They are behind your video games, cryptocurrencies and artificial intelligence but...

What makes them so special?

For many years, the intense rivalry between AMD and NVIDIA has impacted the PC world. Since the late 1980's, these titans of computing have been have been engaged in a war for supremacy in processor technology.

AMD has developed a considerable share of consumer processors and GPU's, whereas NVIDIA's main focus has been on the solutions of graphic processing. As a result of their competitors, both companies have gone a step further in productivity and efficiency.

Their conflicts have spurred technological developments that have benefit customers throughout the world. world, from video games to artificial intelligence.

With a market capitalization of $1,963.5 Billion, Nvidia is 6.7 times larger than AMD.

It is now the 3rd largest company in the world by market capitalization, surpassed only by Apple and Microsoft.

A true explosion of value that additionally has the merit of being the largest increase in capitalization in a single day in history after accumulating $277 billion in a single session.

Los números (En Razones)

No Data Found

No Data Found

- Nvidia's lower Price-to-Earnings Ratio / Revenue Growth is a sign of strong growth and indicates that, despite its recent bullish explosion in the market, expectations for continued expansion of this company are still present.

- Identifying the most relevant metrics in the analysis of a specific industry is crucial, and the Research + Development / Sales ratio shows how technology companies stay ahead of the curve and manage to turn innovation into money, while AMD devotes almost $26 to innovation for every dollar of sales, we can say that Nvidia manages to be about 45% more efficient in translating its advances into revenue.

- Nvidia recently reported to have reduced the lead time for its deliveries considerably, from an average of up to 11 months to only 4 months, which can help it to get cash faster, thus AMD has a better inventory turnover, which helps it to maintain its liquidity and optimize the use of resources.

- Last but not least, a debt/asset ratio makes a difference in the management of these companies, with AMD being much more conservative, but Nvidia using leverage as an aggressive expansion strategy.

ESG criteria

No Data Found

No Data Found

AMD has a lower environmental impact thanks to its efficient use of energy, sustainability in product manufacturing and emissions management, while Nvidia leads the industry in occupational safety, employment practices, rights and community relations.

That last point is most interesting when noting that Nvidia has 26,196 employees, only 196 more than AMD, suggesting that part of its enormous value creation comes from excellent people management.

Advanced Micro Devices also comes out on top with better governance, strong executive composition and compensation, and clear policies that protect its shareholders through very democratic decision-making systems.

That leaves us with two additional questions....

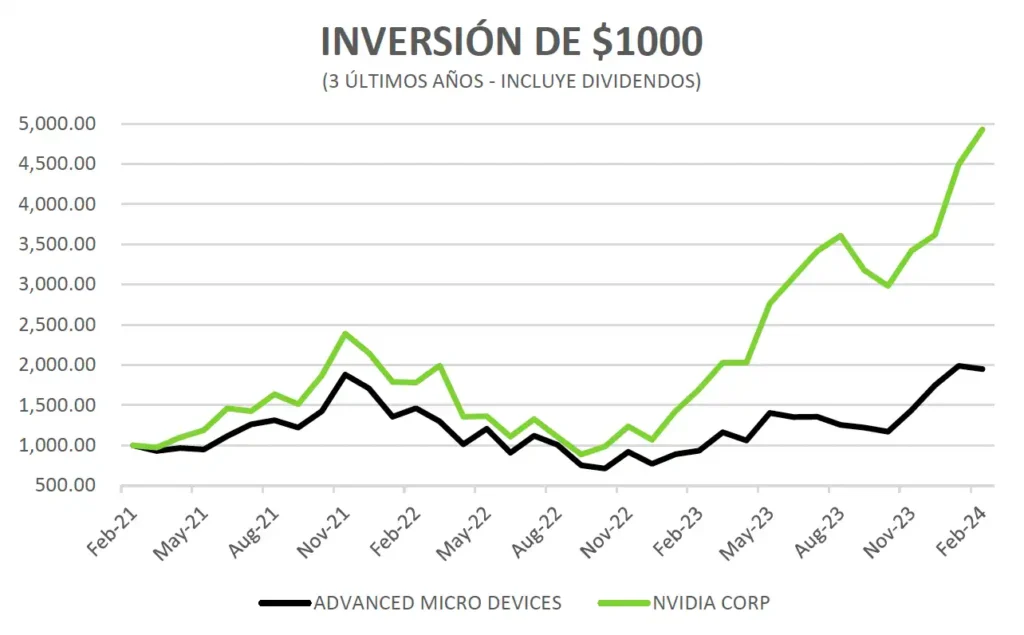

What would have happened a few years ago if you had bought one of the shares?

While Nvidia has performed 3.35 times better, AMD's total return is nothing to dismiss by making around 113% over the last 3 years, demonstrating that even if the difference is clear, the sector as a whole had significant appreciation.

Investing in AMD or NVIDIA is like backing the brains behind artificial intelligence. Their processors and graphics cards fuel this technological revolution, their stocks have been the stars of the year, and their dominance in AI chips and software innovation make them exciting bets.

The AI revolution is real and both AMD and NVIDIA are at the epicenter of it.

Which one to choose? It depends on your appetite for innovation and the future as the appetite of these giants seems to know no bounds!

Would you like to be part of this industry? Investing is the way to do it, contact us:

Contact with us

"*" indicates required fields

DISCLAIMER: Singular Wealth Management, Corp. and Singular Securities, Corp. (SWM&SC), offer perspectives on various markets, sectors and investment opportunities that could be valuable to subscribers of our editorial content. This includes views on different types of securities, as well as commentary on economic and political scenarios. It is crucial to understand that this publication does not constitute financial guidance and is not an invitation to make specific investments. For personalized advice, we recommend using the Unique Advisory Services through our Securities House's qualified financial advisors to achieve your investment objectives. Although the information in this publication comes from reliable sources, we cannot guarantee its accuracy or completeness. Information is current at the time of publication, but may change without notice. Investing in securities involves risks, including the possible loss of principal, and past performance is no guarantee of future returns. SWM&SC personnel may invest in the securities discussed from time to time without receiving any compensation from the companies mentioned. We disclaim any liability for damages resulting from the use of our services. Entity regulated and supervised by the Superintendencia del Mercado de Valores of the Republic of Panama. Singular Wealth Management Corp., "License to operate as a Securities Brokerage Firm, Resolution CNV- No. 219-2005 of September 19, 2005". Singular Securities Corp., "License to operate as a Securities Brokerage Firm. Resolution SMV- N° 672-15 of October 21, 2015".