Earnings reports are in

As we embark on the first quarter 2024 earnings season, investors are watching closely as U.S. companies navigate the current economic landscape. While earnings growth is expected to moderate compared to the previous quarter, the outlook for the remainder of the year suggests a rebound.

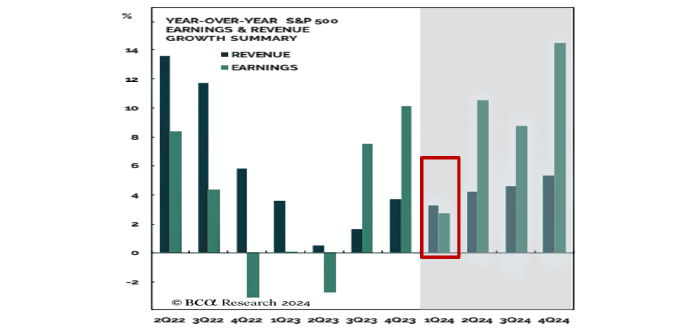

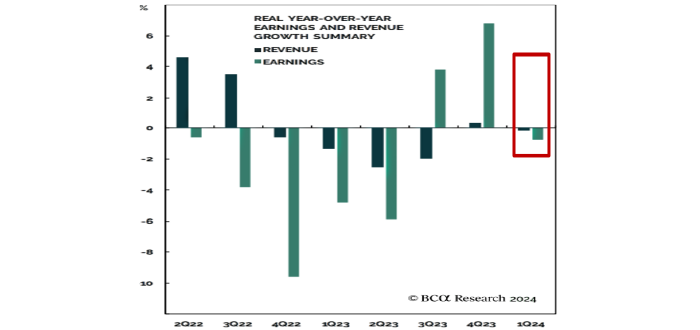

According to Refinitiv IBES data, the S&P 500 is forecast to generate nominal earnings growth of 2.7% year-over-year in Q1 2024 (Chart 1), however, adjusting for inflation, real earnings are forecast to contract by 0.8% in Q1 (Chart 2).

Graph 1: Nominal earnings expectations

Graph 2: Actual profit expectations

Companies and sectors

At the sector level, seven of the eleven sectors are expected to record positive earnings growth (Figure 3), led by communications (26.7%), technology (20.9%), services (18.4%) and discretionary consumption (17.1%). On the other hand, it is expected that energy (-24,4%), materials (-24.8%) and healthcare (-23.8%) experienced profit contractions.

However, these laggards are expected to experience a rebound in growth beyond this quarter, while the leaders are likely to experience a slowdown.

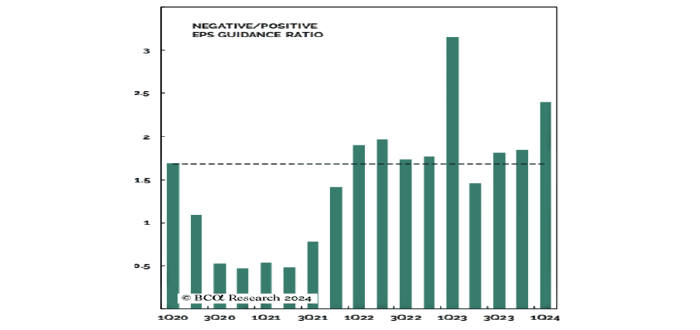

According to FactSet, 112 companies have issued EPS forecasts for the first quarter of 2024, of which 79 companies have given their guidance downward, while 33 upward. This puts the N/P ratio (negative to positive) at 2.4, well above the long-term average (Figure 3).

Chart 3: Negative/positive EPS ratio

"No landing", surprises and expectations.

The market has been lowering its expectations for the first quarter since the beginning of the year. However, the market expects earnings to accelerate thereafter. In fact, EPS expectations for 2024 and 2025 have been sharply increased by analysts in February-March, when macroeconomic figures have started to favor a "No Landing" scenario.

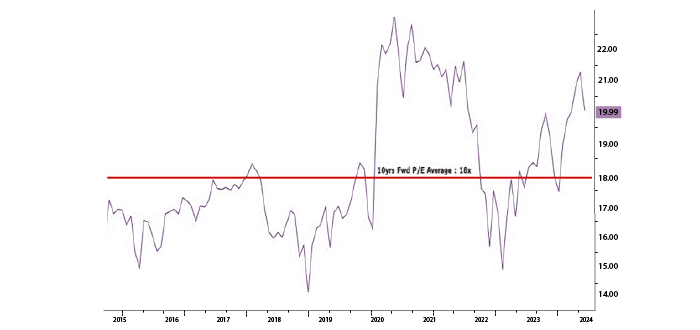

Knowing that the P/E of the S&P 500 is currently at 20x and that its long-term average level stands at 18x (chart 4), the market is currently at a premium of 10-12%.

Chart 4: S&P 500 Fwd P/E Ratio

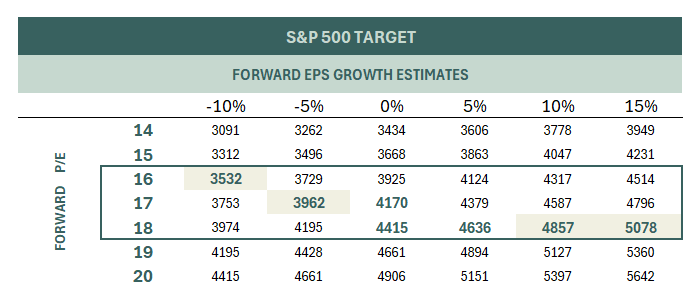

According to BCA Research, for the current valuation level to be justified, earnings growth over the next 12 months would have to exceed 15% (chart 5). Only significant positive surprises could drive the market higher.

Chart 5: EPS growth required for S&P 500 price target

What opportunities do we see?

The 2024 first quarter earnings season may not show resounding growth, but it will provide valuable insights into business adaptation to the economic environment.

Investors should keep an eye on current market trends and conditions. Although a positive surprise would be welcome, the market seems to have already adjusted its expectations for the year.

If you would like to obtain investment advice or identify investment opportunities, our team of brokers will be happy to assist you and provide you with the information and advice you need.

You can contact us through the following form:

Contact with us

"*" indicates required fields

ComShare this content:

DISCLAIMER: Singular Wealth Management, Corp. and Singular Securities, Corp. (SWM&SC), offer perspectives on various markets, sectors and investment opportunities that could be valuable to subscribers of our editorial content. This includes views on different types of securities, as well as commentary on economic and political scenarios. It is crucial to understand that this publication does not constitute financial guidance and is not an invitation to make specific investments. For personalized advice, we recommend using the Unique Advisory Services through our Securities House's qualified financial advisors to achieve your investment objectives. Although the information in this publication comes from reliable sources, we cannot guarantee its accuracy or completeness. Information is current at the time of publication, but may change without notice. Investing in securities involves risks, including the possible loss of principal, and past performance is no guarantee of future returns. SWM&SC personnel may invest in the securities discussed from time to time without receiving any compensation from the companies mentioned. We disclaim any liability for damages resulting from the use of our services. Entity regulated and supervised by the Superintendencia del Mercado de Valores of the Republic of Panama. Singular Wealth Management Corp., "License to operate as a Securities Brokerage Firm, Resolution CNV- No. 219-2005 of September 19, 2005". Singular Securities Corp., "License to operate as a Securities Brokerage Firm. Resolution SMV- No. 672-15 of October 21, 2015"....