USA: Year-over-year CPI was 3.21GDP3Q versus the expected 3.31GDP3Q.

USA: Month-over-month retail sales advance

-0.1% versus the expected -0.3%.- United KingdomUnemployment rate of 4.21 Q3Q3, lower than the expected 4.31 Q33Q3.

- Euro Zone GDP rose 0.1% of growth, in line with expectations.

China Industrial Production Index stood at 4.6%, higher than expected.

- USA. USA: Existing home sales are expected to be 3.90 million.

- USA. USA: FOMC meeting minutes.

- Germany: Quarterly and annual GDP through the third quarter of 2023.

- China PoBC prime lending rate.

- United Kingdom: Autumn forecast statements.

Perspectives 2024: A year with two faces

The year 2023 is drawing to a close and, as usual, analysts and various financial institutions are already beginning to produce the first reports with a view to what is to come in 2024.

The year 2020 can be categorized as "the year of the Covid"; 2021 as "the exuberant"; 2022 as "the double bear market" and the current year (2023) as "the year of the false bullish signal". However, we can classify 2024 as the "two-sided" year, as it is likely to present two different dynamics.

In the first half of the year, we anticipate a market that will correct and fall considerably, due to the effects of rising rates; while in the second half, we expect a recovery thanks to the easing of rates experienced during the first half of the year, which will energize the market and bring about recovery.

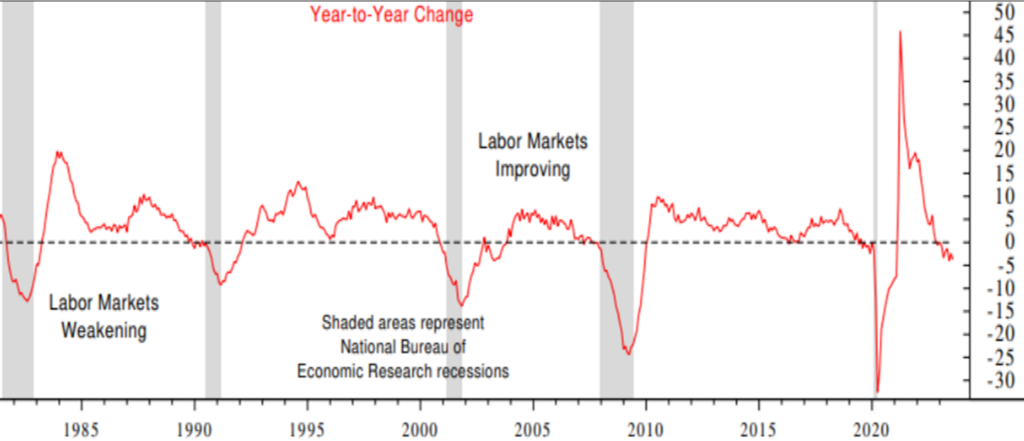

At present, we are just beginning to glimpse the first impacts of the bullish monetary policy, since the fall in investment, the destruction of employment, the deceleration of international trade, among other variables, has already begun.

Figure 1: Year-on-year change in durable goods orders

Graph 2: Year-on-year change in the labor market

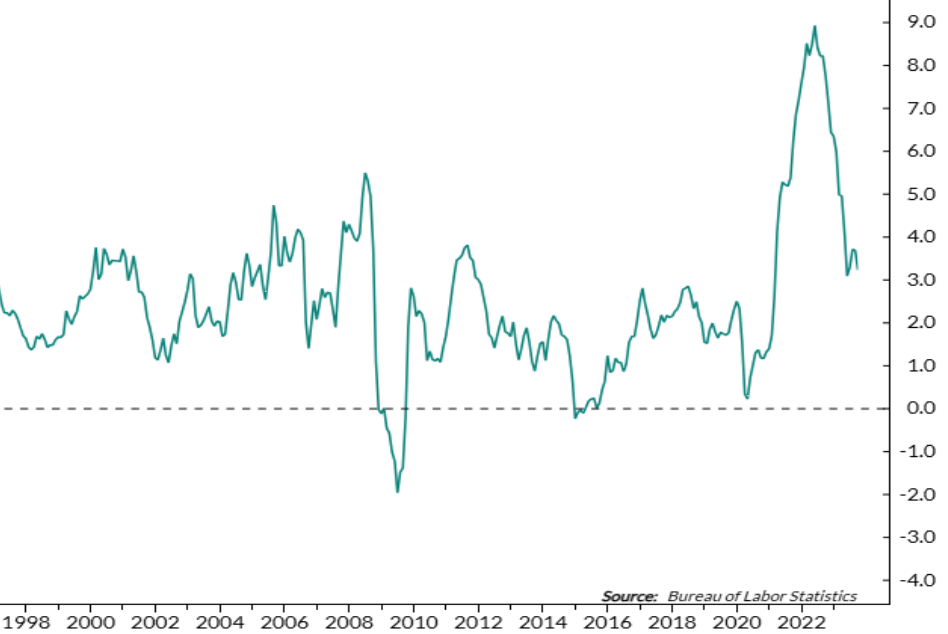

This, while inflation figures slowed in the month of October to 3.2%, although they remain above the Fed's 2% target (Chart 3).

It must be said that geopolitical tensions could keep energy prices high and that the economic slowdown is very likely to appear in the first half of next year, which could slow inflation growth, thus providing a more comfortable environment for the FED to make decisions in a calmer manner at the end of 2024.

Graph 3: U.S. CPI year-over-year (3.21Q3Q3)

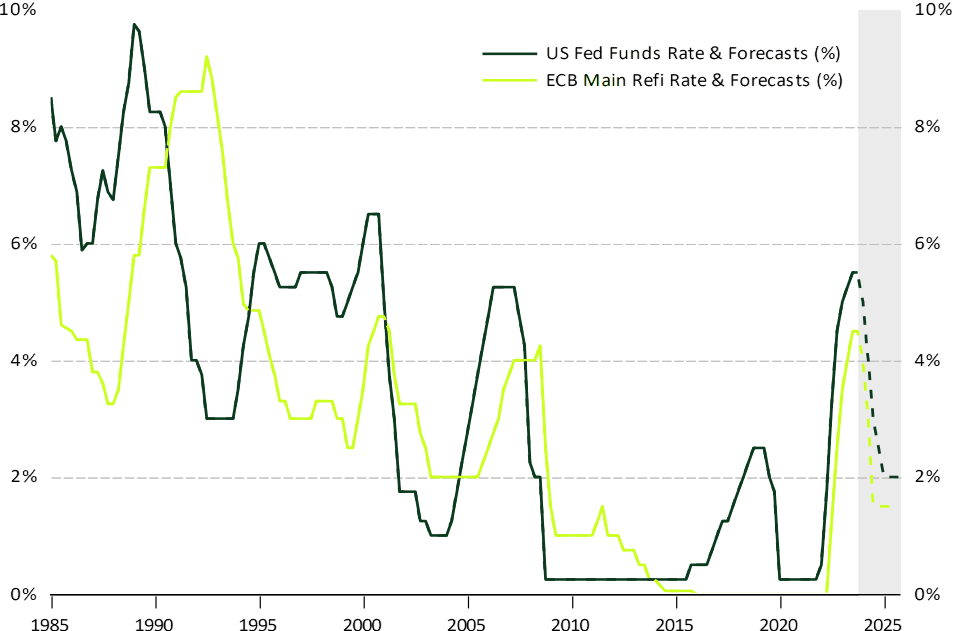

One thing we cannot doubt is that both the Fed and the European Central Bank (ECB) will cut interest rates and they are likely to do so at the same speed they raised them (fast), i.e. by -100 to -150 basis points per quarter (Graph 4).

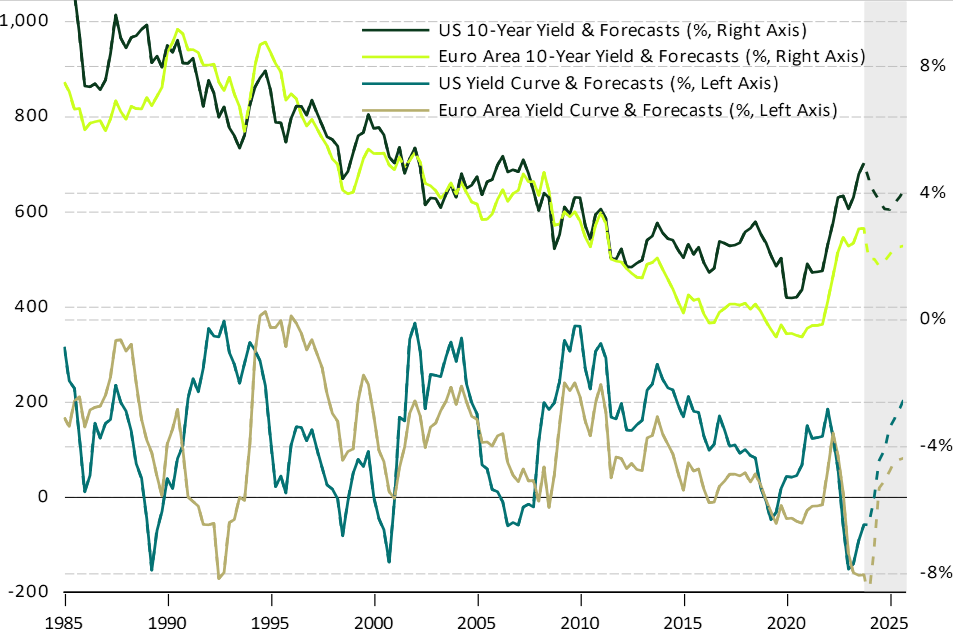

The aforementioned could induce a faster fall in short-term yields, compared to long-term yields, but in which the whole curve will shift (Graph 5).

Chart 4: U.S. Federal Reserve Funds + Projections; ECB Main Rates + Projections

Graph 5: U.S. and European 10-year yields and yield curves

For the equity market, the full "W" scenario should be considered as a continuation of the first downward leg of 2022 into 2024, after a false recovery signal in 2023.

In 1H2024, growing investor anxiety over the economic slowdown and high (restrictive) interest rates should drive the market back down, testing the October 2022 lows at the US$3,500 level for the S&P 500 (-22% from current levels).

Consensus remains very bullish on 2024 "Earnings Per Share (EPS)" for the S&P 500, 10% growth is expected with EPS reaching US$243.50.

Our EPS expectation is more pessimistic and far from this consensus, with EPS falling by -10%, which means it will reach US$200 and not the US$243.50 estimated by the optimists..

Now, if we consider the latter scenario, the combination of the market decline in US$3,500 and a reduction in Earnings Per Share of 10%, would reduce the market valuation towards its long-term average of 18.6 times (chart 6).

Graph 6: Current Earnings Per Share or P/E (Earnings Per Share) of the S&P 500 is 20.8x

What about currencies?

In the foreign exchange market, all currencies will benefit from the fall in interest rates and the consequent depreciation of the US dollar. The euro will undoubtedly appreciate (Figure 7). as the main alternative currency, while gold will no longer have anything to keep it below US$2,000 an ounce. So it is possible that after three long years of stability, its price will skyrocket.

This is based on the fact that lhe Fed will have to lower rates faster than other central banks, as mentioned before, mainly because they have been raising them faster and harder than other central banks and also because their high amount of debt refinancing will have a strong impact on their budget deficit.

There is the interest rate differential between the dollar and the rest of the world. currencieswill affect the U.S. dollarThis could bring a new phase of profitability in emerging markets (Figure 8).).

GChart 7: EURUSD (1.0915)

GFigure 8: Dollar index; Ratio between emerging markets and MSCI World

The die is cast and if we had to summarize our main expectations for 2024 they would be:

- Market downturn in the first half of 2024, then recovery in the second half of the year.

- Outperformance of bonds versus stocks in 2024.

- Disinflation toward the 2% target during the year.

- The yield curve steepens due to the change in monetary policy, creating an "upward steepening".

- Long-term rates should stabilize above 3.5-4% in the US, barring a systemic event.

- Favor defensive value sectors (Health and Consumer Staples) in the first phase of the year.

- Underperformance of the USD against the EUR and other currencies.

- Gold breaks US$2,050 levels.

- Commodities will be supported by the falling dollar and the imbalance.

- There is a risk that a systemic event could change our classic scenario due to a fast and furious rate hike cycle by the Fed.

What opportunities do we see?

The end of the year is approaching and, as always, we must evaluate the performance of our portfolio, the environment in which we find ourselves and the effectiveness of the strategies implemented in order to make better decisions.

Although the future is unwritten, this outlook for 2024 provides us with an outlook for designing our financial tactics. Based on the above, we can say that favoring positions in defensive sectors, such as healthcare and consumer staples, would be a good plan, as both will benefit from the easing of interest rates. Likewise, industrials, small caps and emerging markets, which also share this nature, are good options.

Similarly, we see an opportunity in bonds, as they will outperform equities in 2024.

If you would like investment advice on how to adapt and prosper in a year marked by economic dualities, our team of brokers will be happy to assist you and provide you with the information and advice you need.

You can contact us through the following form:

Share this content:

DISCLAIMER: Singular Wealth Management, Corp. and Singular Securities, Corp. (SWM&SC), offer perspectives on various markets, sectors and investment opportunities that could be valuable to subscribers of our editorial content. This includes views on different types of securities, as well as commentary on economic and political scenarios. It is crucial to understand that this publication does not constitute financial guidance and is not an invitation to make specific investments. For personalized advice, we recommend using the Unique Advisory Services through our Securities House's qualified financial advisors to achieve your investment objectives. Although the information in this publication comes from reliable sources, we cannot guarantee its accuracy or completeness. Information is current at the time of publication, but may change without notice. Investing in securities involves risks, including the possible loss of principal, and past performance is no guarantee of future returns. SWM&SC personnel may invest in the securities discussed from time to time without receiving any compensation from the companies mentioned. We disclaim any liability for damages resulting from the use of our services. Entity regulated and supervised by the Superintendencia del Mercado de Valores of the Republic of Panama. Singular Wealth Management Corp., "License to operate as a Securities Brokerage Firm, Resolution CNV- No. 219-2005 of September 19, 2005". Singular Securities Corp., "License to operate as a Securities Brokerage Firm. Resolution SMV- No. 672-15 of October 21, 2015"....