First target

Fixed Income: Still room for improvement

Winds of change

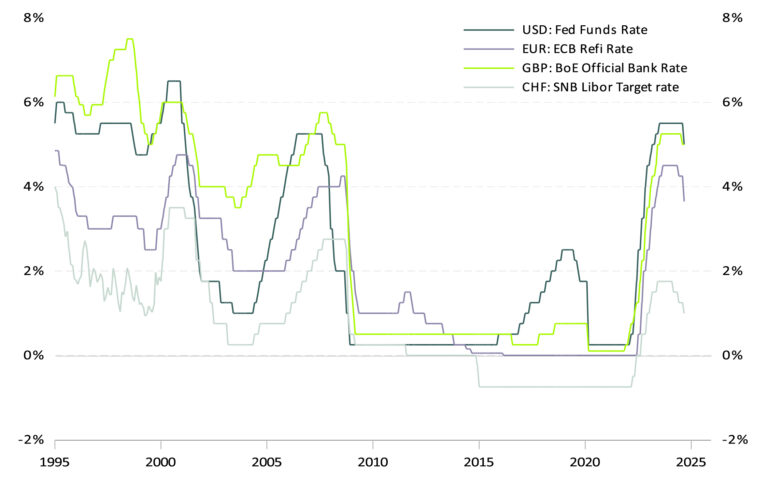

The fixed income market has experienced several shocks. After two years of rapid hikes in key rates and a year of stabilization, central banks have finally changed course (Figure 1). Rates will continue to fall, which has led to the appreciation of fixed income assets by between 5% and 23%, depending on currency and maturity.

Figure 1: Key central bank interest rates

Although the Fed was not the first to cut rates, its delay helped keep the dollar strong against the euro. As they cut rates, expect further dollar depreciation and more gains for bond investors.

Short-term or long-term bonds?

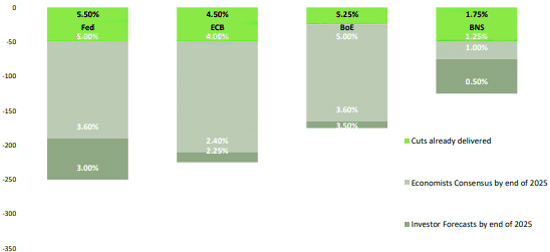

The main question is: "How far will central banks cut rates?" (Figure 2). Cycles tend to repeat themselves and, in each one, rate cuts are often faster than anticipated, suggesting that there is still room for gains in fixed income investments.

Figure 2: Economists' estimates for FED Funds in December 2025

The second question is whether investors should reduce the duration of their bonds or hold them for a few more quarters. While short-term bonds have generated positive returns, 10-year bonds have posted losses, raising questions about the appropriate strategy in this environment.

What history says and what the future paints

In 1970, during five similar cycles, long-term yields began to rise at least 14 months after the Fed's first rate cut, when it had already completed 85% of its monetary easing.

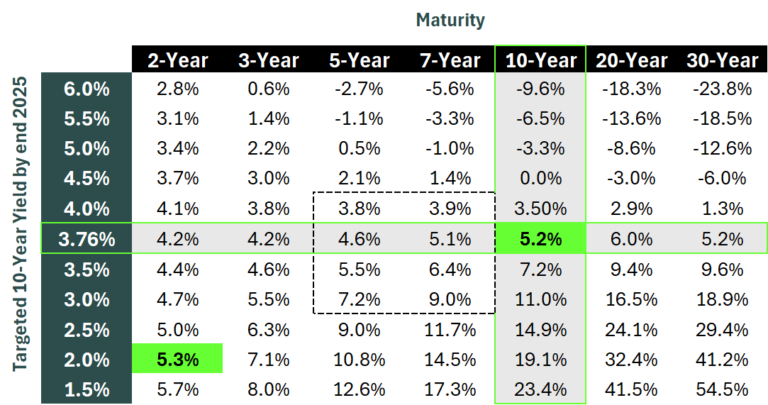

However, between 1980 and 2020, globalization helped to reduce inflation, which led to the structural fall in yields. However, due to current global conditions, in the future this phenomenon could further mask the increase in long-term interest rates. If this happens, long-term rates could stabilize between 31Q3Q and 41Q3Q for several quarters (Figure 3), significantly higher than short-term rates could be in the future. Therefore, it may be an excellent opportunity for investors to generate reasonable returns.

Figure 3: Bond yield estimates based on 10-year yield at the end of 2025

Second target

REITs: Has the time come for real estate?

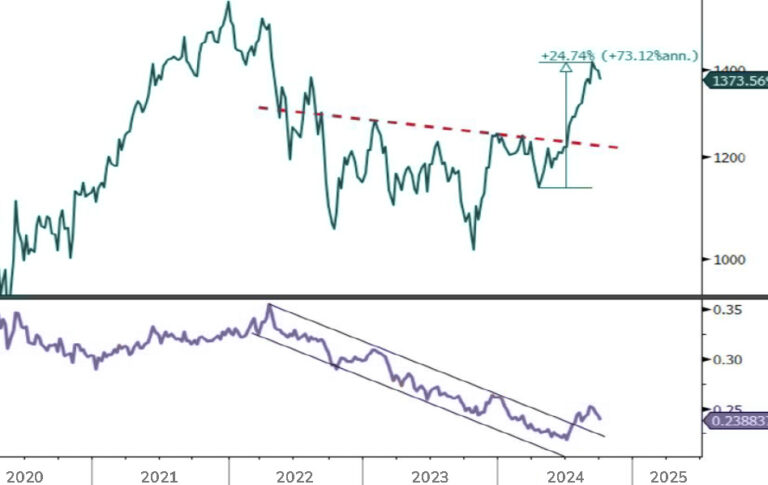

The REITs sector is up 25% since April, outperforming the S&P 500 by 9%. The rise is due to investors' expectations of lower bond yields. The rally began when yields on the U.S. 10-year bond peaked at 4.7%.

As REITs are credit-dependent, their recent recovery has been driven by the potential easing of monetary policy and falling Treasury yields. On a technical level, they broke through significant resistance (chart 4) and their relative value versus the S&P 500 improved. Although the overall outlook is less optimistic, we have upgraded our view from "Negative" to "Neutral".

Chart 4: MSCI US REIT Index; MSCI US REITS vs. S&P 500 ratio

Soft landing or economic climate, which is more important?

A soft landing could benefit the REIT sector. Although they depend on interest rates, overall economic performance is key. In a moderate slowdown scenario, lower borrowing costs and stable growth would improve margins and property values, boosting the sector's performance.

Prior to the Fed's November 7 rate cut of 0.25bps, it was estimated that a reduction of this magnitude could increase the value of REITs by as much as 5-10%, depending on economic conditions. However, with Donald Trump's victory, a no landing scenario is not ruled out, which would not be favorable, as the Fed would not reduce rates at the same speed as expected (slower), due to the inflationary pressures that its policies could generate.

Solid foundations, but are they sufficient?

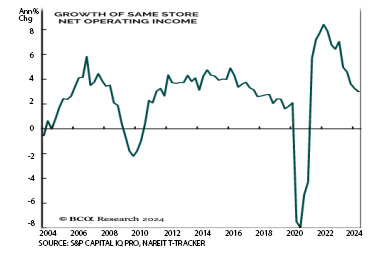

The fundamentals of the real estate sector are solid, but not exciting. Net Operating Income (NOI) growth, which measures a property's profitability before discounting finance charges and taxes, is down at 31TP3Q (chart 5), a slower pace than seen in 2021-2022.

Graph 5: NOI of REITs

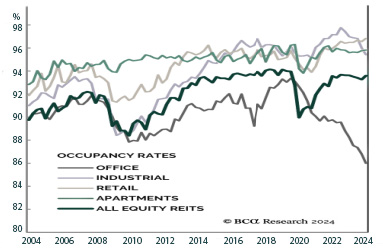

Occupancy rates in equity REITs have stabilized at 93.6%, with differences by subsector: apartments and retail improved, but offices continue to fall (Figure 6). Although operating margins have recovered to pre-pandemic levels, they are below pre-2018 highs when interest rates were low.

Graph 6: Employment rates by sub-sector

However, it is worth mentioning that REITs specialized in data centers stand out positively, driven by the growing demand for digital infrastructure due to the development and application of advances such as artificial intelligence.

The poacher

Basic consumption: A safe place to be

A fierce environment

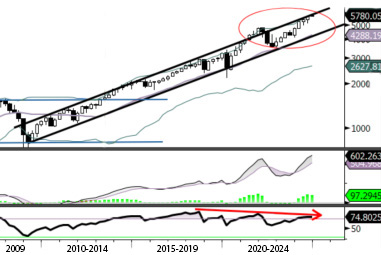

The S&P 500 is up 22.5% so far this year, hitting new highs following the Fed's 50 basis point cut in September, boosting investor optimism.

However, a correction could be imminent due to limited upside capacity and bearish divergences in momentum indicators. Although a rally towards 6,000 is possible (chart 7), this could signal an opportunity for investors to take profits, so thinking about traditionally defensive sectors such as consumer staples is not out of the question.

Chart 7: S&P 500 (5'780.05) / Quarterly Chart

Seeking solid and stable investments

Seeking stable and solid investments is essential, especially in the consumer staples sector, which has underperformed since 2016, intensifying in 2023-2024.

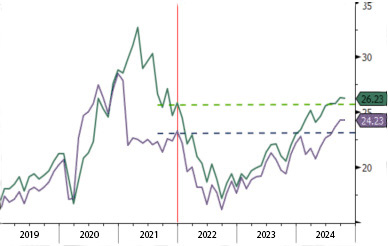

Since July, this sector has begun to stabilize relative to the market. Inelastic demand for essential goods, such as food and hygiene products, ensures steady revenues, which is crucial in an environment where the market has a relatively expensive current P/E of 26.2x (graph 8)..

Chart 8: S&P 500 forward P/E (24.2x), current P/E (26.2x)

Stocks in this sector are attractive because of their stable cash flows and high dividends. As inflationary pressures ease, many companies are well positioned to expand margins and beat expectations.

Some key companies, vehicles and prospects

Interestingly, the lower the consumer confidence, the better the performance of the commodity sector compared to the rest of the market. Investors gravitate toward giants such as Procter & Gamble, Walmart, Coca-Cola, PepsiCo, Nestlé, Unilever, L'Oréal, Mondelez, Colgate-Palmolive, Target, Kimberly-Clark and Danone, which dominate funds such as the Consumer Staples Select Sector SPDR Fund (XLP), the Vanguard Consumer Staples ETF (VDC) and the iShares U.S. Consumer Staples ETF (IYK).

Elements that affect these companies such as energy and agricultural prices remain stable, added to the fact that the rate cut may help the sector's margins and changes in consumer habits such as soft drinks and protein foods that are driving consumption, mean that the sector has a positive outlook for the immediate future.

For investment advice on fixed income, real estate and defensive sectors such as consumer staples, our team of brokers will be happy to assist you and provide you with the information and advice you need.

You can contact us through the following form:

Contact with us

"*" indicates required fields

ComShare this content:

DISCLAIMER: Singular Wealth Management, Corp. and Singular Securities, Corp. (SWM&SC), offer perspectives on various markets, sectors and investment opportunities that could be valuable to subscribers of our editorial content. This includes views on different types of securities, as well as commentary on economic and political scenarios. It is crucial to understand that this publication does not constitute financial guidance and is not an invitation to make specific investments. For personalized advice, we recommend using the Unique Advisory Services through our Securities House's qualified financial advisors to achieve your investment objectives. Although the information in this publication comes from reliable sources, we cannot guarantee its accuracy or completeness. Information is current at the time of publication, but may change without notice. Investing in securities involves risks, including the possible loss of principal, and past performance is no guarantee of future returns. SWM&SC personnel may invest in the securities discussed from time to time without receiving any compensation from the companies mentioned. We disclaim any liability for damages resulting from the use of our services. Entity regulated and supervised by the Superintendencia del Mercado de Valores of the Republic of Panama. Singular Wealth Management Corp., "License to operate as a Securities Brokerage Firm, Resolution CNV- No. 219-2005 of September 19, 2005". Singular Securities Corp., "License to operate as a Securities Brokerage Firm. Resolution SMV- No. 672-15 of October 21, 2015"....