European versus U.S. yields: much difference?

In the last two monthsthe two largest stock market indexes have had opposite market performances. The S&P 500 rose by 5.4%, while the Stoxx 600, the S&P's European counterpart, fell by 4.4%.

This bearish trend can be explained by the European elections that are currently taking place, which put more stress on the European markets, specifically the French market.

France, host of the Paris 2024 Olympics, has experienced major political events recently, such as the dissolution of the National Assembly. This situation has negatively affected the performance of the French CAC 40 stock index compared to the Euro Stoxx (chart 1).

Chart 1: Performance since 2023 - Euro Stoxx Index (excluding France); CAC 40 Index

In contrast, the growth of the S&P 500 is explained by the growth of the technology sector, in particular the growth of the Magnificent 7, which account for 32% of the index.

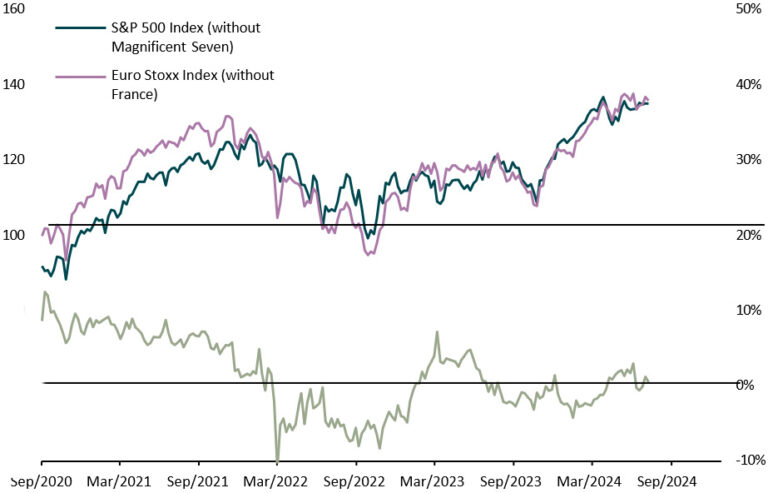

As a result, the S&P 500 is significantly outperforming the Stoxx 600. However, the weight of the Magnificent 7 in the value of the index means that it is not representative of the market, while the Stoxx as a whole is underperforming the market as a whole, a result of the downtrend in the CAC 40. Now, when we look at it adjusted for this, the performance of the two indices are actually very similar.

Chart 2: Performance of the S&P 500 without the Magnificent Seven and of the Euro Stoxx without France

Allez, allez: Opportunities in French equities

Due to the current situation of the French market, French stocks now offer much more opportunities for long-term investors, because the stress and panic generated by the political moves of the French government will probably disappear as they backtrack on such measures due to the resistance that the population seems to present for the time being.

However, there is still a strong possibility of markets entering a period of significant tightening, which could result in more pragmatic and balanced policies, resulting in market stabilization. In addition, the vast majority of the stocks that make up the CAC 40 are international, meaning that domestic growth only accounts for 15% of their growth.

Strategies: To properly embed in La France

Here are two possible strategies for investing in the French market:

- Basket of stocks belonging mainly to domestic companies or companies dependent on the French political situation: These companies should far outperform the market and enter into uptrends once it stabilizes. For example, bank, industrial and utility stocks.

The second way would be a basket of stocks that have outperformed the CAC 40: In this case, these companies should also outperform the index as markets recover thanks to their resilience. For example, stocks such as Michelin, L'Oreal or Essilor are good candidates.

What opportunities do we see?

In conclusion, although the US market has been outperforming the European market since May, the political situation in France and the weight of the Magnificent 7 are the main reasons for this outperformance and mean that the markets are actually quite similar.

In addition, the French situation has created some medium- to long-term opportunities in French equities as the market stabilizes in the future.

For investment advice on French and European stocks, our team of brokers will be happy to assist you and provide you with the information and advice you need.

You can contact us through the following form:

Contact with us

"*" indicates required fields

ComShare this content:

DISCLAIMER: Singular Wealth Management, Corp. and Singular Securities, Corp. (SWM&SC), offer perspectives on various markets, sectors and investment opportunities that could be valuable to subscribers of our editorial content. This includes views on different types of securities, as well as commentary on economic and political scenarios. It is crucial to understand that this publication does not constitute financial guidance and is not an invitation to make specific investments. For personalized advice, we recommend using the Unique Advisory Services through our Securities House's qualified financial advisors to achieve your investment objectives. Although the information in this publication comes from reliable sources, we cannot guarantee its accuracy or completeness. Information is current at the time of publication, but may change without notice. Investing in securities involves risks, including the possible loss of principal, and past performance is no guarantee of future returns. SWM&SC personnel may invest in the securities discussed from time to time without receiving any compensation from the companies mentioned. We disclaim any liability for damages resulting from the use of our services. Entity regulated and supervised by the Superintendencia del Mercado de Valores of the Republic of Panama. Singular Wealth Management Corp., "License to operate as a Securities Brokerage Firm, Resolution CNV- No. 219-2005 of September 19, 2005". Singular Securities Corp., "License to operate as a Securities Brokerage Firm. Resolution SMV- No. 672-15 of October 21, 2015"....