Donald Trump, 78, was elected as the 47th president of the United States, making a historic comeback after his previous defeat. Republicans gained control of the Senate and likely Congress, consolidating their influence in major institutions and paving the way to fulfill their conservative agenda.

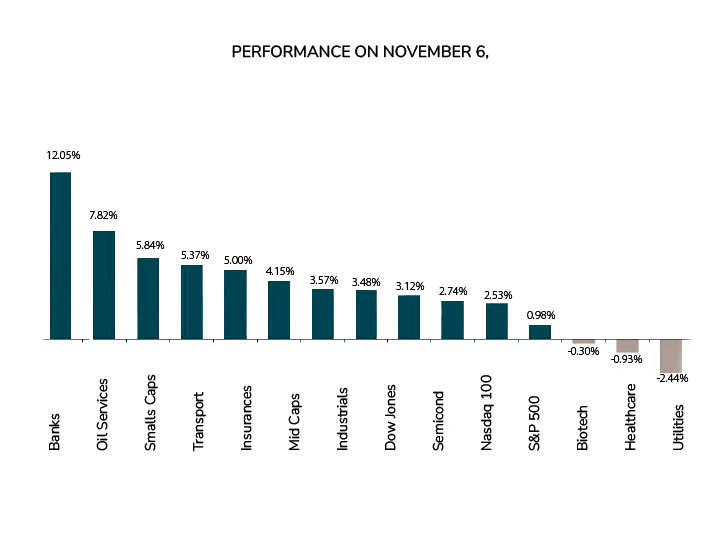

Financial markets reacted calmly to his victory, already anticipated by investors. The VIX index fell 22% to 15.6%, while the major stock indexes rose, led by the Russell 2000 at 5,84% (chart 1).

Chart 1: Market reaction after Donald Trump's election.

Investors are betting on economic policies favorable to business growth, however, the political program it brings is complex on several points, so it is worth asking what else the market expects?

First target

Trump's overall macroeconomics: Tariffs, incentives and production.

Trump's second-term economic agenda includes transformative initiatives, most notably the "Trump Reciprocal Trade Act," with a 60% tariff on Chinese imports and possible tariffs on other countries. He plans to extend the 2017 tax provisions and prioritize incentives for the middle class and manufacturing, while bolstering fossil fuel production, reducing support for clean energy.

In monetary policy, he advocates lower interest rates and greater deregulation in banking, environment and business. He promotes incentives for domestic manufacturing, greater oversight of foreign investment and a more restrictive immigration policy. His approach prioritizes economic nationalism and domestic production, even though it may generate higher consumer prices and international tensions.

Second target

Sectors and activities: Who benefits and who does not?

Potential beneficiaries

Trump's policies could benefit banking with fewer regulations, increasing the profitability of large banks. The energy sector could shift to fossil fuels, favoring traditional companies and affecting renewables. Mining companies would gain with fewer restrictions and higher prices. Small businesses would prosper with tax incentives and "America First" policies.

In the middle

The technology sector would face less regulation overall, but greater antitrust pressure for companies such as Alphabet and Meta. Industry would benefit from local production, but with high tariff costs. Healthcare would face challenges from lower ACA subsidies, and consumer discretionary would have a mixed environment with tariff impacts and lower operating costs.

Those who possibly not so much

The sector of clean energy will face obstacles due to the possible reduction of tax incentives and government support, affecting their expansion. Retailers dependent on Chinese imports will suffer from 60% tariffs, and labor-intensive services will face rising labor costs, forcing them to raise prices or invest in automation.

Third target

What about the dollar and interest rates?

The dollar's future is uncertain due to conflicting factors. On the one hand, expected growth reduces expectations of a rate cut by the Fed, which supports the dollar. However, the implementation of tariffs could strengthen it initially, although aggressive trade policies could weaken it in the long term.

In addition, the international diversification and "de-dollarization" intentions of the BRICS represent a threat (Figure 2).

Chart 2: Long term chart on Dollar Index (104.90

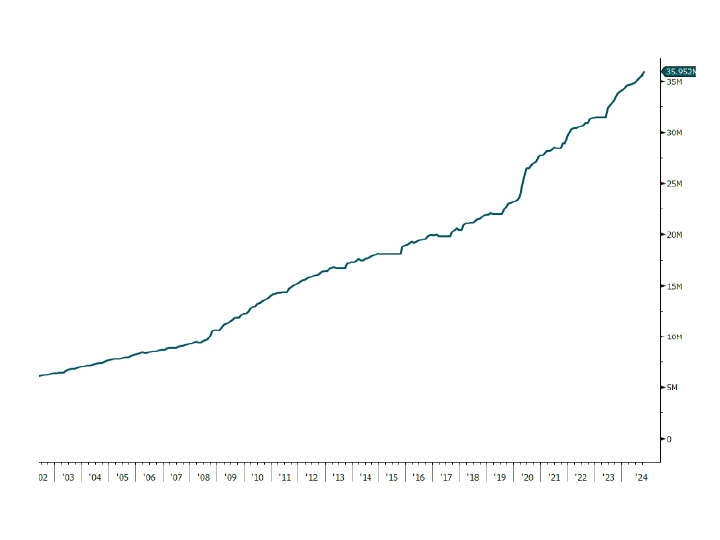

High U.S. debt and proposed tax cuts could increase pressure on interest rates (Figure 3), which would affect the dollar in the medium to long term.

Chart 3: US Outstanding Debt (1TP4Q35.9trn)

The poacher

Basic consumption: A safe place to be

In conclusion, the market has adopted a risk-on approach since the election of the new president, with long-term rates rising faster than short-term rates, reflecting expectations of economic growth. Although the current euphoria may continue in the short term, prices are overbought and the P/E of the S&P 500 is elevated (chart 4).

Chart 4: Projected P/E (25.2x), current P/E (27.05x)

Despite short-term opportunities, we advise long-term investors to remain cautious and adopt a more defensive posture, as a market correction is likely to occur.. We await a correction before reconsidering our overall stock view.

If you wish to get advice and learn how to cope with market changes, our team of brokers will be happy to assist you and provide you with the information and advice you need.

You can contact us through the following form:

Contact with us

"*" indicates required fields

ComShare this content:

DISCLAIMER: Singular Wealth Management, Corp. and Singular Securities, Corp. (SWM&SC), offer perspectives on various markets, sectors and investment opportunities that could be valuable to subscribers of our editorial content. This includes views on different types of securities, as well as commentary on economic and political scenarios. It is crucial to understand that this publication does not constitute financial guidance and is not an invitation to make specific investments. For personalized advice, we recommend using the Unique Advisory Services through our Securities House's qualified financial advisors to achieve your investment objectives. Although the information in this publication comes from reliable sources, we cannot guarantee its accuracy or completeness. Information is current at the time of publication, but may change without notice. Investing in securities involves risks, including the possible loss of principal, and past performance is no guarantee of future returns. SWM&SC personnel may invest in the securities discussed from time to time without receiving any compensation from the companies mentioned. We disclaim any liability for damages resulting from the use of our services. Entity regulated and supervised by the Superintendencia del Mercado de Valores of the Republic of Panama. Singular Wealth Management Corp., "License to operate as a Securities Brokerage Firm, Resolution CNV- No. 219-2005 of September 19, 2005". Singular Securities Corp., "License to operate as a Securities Brokerage Firm. Resolution SMV- No. 672-15 of October 21, 2015"....