Volatility and spread bond yields are at an historic high

Although the market is strong, we have pointed out potential lurking risks. The combination of low volatility and economic risks offers protection opportunities for investors. As of October 2022, thiss take more risk, driving equity markets, which are up 50% in 18 months.

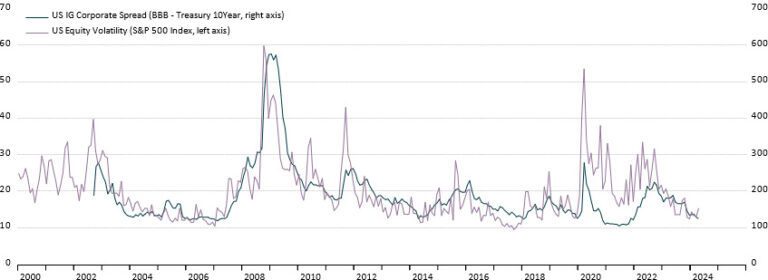

Investor confidence is reflected in volatility indices and bond markets. The VIX is near historic lows of 12,35% , and yield spreads between corporate and Treasury bonds have fallen. (graph 1). Lower perceived risk reduces volatility and default risk simultaneously.

Chart 1 : VIX Index (12,35%); BBB investment grade credit spread (125 basis points)

A closer look

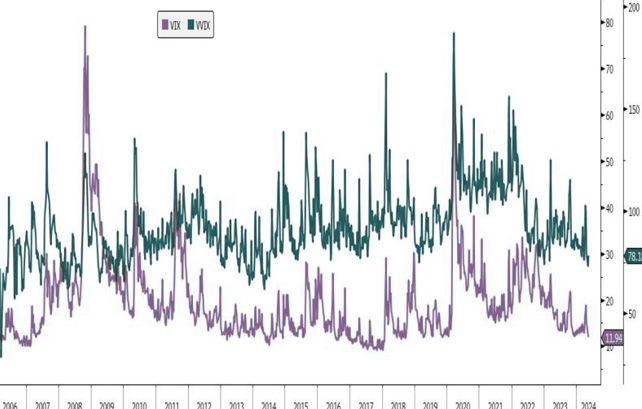

Volatility volatility (VVIX) has fallen to an abnormally low level of 73% (chart 2), suggesting a possible future panic for VIX and VVIX to exceed their medians of 17% and 90%.

Chart 2: VIX (11,94%); VVIX (78.08)

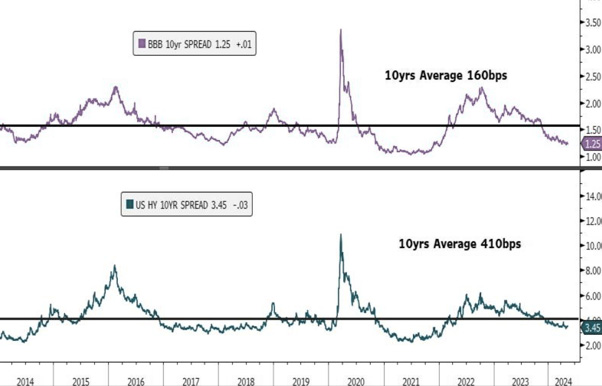

In bonds, spreads have been compressed: investment grade offers only 125 basis points more than 10-year government bonds, and high yield, only 345 basis points (graph 3).

The low level of these spreads is remarkable as yields on "risk-free" assets have risen sharply. Spreads represent only 20% of total corporate bond yields, the lowest level since 2006.

Chart 3: 10-year BBB credit spread (125 basis points); 10-year high-yield credit spread (345 basis points)

Economic slowdown and monetary policy

Investors' appetite for risk is not linear and can change rapidly. Two macroeconomic factors of concern are the slowdown in economic activityThe risk of a slowdown in the economy, especially in job creation, and the risk that activity indicators will fall. Lower growth reduces corporate earnings, impairs their ability to reward shareholders and pay debts, increasing volatility and credit spreads.

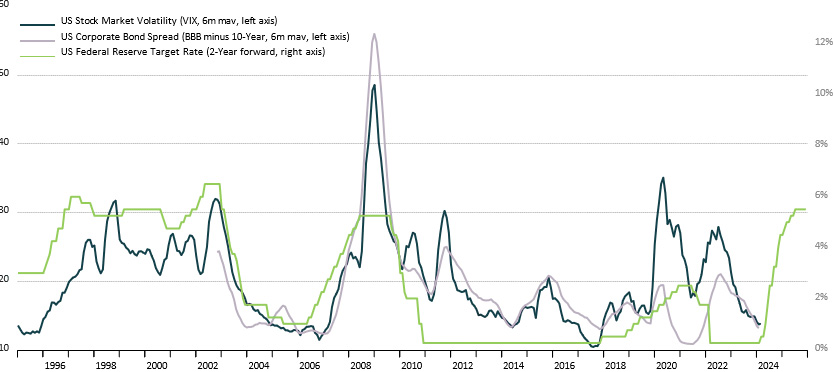

The other is restrictive monetary policy to control inflation. This tightening by central banks often causes turbulence in financial markets (Figure 4). Due to the speed and magnitude of the rise in official rates, volatility and spreads are likely to increase structurally over the next two years.

Chart 4: 6-month moving average VIX; 6m moving average BBB Spread; 2-year U.S. Fed Target Rate

What opportunities do we see?

The market is resilient and investor sentiment is upbeat. The recovery of the emerging marketsespecially China, suggests that there is no imminent collapse. However, the economic situation is deteriorating and a slowdown in growth is expected in the coming months.

With credit spreads and volatility historically low and interest rates high, it is an attractive time to protect portfolios against market corrections. For fixed income investors, it makes more sense to invest in U.S. government bonds than in low-quality corporate bonds, as current spreads do not offset the risk.

If you would like to obtain investment advice or identify opportunities in bonds, our team of brokers will be happy to assist you and provide you with the information and advice you need.

You can contact us through the following form:

Contact with us

"*" indicates required fields

ComShare this content:

DISCLAIMER: Singular Wealth Management, Corp. and Singular Securities, Corp. (SWM&SC), offer perspectives on various markets, sectors and investment opportunities that could be valuable to subscribers of our editorial content. This includes views on different types of securities, as well as commentary on economic and political scenarios. It is crucial to understand that this publication does not constitute financial guidance and is not an invitation to make specific investments. For personalized advice, we recommend using the Unique Advisory Services through our Securities House's qualified financial advisors to achieve your investment objectives. Although the information in this publication comes from reliable sources, we cannot guarantee its accuracy or completeness. Information is current at the time of publication, but may change without notice. Investing in securities involves risks, including the possible loss of principal, and past performance is no guarantee of future returns. SWM&SC personnel may invest in the securities discussed from time to time without receiving any compensation from the companies mentioned. We disclaim any liability for damages resulting from the use of our services. Entity regulated and supervised by the Superintendencia del Mercado de Valores of the Republic of Panama. Singular Wealth Management Corp., "License to operate as a Securities Brokerage Firm, Resolution CNV- No. 219-2005 of September 19, 2005". Singular Securities Corp., "License to operate as a Securities Brokerage Firm. Resolution SMV- No. 672-15 of October 21, 2015"....