Towards 2024: A year of strategic decisions

- In November 2023, U.S. stock markets posted notable gains, driven largely by investor optimism regarding the possible pause in interest rate hikes by the Fed and the weaker-than-expected October employment report.

- Despite positive market movements and consumer resilience, the economic outlook remains uncertain. We believe the market is technically deteriorating within fragile macroeconomic conditions.

- The consumer had strong spending numbers over Thanksgiving, but most of the pandemic savings now seem to have disappeared.

Macro Corner

U.S. stock markets experienced notable gains, posting strong weekly increases. This upward trend was driven mainly by investor optimism that the Fed might pause in its interest rate hikes, a sentiment that was reinforced by a weaker-than-expected October employment report.

However, the economic outlook remains uncertain. Fed Chairman Jerome Powell's press conference revealed ambiguity about the end of the rate hike cycle.

On the other hand, retail sales data, which showed a marginal decline, suggested that consumer spending may remain resilient, supported by a strong labor market.

On the geopolitical front, the meeting between President Biden and Chinese President Xi Jinping concluded with an agreement to continue high-level dialogues and on the corporate earnings front, companies such as Home Depot, Macy's and Gap reported earnings that beat estimates, while Walmart's cautious outlook on consumer spending and Nvidia's stock fell due to the looming crisis in the United States.

The market appears to be deteriorating technically. The fragile macroeconomic situation, with high interest rates, tight credit conditions and negative leading indicators, compels us to remain cautious.

Technical Corner

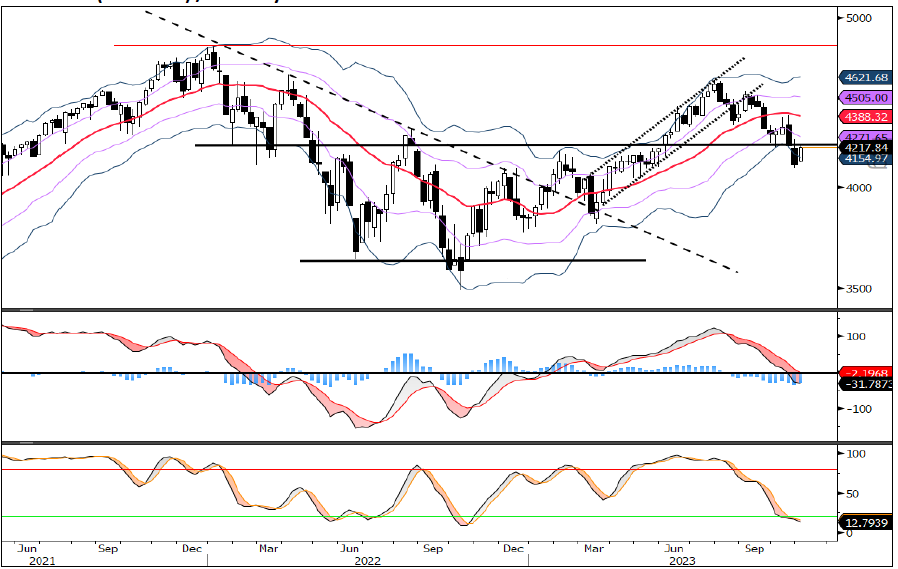

November was a month of strong recovery with 5 consecutive positive weeks, which has allowed prices to completely nullify the immediate downside risk shown by the market, with prices breaking above the 4,200 support in October. The short-term situation has therefore clearly improved.

After 5 consecutive weeks of upside, which also corresponds to the July high at 4'600-4'650, which are considered major resistance, the market should have some difficulty going directly much higher than this.

To expect higher highs, prices should hold above the 20-week moving average (red line) located at 4,400, any break below this support would strongly diminish the possibility of further short-term rallies. With a break of 4,600, the next target would be the January 2022 highs at 4,800.

Now, if we look at the quarterly chart, we are in favor of a long-term downward process of the equity market after almost 15 years of bull market. This downward process may form sideways or vertically, it will depend mainly on economic developments.

In any case, we do not see the market continuing with the same dynamics of the last 15 years, as the economic situation, interest rate levels and overall system leverage are challenging future dynamics. The era of high-digit annual returns is likely behind us.

S&P 500 (4'594.63) / Quarterly Chart

S&P 500 (4'594.63) / Weekly Chart

Topic of the month

Perspectives 2024: A year with two faces

As 2023 draws to a close, the financial outlook for 2024 takes shape. Next year will potentially be characterized as the year of the false bullish signal.

Rate hikes are expected to have a delayed impact on several sectors in 2024, leading to a weakening of the overall economy.

Inflation slowed to 3.2% in October, but remains above the Fed's 2% target. This situation suggests that the Fed could delay rate cuts until mid-2024.

Meanwhile, geopolitical tensions could keep energy prices high, but an expected economic slowdown in the first half of the year could ease cyclical pressures on prices, allowing for a more moderate approach by central banks later in the year.

In bonds, this scenario is favorable, as they can expect a rebound in yields after years of underperformance; equities may show a W-shaped pattern, with a continuation of the downtrend from 2022 to 2024, after a false recovery in 2023; in currencies, the expected fall in interest rates and the resulting depreciation of the US dollar will benefit all currencies; and in gold, it is expected to remain above $2,000 per ounce.

In short, the effects of recent rate hikes will continue to weigh on the economy in 2024, which could lead to a recession and make the 2023 stock market rally look like a false start.

It is the easing of monetary policy that will finally signal the end of the capitulation phase and the beginning of the recovery.

What we have in our sights

iShares Aaa - A Rated Corporate Bond ETF:

This is an exchange-traded fund (ETF) incorporated in the United States. This ETF aims to achieve investment results that generally correspond to the price and yield performance, before fees and expenses, of the Bloomberg U.S. Corporate Aaa - A Capped Index.

In other words, this fund seeks to replicate the performance of a specific index, in this case, the Bloomberg U.S. Corporate Aaa - A Capped Index, which includes corporate bonds with ratings ranging from Aaa to A. These ratings reflect the credit quality of the underlying bonds in the index, with Aaa being the highest and A being the next highest on the scale. These ratings reflect the credit quality of the underlying bonds in the index, with Aaa being the highest rating and A being the next highest on the scale.

If this topic has piqued your interest and you would like to know how safe haven assets can impact your investments, our team of brokers will be happy to assist you and provide you with the information and advice you need.

If you wish to contact us, you can do it through the following form:

Share this content:

DISCLAIMER: Singular Wealth Management, Corp. and Singular Securities, Corp. (SWM&SC), offer perspectives on various markets, sectors and investment opportunities that could be valuable to subscribers of our editorial content. This includes views on different types of securities, as well as commentary on economic and political scenarios. It is crucial to understand that this publication does not constitute financial guidance and is not an invitation to make specific investments. For personalized advice, we recommend using the Unique Advisory Services through our Securities House's qualified financial advisors to achieve your investment objectives. Although the information in this publication comes from reliable sources, we cannot guarantee its accuracy or completeness. Information is current at the time of publication, but may change without notice. Investing in securities involves risks, including the possible loss of principal, and past performance is no guarantee of future returns. SWM&SC personnel may invest in the securities discussed from time to time without receiving any compensation from the companies mentioned. We disclaim any liability for damages resulting from the use of our services. Entity regulated and supervised by the Superintendencia del Mercado de Valores of the Republic of Panama. Singular Wealth Management Corp., "License to operate as a Securities Brokerage Firm, Resolution CNV- No. 219-2005 of September 19, 2005". Singular Securities Corp., "License to operate as a Securities Brokerage Firm. Resolution SMV- No. 672-15 of October 21, 2015"....