, highlighting good investment opportunities (graph 5).

Chart 5: S&P Global Clean Energy Fwd P/B (1.90X); P/S (1.74X)

What opportunities do we see?

After more than 3 years of challenges, clean energies are once again attractive with positive signals. Prices seem to be stabilizing, stimulated by the demand for energy in power generation projects. IA of information technology companies. The current valuation and growth prospects make this sector a promising long-term investment.

If you would like to obtain investment advice or identify investment opportunities in companies involved in clean energy, our team of brokers will be happy to assist you and provide you with the information and advice you need.

You can contact us through the following form:

Contact with us

"*" indicates required fields

ComShare this content:

DISCLAIMER: Singular Wealth Management, Corp. and Singular Securities, Corp. (SWM&SC), offer perspectives on various markets, sectors and investment opportunities that could be valuable to subscribers of our editorial content. This includes views on different types of securities, as well as commentary on economic and political scenarios. It is crucial to understand that this publication does not constitute financial guidance and is not an invitation to make specific investments. For personalized advice, we recommend using the Unique Advisory Services through our Securities House's qualified financial advisors to achieve your investment objectives. Although the information in this publication comes from reliable sources, we cannot guarantee its accuracy or completeness. Information is current at the time of publication, but may change without notice. Investing in securities involves risks, including the possible loss of principal, and past performance is no guarantee of future returns. SWM&SC personnel may invest in the securities discussed from time to time without receiving any compensation from the companies mentioned. We disclaim any liability for damages resulting from the use of our services. Entity regulated and supervised by the Superintendencia del Mercado de Valores of the Republic of Panama. Singular Wealth Management Corp., "License to operate as a Securities Brokerage Firm, Resolution CNV- No. 219-2005 of September 19, 2005". Singular Securities Corp., "License to operate as a Securities Brokerage Firm. Resolution SMV- No. 672-15 of October 21, 2015"....