Energy and timing

Our overweight in energy has been in place for almost 2.5 years (more precisely since January 2022) and our positioning has been quite accurate. Since our update, the energy sector has far outperformed the global market by +20%, with a return of +33.6% vs. +10.6% for the MSCI World (chart 1).

Chart 1: Performance from 07.01.2022 to date : MSCI World Energy Sector (+33.6%); MSCI World Index (+10.6%)

In 2022, the MSCI Energy Index returned 47.9%, leading the MSCI World Index due to rising oil and gas prices due to the conflict between Russia and Ukraine. In contrast, the MSCI World fell by -17.6%. However, in 2023, this changed, as while global markets rose by 24%, the energy sector rose by only 3.6%.

OPEC statement worries investors (again)

At its June 2 meeting, OPEC announced some important developments. As we know, OPEC has maintained production cuts of approximately 6% of daily production for some time now.

The organization revealed that it will reverse 2% of production cuts from October 2024 to maintain market share. The announcement surprised the market, causing Brent and crude oil to fall by almost -10% to $77 and $73.

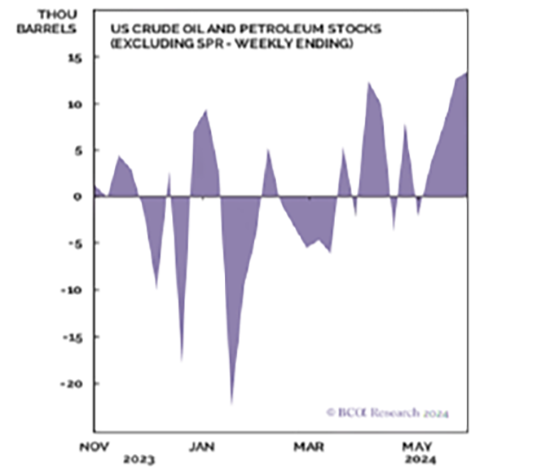

The IEA, EIA and OPEC forecasts for oil demand appear overly optimistic, as they ignore the risk of a global economic slowdown. Energy prices have followed negative economic data (Figure 2), and rising crude inventories in the US suggest weakening demand (Figure 3).

Chart 2: WTI Crude Oil (79 1Q4Q4); Citi Economic Surprise (-14.2)

Graph 3: Crude oil stocks

Energy, inflation and geopolitics: A close relationship

The energy sector is often seen as a hedge against geopolitical and inflation risks.

From a geopolitical point of view, energy prices are sensitive to global political events and tensions, so when military conflicts increase, for example, oil prices generally rise, which ends up benefiting companies in this sector.

As for inflation, oil and gas prices tend to rise in tandem with it, so energy companies benefit. In the current environment, we see global inflation starting to cool down, at the same time that activity economic deteriorationAs a result, inflation has a good chance of continuing to fall, as does oil demand.

From a more technical point of view

Despite the energy sector discount, its historical valuation is high. It trades at 1.03x sales and 1.8x book, a premium of +2% and +13% compared to long-term historical values. Technically, it completed a bull trap (chart 4), with bearish MACD and stochastic indicators. Relative strength is also negative.

Chart 4: MSCI Energy Index / Weekly chart

The relationship between the energy sector and the MSCI World is in a downtrend, with no concrete signs of trend reversal (Figure 5).

Figure 5: Ratio MSCI Energy Index vs. MSCI World Index

What opportunities do we see?

Although we remain optimistic in the long term, an increase in supply, a possible weakening of demand, high valuations and technical deterioration lead us to be neutral on this sector. The transition to clean energy will be gradual, so oil will remain crucial. With a distribution of approximately 4% in dividends, the sector still remains interesting.

If you would like advice on investment in the energy sector or portfolio diversification, our team of brokers will be happy to assist you and provide you with the information and advice you need.

You can contact us through the following form:

Contact with us

"*" indicates required fields

ComShare this content:

DISCLAIMER: Singular Wealth Management, Corp. and Singular Securities, Corp. (SWM&SC), offer perspectives on various markets, sectors and investment opportunities that could be valuable to subscribers of our editorial content. This includes views on different types of securities, as well as commentary on economic and political scenarios. It is crucial to understand that this publication does not constitute financial guidance and is not an invitation to make specific investments. For personalized advice, we recommend using the Unique Advisory Services through our Securities House's qualified financial advisors to achieve your investment objectives. Although the information in this publication comes from reliable sources, we cannot guarantee its accuracy or completeness. Information is current at the time of publication, but may change without notice. Investing in securities involves risks, including the possible loss of principal, and past performance is no guarantee of future returns. SWM&SC personnel may invest in the securities discussed from time to time without receiving any compensation from the companies mentioned. We disclaim any liability for damages resulting from the use of our services. Entity regulated and supervised by the Superintendencia del Mercado de Valores of the Republic of Panama. Singular Wealth Management Corp., "License to operate as a Securities Brokerage Firm, Resolution CNV- No. 219-2005 of September 19, 2005". Singular Securities Corp., "License to operate as a Securities Brokerage Firm. Resolution SMV- No. 672-15 of October 21, 2015"....