Emerging markets appear to be bottoming out

Emerging markets appear to be showing signs of life, with theAfter a long stock market winter between 2021 and 2023, as from On January 17, its benchmark index, the MSCI Emerging Markets, was up 11%, compared with 9% for the MSCI World All Countries (Figure 1). This superior performancer was achieved only recently, in the last weeks of negotiations.

Chart 1: MSCI World All Countries (+9%); MSCI Emerging Markets (+11%)

Technically speaking, the index has just passed a key milestone. By overcoming the strong resistance at USD 1,063, it has paved the way for possible significant gains (Chart 2). In addition, lRelative strength is improvingproviding significant signals of a possible upward trend.

Chart 2: MSCI Emerging Markets (1,066); MSCI EM vs. MSCI World All Countries

Factors of this re-emergence

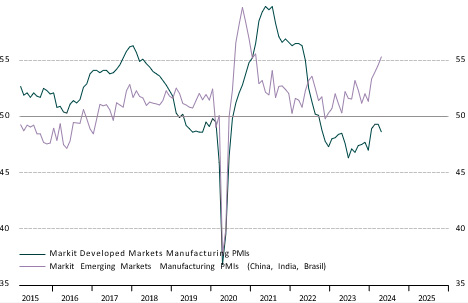

As good news never comes alone, there are a number of fundamental factors that are whetting investor appetite for emerging markets. Specifically, growth prospects are improving, while inflation is under control and the PMI indicators of the various countries that make up the emerging markets are expanding (graph 3).

Chart 3: Emerging Markets PMI; Developed Markets PMI

An important factor is the trend of lower interest rates in many emerging countries.. Central banks, as in China, have begun to ease monetary policy, for example by lowering the reserve ratio from 12.5% to 10%, which should encourage companies to deploy capital and hire more staff, while households consume more.

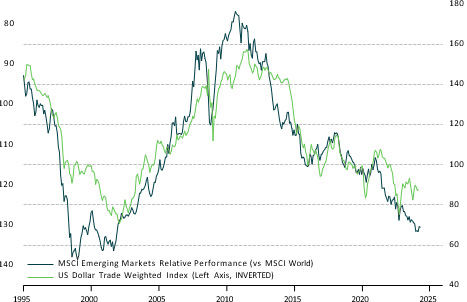

Another important factor to highlight in this context is that markets are anticipating a weakening of the dollar. Historically, when the dollar depreciates, emerging markets outperform (graph 4).

Figure 4: Dollar Index (Invested); MSCI EM vs. MSCI World

Who are the main emerging players

Among emerging markets, China stands out, accounting for more than 25%. India and Taiwan follow with 18% each, while South Korea accounts for 12%. Brazil, with only 5%, is the other visible country. Technology y communication services lead with 23% and 9%, respectively.

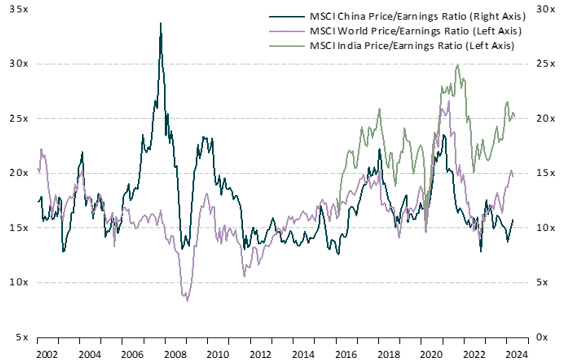

In the case of India, capital flows have been excessive, raising prices to speculative levels (graph 5). In China, investor confidence in equities is low, due to fears of excessive government intervention in the market. As a result, Chinese indices are undervalued, while the country is gradually recovering, driven by government stimulus and a rebound in consumption and tourism.

Chart 5: MSCI World P/E; MSCI China P/E; MSCI India P/E

What opportunities do we see?

After years of underperformance, emerging markets, especially China, appear to be approaching a turning point. Economic recovery, tame inflation, a weak dollar, attractive valuations and positive technical indicators are supporting this turnaround. Although there is a risk of a pullback, missing the first wave of outperformance is often costly.

If you would like to obtain investment advice or identify opportunities in technology or the communication services industry, our team of brokers will be happy to assist you and provide you with the information and advice you need.

You can contact us through the following form:

Contact with us

"*" indicates required fields

ComShare this content:

DISCLAIMER: Singular Wealth Management, Corp. and Singular Securities, Corp. (SWM&SC), offer perspectives on various markets, sectors and investment opportunities that could be valuable to subscribers of our editorial content. This includes views on different types of securities, as well as commentary on economic and political scenarios. It is crucial to understand that this publication does not constitute financial guidance and is not an invitation to make specific investments. For personalized advice, we recommend using the Unique Advisory Services through our Securities House's qualified financial advisors to achieve your investment objectives. Although the information in this publication comes from reliable sources, we cannot guarantee its accuracy or completeness. Information is current at the time of publication, but may change without notice. Investing in securities involves risks, including the possible loss of principal, and past performance is no guarantee of future returns. SWM&SC personnel may invest in the securities discussed from time to time without receiving any compensation from the companies mentioned. We disclaim any liability for damages resulting from the use of our services. Entity regulated and supervised by the Superintendencia del Mercado de Valores of the Republic of Panama. Singular Wealth Management Corp., "License to operate as a Securities Brokerage Firm, Resolution CNV- No. 219-2005 of September 19, 2005". Singular Securities Corp., "License to operate as a Securities Brokerage Firm. Resolution SMV- No. 672-15 of October 21, 2015"....