Has the light at the end of the road arrived for banking?

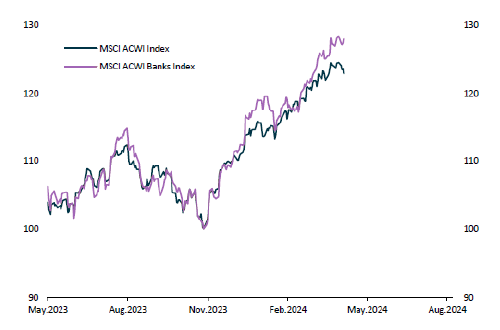

The banking sector, since November 2023 in the United States and February 2024 in Europe, has captured the attention of investors due to its resurgence after a period of stagnation (chart 1). Although the major listed banks outperform the indexes (chart 2), they persist risks such as interest rate fluctuations and the weakness of the real estate market.

Figure 1: MSCI World All Country Index; MSCI World Bank Index since 2017.

Chart 2: MSCI World All Country Index; MSCI World Bank Index as of May 2023

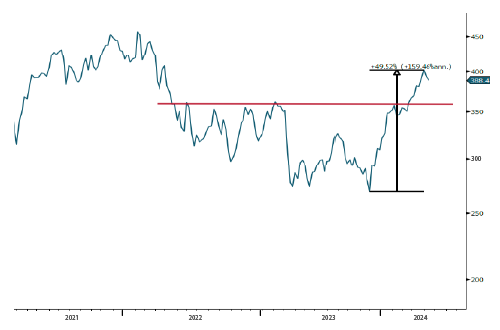

US banks' performance, negative for over 6 years, shows signs of relative strength and stabilization since November 2023, despite persistent challenges. With an increase of +50% since then, the sector appears to be stabilizing (Figure 3).

Chart 3: S&P 500 Banks Index

U.S. Banks: What happened since Sillicon Valley Bank?

Regional banks in the United States are essential to the country's financial fabric by backing SMEs and startups, thereby boosting local growth. However, since the normalization of interest rates in 2022, face a crisis of liquidity due to poor risk management, as evidenced by the bankruptcies such as Silicon Valley Bank.

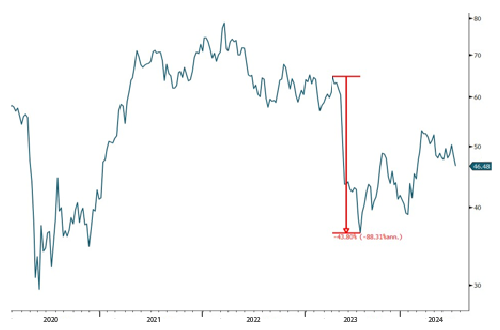

Since March 2023, U.S. regional banks have faced higher funding costs due to higher interest rates on deposits, which has reduced interest margins and led to a -44% decline in the regional bank index between February and May 2023 (Figure 4). Despite this, its performance continues to underperform that of the major banks. (graph 5), no indications of contagion towards the latter according to the market.

Figure 4: U.S. Regional Banks SPDR S&P

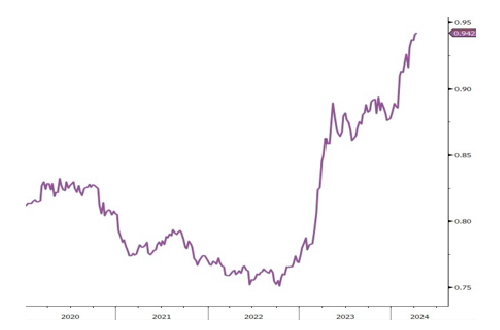

Chart 5: Ratio between SPDR US Bank and SPDR US Regional Banks

European banks > U.S. banks... for now

In Europe, banks rely on loans to generate profits, unlike the U.S., which is funded by bonds. Despite a decade of low interest rates, in 2022, the economic recovery and the increase in rates provided a dual impetus.

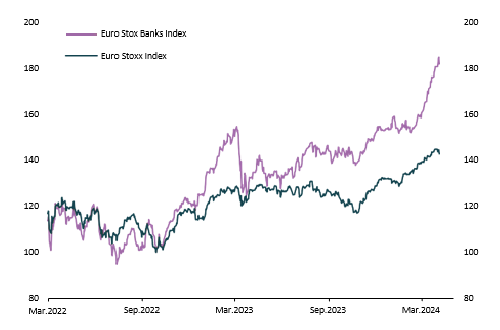

Over the past 18 months, European banks have seen an 82% increase, outperforming the Euro Stoxx (chart 6). In addition, the relative strength of the European Bank, driven by expectations of a steeper rate curve, suggests that could outperform U.S. banks.

Chart 6: Euro Stoxx Banking Index; Euro Stoxx Index

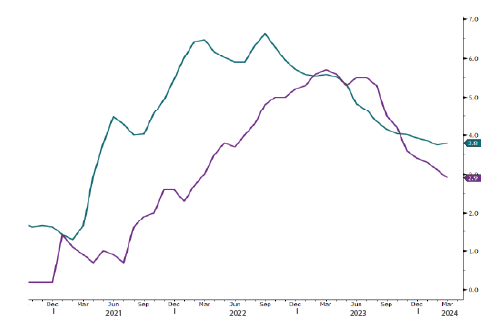

This is not to mention that, according to the market, the current macroeconomic conditions in the Euro Zone suggest that the The European Central Bank (ECB) is likely to cut rates earlier and faster than the Fed (Figure 7).

In any case, European banks have outperformed U.S. banks since early 2022, and this trend should continue.

Graph 7: Inflation in the U.S. (3.51 P3GDP3T); Inflation in Europe (2.91 P3GDP3T)

What opportunities do we see?

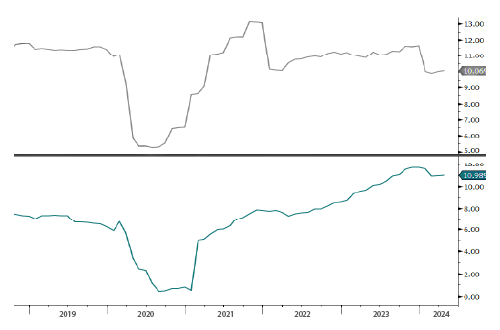

The banking sector is stabilizing thanks to higher interest rates and better macroeconomic prospects. European banks are currently doing better than U.S. banks in terms of ROE (Figure 8), and they are also benefiting from the ECB's flexibility in monetary policy, reflected in a steeper yield curve.

Chart 8: Fwd ROE of S&P 500 Banks (10x); Euro Stoxx Bank (11x)

In terms of segmentation, investments in regional and commercial banks in general present higher risks according to the current conditions we have already mentioned.

If you would like to obtain investment advice or identify opportunities in the banking market, our team of brokers will be happy to assist you and provide you with the information and advice you need.

You can contact us through the following form:

Contact with us

"*" indicates required fields

ComShare this content:

DISCLAIMER: Singular Wealth Management, Corp. and Singular Securities, Corp. (SWM&SC), offer perspectives on various markets, sectors and investment opportunities that could be valuable to subscribers of our editorial content. This includes views on different types of securities, as well as commentary on economic and political scenarios. It is crucial to understand that this publication does not constitute financial guidance and is not an invitation to make specific investments. For personalized advice, we recommend using the Unique Advisory Services through our Securities House's qualified financial advisors to achieve your investment objectives. Although the information in this publication comes from reliable sources, we cannot guarantee its accuracy or completeness. Information is current at the time of publication, but may change without notice. Investing in securities involves risks, including the possible loss of principal, and past performance is no guarantee of future returns. SWM&SC personnel may invest in the securities discussed from time to time without receiving any compensation from the companies mentioned. We disclaim any liability for damages resulting from the use of our services. Entity regulated and supervised by the Superintendencia del Mercado de Valores of the Republic of Panama. Singular Wealth Management Corp., "License to operate as a Securities Brokerage Firm, Resolution CNV- No. 219-2005 of September 19, 2005". Singular Securities Corp., "License to operate as a Securities Brokerage Firm. Resolution SMV- No. 672-15 of October 21, 2015"....